Is it a rum, is it a beer — no, it’s a spirit-flavoured beer. It’s both, it’s everything. Did we mention it also has jam in it? And smoke, and cinnamon, chilli and cherries. We wouldn’t be surprised.

Drinks, certainly over the past year, have begun to dabble with flavour and composition and this has led to a great deal of category blurring.

It’s confusing, but it’s igniting the taste buds too and we shouldn’t overlook the trends, especially if some of these drinks are selling like re-invented hotcakes.

Blurring of categories

Mark Hopper, head of innovation and development at SHS Drinks, says: “This blurring and crossover of categories isn’t confined to alcoholic drinks, we’re also seeing it throughout the FMCG [fast-moving consumer goods] market, from chocolate-flavoured cheese to ‘pizza burgers’.”

SHS Drinks also recently revamped its ‘speer’ brand Dead Crow to capitalise on the hybrid-drink trend. The company not only redesigned the packaging for the original Dead Crow Bourbon beer but brought rum beer Cuvana under the same brand, uniting the two speers to give them more clout and recognition at the bar.

Hopper explained the new bottles are rolling out now, alongside advertising that uses the catchline Follow the crow and not the crowd, so it goes without saying that ramping up points of difference to appeal to people bored of the same old drinks is very cunning.

Sweetness and light

According to CGA Strategy, 47% of on-trade premium packaged cider sales are flavoured ciders and, over the past year, sales of these have climbed 10%.

Next month, Orwell’s Amaretto Cider, a 5.5% ABV mix of apple cider, amaretto and cherry, will be available to pubs. The drink spent nearly a year in the development stage by SHS Drinks, which is a long time for people to spend in white coats in a lab playing with flavours.

The range at Crabbie’s — which is well-known for its Ginger Beer — now also includes Crabbie’s Fruits, which comprises two new flavours: Raspberry & Rhubarb and Black Cherry. Last summer, Crabbie’s launched its Cloudy Alcoholic Lemonade and has since rebranded it Zesty Lemon.

The upshot is that drinks are beginning to sound just as exciting as they taste.

Smoky brews

West Yorkshire-based Saltaire Brewery’s recent collaboration with Northern Monk Brew Co, which is headquartered in Leeds, resulted in Smoked Porter — a lip-smacking 6% ABV brew that’s smokier than a fresher’s bedroom (and almost certainly more enticing).

Casks of Smoked Porter can be ordered from Saltaire and kegs called in from Northern Monk, so it’s straightforward enough to get your hands on too.

But smokiness in beers and other drinks is nothing new, there is just more readiness to try different flavours nowadays.

At the last Great British Beer Festival, Brains ramped up our palates with a double chocolate and bacon porter called A-Pork-Alypse. The beer was inspired by head brewer Bill Dobson’s trip to the Great American Beer Festival in Denver, Colorado, where the range of flavours and ingredients used in the beers was, let’s say, a tad more experimental than over here. Dobson combined a grist of roast and smoked malts with freshly grilled bacon added to the boil, along with cacao nibs, to give the beer a smoky flavour alongside the chocolate. It was a stunning brew, and full of depth.

Fire and spice

For the shot market, we’re seeing more people downing chilled, spiced numbers or ordering ‘larynx-liveners’.

“There’s a strong trend from fruit to spice flavours in the spirits market, especially when it comes to chilled shots,” says Dan Bolton, managing director at Hi-Spirits, admitting that

— since the 2010 UK launch of Fireball — the company has seen it grow.

“The core appeal is in venues targeting younger customers, especially students, and spiced shots also have a strong affinity with live music. Along with Fireball, our Antica Sambuca Chilli variant hits the same market and sells well in younger venues,” he adds.

Signature Brands recently launched a high-ABV limited-edition spiced rum named Old J Tiki Fire 151, which is positioned to mix with Coke, ginger or Ting (a sparkling grapefruit juice popular in the Caribbean) or as a ‘Tiki Fire Bomb,’ when a shot of the rum is lit and dropped into a glass of energy drink.

The spiced rum, which is 75.5% ABV, uses the same recipe of spices as the original Old J rum and targets cocktail and Tiki bars, illustrating how the trend for drinks that are more full-bodied and feisty in flavour are growing a strong following.

American styling

The Americana trend is still alive and well, although some of it is admittedly more Richie Cunningham (the charming ladies’ man from Happy Days, in case you were wondering) than Don Draper. None of it should be neglected though. As more pubs plump for booth seating or Prohibition-style décor, drinks need to play up to the same themes.

Last month, Halewood International launched its Lazy Jack’s brand as a US-style cider to capitalise on the trend for American-style drinks.

The 4.7% ABV drink is aimed at 22 to 30-year-olds and comes in a US-sized 335ml bottle to provide “a refreshing, sweet taste to appeal to younger consumers”, according to Richard Clark, director of innovation at Halewood.

The company also recently teamed up with DJ BBQ (aka Christian Stevenson) for the barbecue and music festival Grillstock, which takes place in Bristol (7 and 8 June) and Manchester (28 and 29 June) to give people a chance to sample Lazy Jack’s.

Old-fashioned glamour

In the meantime, American TV shows such as Mad Men and Boardwalk Empire have resurrected vintage glamour, leading to a resurgence of classic American whiskey cocktails such as the Old Fashioned.

“American whiskey has a natural link to this culture due to the impact of Prohibition on the various distilleries and states of the Deep South. However, while we have seen more people mixing American whiskeys, there has been more experimentation than just a focus on classic cocktails,” says Crispin Stephens, trade marketing manager (UK) at Bacardi Brown-Forman.

