G1 buys tenanted vehicle outright

The move was revealed in G1’s full year results, published today, which show that G1’s operating profit - including IP Partnership, its subsidiary that trades as Iona - grew 18.6% to £10.4m in the year to 5 April 2013. Turnover increased 11.2% to £66m and EBITDA was £16.3m.

Excluding the IP Partnership venture, operating profit grew 36.4% to £10.2m.

“The increase in operating profit reflected the benefit of a full year of prior year acquisitions and developments,” GI said.

'Nominal' purchase

G1 finance director Stephen McQuade told the Publican’s Morning Advertiser’s sister title M&C Report that Heineken’s stake in IP Partnership, which operates more than 100 tenanted pubs, was bought for a “nominal” amount on the final day of its financial year.

In the year, G1’s gross profit percentage increased from 75.5% to 76.4%.

Group net assets increased by £5.2m to £39.8m at 5 April 2013. G1 said it undertook a significant capex programme in the year, with £9.6m invested in the estate “to maintain its integrity and market position”.

Renovations

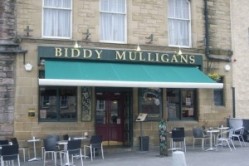

Development and refurbishment activity during the period included the launch of Forgan’s in St. Andrews, a former golf club manufacturing factory that became a bar, restaurant and live music venue. Full refurbishments also took place at the Bank Hotel in Edinburgh, which is now the Inn on the Mile; plus Biddy Mulligans and the Central Hotel in Edinburgh. It also saw the creation of the boutique hotel at Murrayfield House in Edinburgh.

Regarding expansion, McQuade told M&C Report: “The group is always looking to expand its interests. We are still looking to grow. We are being selective given the current economic environment.”

The company said: “With a strong balance sheet and the benefit of a 99% freehold estate, G1 Group looks forward to 2014 with cautious optimism. Every opportunity will be scrutinised with only the very best opportunities for the Group being considered.

“Commitment to innovation and the highest standards of service have helped with another year of growth for G1. The company has continued to invest heavily in its core estate to maintain its reputation for unique and exciting venues.

Risks

“Operating in the leisure market, the most significant risk is customer demand in an extended period of economic uncertainty. Other risks are changing regulatory requirements such as health and safety legislation, and the impact of rising utility costs. The group has to address these and other exposures on a continuing basis. The widely diversified leisure portfolio and the significant purchasing power which it has, enable the group to mitigate these exposures.

“Although the economy has followed an uncertain path in recent years, the group has continued to develop in the leisure and hospitality sector. Whilst these economic conditions look likely to continue beyond 2013, the quality of the venues and commitment to service excellence give the directors confidence that the group can address the challenges successfully and continue to expand.”

Head Office

It added: “2013 finally saw the relocation of the Head Office activities from Virginia House in the Merchant City to Hamilton House in Glasgow’s West End. It took a good deal longer than originally anticipated but the superb environment provides a stimulus to all the team.

“The group is looking to maintain its momentum into 2014 and beyond, but is likewise alert to the uncertainties alluded to earlier, and the challenges of a slowly recovering market.”