Property: Average free of tie leases up as much as 22%

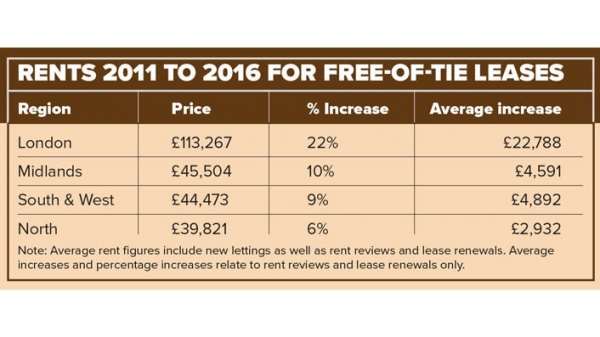

The average rent of a free-of-tie pub lease in London has hit £113,267 per annum, an increase of 22% in the past five years, the 32nd annual Fleurets rental survey has revealed.

This means the average increase in London is £22,788, according to the report, which covers rent reviews and lease renewals undertaken by the property agent between 2011 to 2016. It includes both free-of-tie pub leases and shell properties, which are mainly high-street bar and restaurant venues.

London has also seen the highest level of rent review activity, with 80% resulting in a rent increase. In the regions, between 52% and 65% of reviews resulted in an increase.

“Not surprisingly London continues to dominate with the levels of rent and of rental growth, as well as rent review activity being actioned by landlords,” David Sutcliffe, director and head of

professional services at Fleurets, told The Morning Advertiser.

“There is still a north-south divide, and to a certain extent London is its own market. There is a lot more activity there with new entrants coming to the market, especially restaurateurs and overseas operators.”

The regions still saw an upward trend, but increases were not as steep as in the capital. In fact, regionally numbers were significantly lower, with the average increase between 6% and 10% over the five-year period, equating to increases of only £2,932 to £4,892.

Free-of-tie pub leases in the Midlands increased by 10% or £4,591 to £45,504, while the south and west saw leases at £44,473, up 9% or £4,892 over the period. The cheapest place to rent a free-of-tie lease was in the north at £39,821, which has increased the least over the period at 6% or £2,932.

Rents were higher in the shell sector, due in part to their location in high-street areas. London still dominates, with average rents at £144,661, up 20%; the north at £69,500, up 2%; the south and west at £59,337, up 6%; and, lowest of all, the Midlands at £59,253, up 7%.

Despite lower growth in the regions, there are hot spots driving rents. “Cities such as Manchester have seen a lot of activity over the last two, three and four years,” Sutcliffe argues.

“Some rents are jumping quite high to where we thought the headline rents were maybe four to five years ago. Cities like Bath are experiencing strong growth because of new activity.”

The report also highlights the blurring of boundaries between a bar, a gastropub and a restaurant.

This change in the market has also meant less clarity about what evidence can be used in conducting rent reviews.

However, not all rent reviews have resulted in an increase, as many highstreet shell rents have had lease re-newals agreed at market rent. The report shows only around half of all rent reviews for shell properties saw some form of increase.

Sutcliffe says that a number of operators such as JD Wetherspoon have also been renegotiating their leases to take out the “upward-only rent review clauses” still being used in the commercial property market.

The report claims the Brexit vote has been the “biggest single issue” to have impacted the pub sector over the past 12 months. This, and the snap general election, has caused a degree of market uncertainty that has impacted on the value of the pound which is likely to create issues for the market, ultimately impacting rental rates.

Sutcliffe highlights that imports such as fuel and food will continue increasing if the pound stays at its current levels. “Brexit underpins all of this. We know markets do not like uncertainty, they want stability,” he says.

The report also reveals there are signs the economy is stalling, and indications the London market is reaching a tipping point are starting to emerge. “Growth has got to stop and there needs to be rebalance,” Sutcliffe adds.

The national living wage and the new rating list are two other issues likely to affect profitability that are highlighted in the report. The survey says it is likely to take another 12 months before any rating appeals are dealt with, which may be too long for some businesses to survive.

While Sutcliffe accuses the new rating system of “penalising success and not encouraging it”, he also admits a combination of these costs as well as the rating system are set to have an impact. “All of this is about affordability and will ultimately impact the amount operators are able to pay for rents.”

Mixed reviews over MRO

On the pubs code, the report says there have been “mixed reviews” over its success. But it admits that in some cases tenants are using the “threat” of MRO to negotiate more favourable lease terms.

Sutcliffe argues that the voluntary codes in place prior to the pubs code legislation encouraged more balance in tied rents, with pubcos becoming more flexible over the discounts they offer to tied tenants. “Some of the heat there was four or five years ago of going down the MRO route has been taken out of the market.

“The pubcos are negotiating on the tied leases against the threat of MRO.”

However, he admits MRO is not for everybody and that many tenants are keen on keeping a level of support from the pubco.

The complexity of the legislation was highlighted in the report. It claims the “complicated framework” and “disjointed nature of the code” has meant tenants have had to employ external parties such as accountants and lawyers, which has driven up costs. “The legislation is particularly complicated and licensees are trained to run pubs, not deal with complex legal documents,” says Sutcliffe. “The code is so ambiguous in places that it is difficult to interpret.”

Ultimately, the report concludes, that the “potential economic uncertainties” could have a knock-on impact on rental values.

- To find out more about pubs for sale, lease and tenancy visit our property site

- For the full survey visit Fleurets.