“We can also expect to see a rise in ‘accessible cocktails’. The growing cocktail culture seen in high-end and premium accounts will filter down to the mainstream, leading to a demand for well-priced and well-made drinks for a more every-day market,” he adds.

Hard shakes

Off the back of the trend for American diner-style furnishings as well as burgers and hot dogs, the popularity of alcoholic milkshakes is rising. Currently being seen more in cafés and retro bowling alley bars, where the style complements the booth seating, pubs could experiment with this trend.

Burger & Shake in Bloomsbury, central London, serves an Ovaltini — a hard shake made with malt, coconut, rum and Tequila — in a Martini glass, which is like a liquid biscuit with a kick.

Britvic also has plans to get more of its French Teisseire syrup brand into pubs and bars, as it could easily be added to shakes. The syrups can be used to create simple varied-flavour drinks, which is bang on-trend for pubs serving hard shakes and looking for convenient ways to flavour them. All Star Lanes, which has five venues (four in London and one in Manchester) sells hard shakes for £6.50 each, including options such as Jack Daniel’s and mint through to Bacardi Oakheart, vanilla and coconut.

Coconut

Interestingly, coconut water has been a surprise success in the drinks industry in recent years, according to reports from Mintel. However, its take-up in pubs is yet to be exploited and that’s where there could be some more gains.

The number of product introductions more than quintupled (up 540%) between 2008 and 2012 and products containing it have taken off on an international scale.

New product launches are dominated by North America, totalling 35% of global coconut water introductions in 2012, up from just 17% in 2008. Europe followed, with 34% of new products launched in 2012, up from 13% in 2008.

“Coconut water contains naturally high levels of electrolytes, including potassium, calcium and magnesium, which have made it popular as a sports drink for natural foods consumers. Coconut water is doing particularly well in the US because both sports recovery drinks and vitamin-enhanced waters are well-established — much more so than in other countries — meaning that people already buy into the benefits of electrolytes in a beverage,” says Mintel’s global drinks analyst Jonny Forsyth.

He adds: “Sales of the product have also been helped by its rapid take-up among celebrities [Madonna and Rihanna are fans, naturally] and high-profile investments from beverage companies.”

In the off-trade, brands such as Vita Coco, Zico and Go Coco dominate the market but AG Barr recently admitted it has plans to harness the thriving category by launching a coconut variant under its Rubicon juice brand and support the launch with a £2m campaign. Good news for pubs indeed.

Cans

The once-unloved child of the off-trade, cans were often a favoured receptacle of rough sleepers, but times have changed — and perceptions too.

Indeed, smaller-sized cans of craft beer are actually now seen as something rather hip. The Indie Beer Can Festival will take place in London on 11 September and is the brainchild of both the Society of Independent Brewers (SIBA) and the Can Makers, a body dedicated to promoting the benefits of canned drinks.

Brewers are being asked to enter their beers — regardless of how they are currently packaged — into a competition and 12 finalists will see their beers being canned for free in a limited-edition production run organised by the body.

Pub chain JD Wetherspoon announced in February that it would serve cans of beer in all 900 of its venues, following a deal with the New York-based Sixpoint Brewery, which is good news for the industry as a whole. Cans are just small kegs, it’s that simple.

Quirky serves

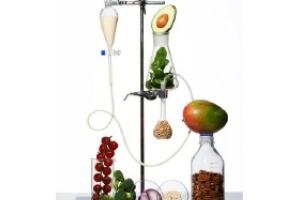

Jam jars, teapots and conical flasks tick all of the boxes for having been tried and tested as quirky serves, but some outlets are going a stage further and blending retro trends with an inventive twist.

Craft beer-focused outlet the Fox, in Haggerston, east London, recently installed what is thought to be the first beer vending machine in a British pub — and it has certainly drawn in the hipsters, becoming a major talking point.

Owner Joseph Ryan bought the Japan-made vending machine on eBay for £1,500 and installed it in March, making sure that the temperature control facility is just right.

It houses around 50 different craft beers that are unavailable at the bar to give it a point of difference. There is a bottle-opener attached to the machine and glasses are stacked on top. Legally, the machine needs to be in clear sight of the bar — which it is at the Fox.

The pub sells between 20 and 25 bottles from the machine alone per week, with beers costing between £3 and £7.

Knowledgeable bartenders

While some tactics get attention, others simply epitomise good hospitality. A knowledgeable staff member who knows about your drinks and can make recommendations or suggestions is really what every pub needs. Spirits are especially overlooked in some cases and can be upsold well with the right training.

Drinks giant Diageo recently launched its Spirits Revolution campaign to help give pubs and bars a way to maximise summer drinks sales.

Bacardi Brown-Forman’s Stephens says: “Like many segments within the alcohol category, spirits have been shaped by the trend for premiumisation. There has been an increase in consumers who are willing to trade up to premium brands, with drinkers taking a lot more time and care to look into what they are drinking.”

He adds that spirits are still seen as a relatively inexpensive treat in comparison to other items and consumers are therefore prepared to pay more for premium spirits that can be savoured and enjoyed.

Faith Holland, head of on-trade category development at Diageo, says: “We know from recent research that if we can work with licensees to encourage consumers to choose spirits on more occasions and increase the average spend through upselling, then the category growth opportunity in one year could be a huge £660m. This presents a significant opportunity for growth in the spirits category.”

As part of the campaign, Diageo is offering licensees information on its bartender training programme, ‘Diageo Bar Academy’, which provides accredited training to inspire bartenders and raise industry standards, offering a comprehensive suite of courses designed to boost a bartender’s knowledge, skillset and confidence.