RTDs - The Fight for Fridge Space

Remember the joke: How many elephants can you fit into a Mini? Four. Two in the front and two in the back. How many giraffes can you fit into a Mini? None. It’s full of elephants. Well, it couldn’t be more appropriate for the alcoholic ready-to-drink [RTD] sector.

Put another way, the number of brands currently vying for fridge space behind your bar is huge. But your fridges are space-saving, efficient and compact, so their capacity is limited. Add into the mix the fact that the packaged-drinks market is over saturated and you have a problem that largely comes down to choice, preference and sales priority.

RTDs now have to compete with flavoured ciders, bottled beers, alcoholic ginger beers, soft drinks and the newly-introduced category of spirit-beers, but they’re still growing at 7.8% in value, according to recent figures from CGA Strategy. Basically, everyone wants to be in that Mini. Every species. And you’ve got the keys.

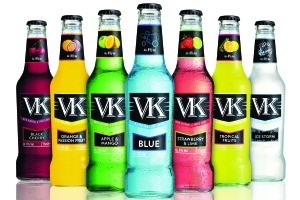

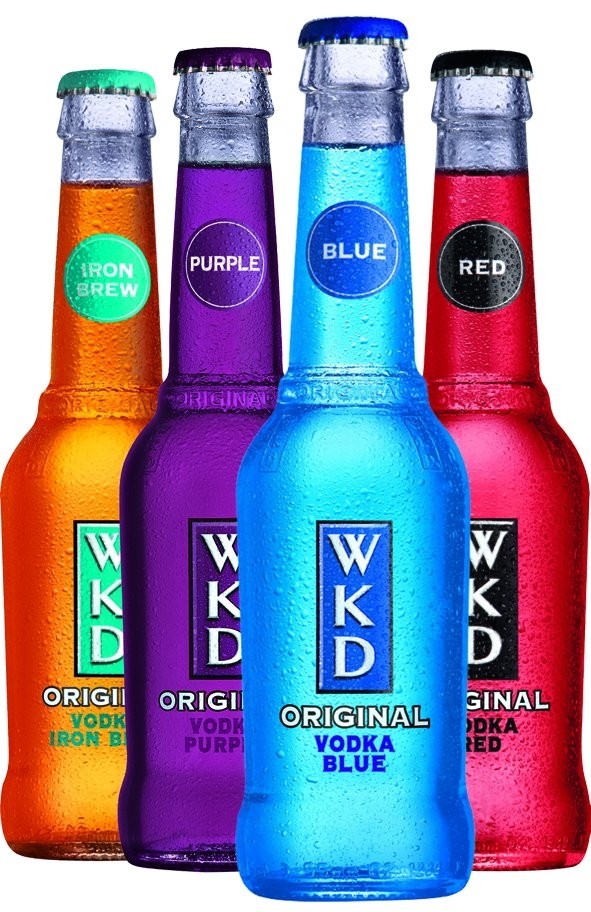

Top five variants by value

■ WKD Blue

■ Smirnoff Ice Red

■ WKD Iron Brew

■ VK Blue

■ VK Orange

Top five brands by value

■ WKD

■ VK

■ Smirnoff Ice

■ Bacardi Breezer

■ Jeremiah Weed

“The fight to win space in the fridge is at an all-time high, with plenty of new product developments coming from the packaged-cider category and the continued rise of bottled craft and world

lager,” explains Matthew Crompton, account manager at CGA Strategy.

But, although many a brand owner will say it’s great to draw interest to the fridges with a range of interesting options, the space issue still makes it problematic. “The biggest challenge [for RTDs] is around fridge space, because fridge space is fixed,” says WKD marketing director Debs Carter, pointing out that “the RTD category is growing 6% in volume and the on-trade accounts for 65% of RTD sales” — so getting a place within them is vital.

Global Brands, which has a rich heritage in the RTD category and owns brands including VK, Reef, Hooch and Hooper’s, is contributing to the resurgence of RTDs.

“VK is a brand that has moved with the times and is number two in the category,” says Global Brands marketing director Simon Green. “It’s a £76m brand and performing well,” he adds, noting that it appeals to a younger demographic with “music and festival associations as well as communicating through social and digital-media platforms” for its Mix Up Your VKend marketing activity.

Green adds that, since Global Brands “bought Reef from Coors last year, the brand has enjoyed 27% month-on-month growth” and intends to push the brand further with “themed party nights in outlets with beach themes and lifeguard imagery”.

The Hooch brand is also contributing to Global Brands’ presence in the sector. It is currently seeing “an average monthly volume growth rate of 30%” and aims to be on “mainstream terrestrial TV in the next few months”.

Its alcoholic RTD Hooper’s will be investing in a “British traditionalist approach” and sending branded Mini Cooper vans with promotional teams to pubs, as well as ramping up food and drink matching for

classic British dishes, like suggesting “Dandelion & Burdock goes well with fish and chips”.

It’s through products like Hooper’s that the RTD sector has broadened. No longer considered to be just alcopops, CGA’s Crompton points out that the RTD category has returned to growth in recent months thanks to a variety of different innovations.

“The category is now more diverse and engaging than it has ever been, with many new styles of RTD driving increases in volume. The category is now no longer solely made up of fizzy, carbonated alcopop-esque drinks but now also includes more premium, mature products,” he explains, adding that “this new type of RTD has changed the perception of the category to the consumer and helped regain much-needed credibility”.

So where did it all begin? The game-changers to the standard drinks offer began rolling out in the late ’90s and what followed was a lot of interest.

“Diageo launched Smirnoff Ice and Smirnoff Black Ice in 1999, and their introduction helped create an exciting and entirely new segment in the alcohol category. Smirnoff Ice is now worth £3.9m in the GB on-trade and holds a 17.1% share of the RTD segment,” says Andrew Leat, on-trade category manager at Diageo.

