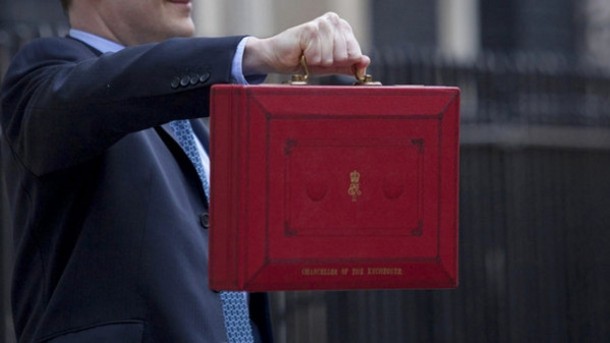

Budget 2016

Budget 2016: Licensees want more than 'token' beer duty cut

A coalition of trade associations and industry groups are campaigning for a fourth successive cut to beer duty when George Osborne reveals his plans on 16 March.

They argue that duty cuts have secured thousands of jobs in the sector and helped keep pubs open in a period that has seen widespread closures over the past decade.

Beer prices

But Anthony Harvey, licensee at the Wheatsheaf Inn, No Mans Heath, Cheshire, said any benefits from a duty cut would be wiped out by rising beer prices from brewers.

He said: “I don’t believe a cut in duty will make any difference other than further increase the margins of the big brewers. Last time we saw no change in price, we still had the annual fleecing.”

Harvey also fears rural rates relief might disappear in the Budget. “I’d like to see assistance with the national living wage, maintenance of rates relief and a reduction in the VAT rate,” he added.

Supermarkets

John Ellis, licensee at the Crown Inn, Oakengates, Shropshire, told the PMA a cut in beer duty would not go far enough to help pubs compete with supermarkets on alcohol prices.

“Supermarkets sell multi-buy deals at a loss to draw customers in for their other products. Fags aren’t £2 so why should alcohol be so cheap? It’s immoral and should be illegal,” he said.

Ellis called for Government to create a law to prevent supermarkets from selling alcohol at low prices. “I know one small brewer who said the supermarkets sell his beer for less than they buy it from him. Until there’s a law to stop this, there isn’t a level playing field,” he said.

Ellis said he also wants clarification of the Government’s plans for business rates.

“If control goes to local authorities who are strapped for cash, rates are going to go through the roof,” he added.

Business rates

Andrew Fishwick, owner of the Truscott Arms, Maida Vale, west London, agreed that a cut to beer duty wouldn’t go far enough for many pubs.

“The more fundamental issues of the inequitable VAT system and business rates will be the only Government intervention which will manifestly aid struggling operators,” he said.

His thoughts were echoed by Helen Greer of the Feathers Inn, Stocksfield, Northumberland.

“I’d like to see a cut in VAT for hospitality operators, in the way that there is on the Continent. The difference in the amount we pay in this country should be addressed,” she said.

Token beer cut

Association of Licensed Multiple Retailers chief executive Kate Nicholls agrees that a beer duty cut won't go far enough.

She said: “Although we are seeing attempts at a reduction in costs, beer duty for instance, many pubs and bars have simply not been able to cut prices and pass that saving on to customers.

"The reality is that the token gesture of a penny cut, however well-intended, will be absorbed by other costs and it is these that need addressing.

“Further cuts to beer duty in this year’s Budget may also have the unintended effect of widening the gap between the on-trade and supermarkets — not faced with such costs but still benefiting from a duty cut. We are looking at falling levels of consumption in the on-trade, and an off-licence and supermarket sector that is booming.

“If the Chancellor is serious about helping pubs, bars and nightclubs, then we need meaningful reform directed at a retail level to address the issue of rising costs in the on-trade.”