But, according to Global Brands’ Green, RTDs have “evolved in two parts”. There are brands that were there at the forefront at the beginning and newcomers that are doing interesting and innovative things, he says, pointing out that there are also two main groupings that consume them — older consumers who are still drinking the original brands and younger drinkers who are attracted to the fun style in which some of the variants are marketed. “The on-trade market is still pretty big — worth £420m. And RTDs are a big and significant category, he points out, claiming that “some are being dragged down by brands that have given up on the category — they are playing a relevant but static role — while there are those brands that were there at the forefront at the start, as well as some that have taken their foot off the gas.”

One of the biggest challenges of the RTD category is to continually keep it moving forwards. It needs to remain fresh and exciting for the members of its audience before they migrate to other categories or trade up to different brands that entice them.

“It’s a really exciting category and it does need to keep evolving,” says Green. “If you look at what Volkswagen does with the Golf, it is constantly re-inventing the model. We need to do the same for the RTD category. We need to think about how that translates into innovation, as well as the serve and versatility of the product,” says Green.

CGA’s Crompton agrees that “in terms of the more traditional RTD, brands that do well are often the ones that constantly innovate with various new flavour launches.” But why is this necessary? WKD’s Carter says it has a lot to do with the fact that “the core consumers are within the 18 to 25-year-old category and the fact that people move on to different categories right through their lives”.

To keep its customers interested, last year WKD began using the free augmented reality app Blippar. “Essentially what people do is download it to their smartphone and put it up against WKD and different things will happen. Characters come on to the screen and dance,” says Carter, adding that it can come up with cocktail suggestions and other fun things too. “Our target market’s mobile phones are their lives, it’s not just about Facebook and Twitter,” says Carter who points out that the bottle label can act as a marker. “And you blip it. It’s called blipping. If you blipped the dripmat, some content comes on to your phone and we have taken it into the on-trade. We did a campaign for universities’ autumn terms last year, showing random imagery when you blipped staff T-shirts. Augmented reality is something you want to share with your friends, so it advertises itself too.”

But is it easy for pubs to adopt? Carter says that the beauty is that publicans don’t need to do anything — it’s the brands that are all singing and dancing. “All licensees have to do is put out the dripmat on the table,” she explains, hinting that there’s lots of room for any brand to begin experimenting with giving their customers more via augmented reality. “I think we’re at the tip of the iceberg here. We’ve been doing this for a year, but we are still at the adopter stage of cutting-edge technology. We would encourage publicans to embrace the digital revolution. Lots of people now are communicating like this. I think publicans shouldn’t be scared of digital. It’s just a way of getting a message across.”

Growth in RTD sales will come from “ongoing innovation in the sector to stimulate consumer demand for new taste and flavour experiences to explore and enjoy”, according to Maxxium UK marketing controller Eileen Livingston. She points out that the core consumers of Sourz are 18 to 24-year-old men and women, and it is these consumers who are largely driving the category, as they develop their repertoire of drinks. “However due to the versatility of the category, there is a diverse consumer profile buying into it,” she maintains.

Livingston also claims that recent consumer research showed that there was an opportunity to reinvigorate the RTD category. “As 51% of Sourz drinkers drink RTDs, we knew the time was right for Sourz to introduce an RTD that stands out from the competition and importantly, one that gives consumers an exciting new opportunity to engage with the brand as they seek new flavour experiences,” she says. “That’s why, last summer, we launched Sourz Fusionz — a new alternative for the category, available in two refreshing flavours: Apple Bite and Purple Twist.”

In addition, Livingston points out, Maxxium had launched different formats and sizes of Sourz Fusionz to make it “a pre-mixed drink that is ready to go for any occasion”. That’s a useful attribute in a market where CGA claims that one in five outlets are now serving cocktails — a segment that’s valued at £220m.

And innovation within serves, rather than simply adding new flavours, has certainly caught on. RTDs present a chance to offer easy cocktails as well as quirky ways for people to share the drink, which adds to the category’s appeal as pubs approach the summer months.

This last route to market is one that has certainly paid off for WKD. According to WKD’s Carter, since the brand launched its WKD kettles to offer a new way of capturing interest, it has seen huge growth. “What we are talking about is a bottle of WKD, some lemonade and a spirit. It’s very useful and easy and brings fun into the on-trade,” she adds.

“In the case of cocktails, it opens up the opportunity to a wider range of outlets and consumers, which in turn drives the category,” agrees Funkin CEO Andrew King. “The demand for cocktails has grown year-on-year since Funkin launched, and the growth has seen more men and women include cocktails as part of their repertoire, with particular focus on Friday and Saturday nights. One in five bars now sell cocktails and the numbers are growing by 19,500 bars per year, a 16% increase in distribution, and a projected steady growth of 5% for the next two years,” he adds.

Funkin produces mixers that provide a simple way to make cocktails with minimal training and just the addition of ice and a spirit. “They take only 10 seconds to prepare and serve,” says King, so “venues not normally associated with cocktails should look to add Funkin mixers for a simple, yet high-quality cocktail solution. “Following the success of our single-serve cocktail mixers, the offering now includes a larger pack format that allows for increased speed of serve and even greater profit margins. “The one-litre range enables licensees to capitalise fully on the potential of the pitcher cocktail offering and each pack can make up to 10 cocktails or three pitchers and can be stored in the fridge for up to 10 days,” he adds.

That, of course, depends on the fridge space being available. Which brings us neatly back to the problem that many of these products face. Fridge space shouldn’t be considered on a first-come, first-stocked basis. There really does need to be an overhaul of stocking policies and shrewd selection methods put into play. It looks like it might be time to remove a few of those elephants.