The annual Pub Market Report, published by Publican’s Morning Advertiser's sister brand MCA, shows that despite continued uncertainty around the impact of the new pubs code, alongside rising running costs, six in 10 operators in England and Wales forecast higher sales in the coming year.

A quarter of respondents describe sales as being up substantially over the past 12 months, up from 16% previously. More than a third (36%) say sales are up a bit, unchanged from a year ago. Respondents are also bullish about profits: 43% describe profitability as being up a bit (36% in 2015) and one in seven claim it is up substantially.

Pub Market Report - in numbers

£21.55bn

total pub market value

47,548

total outlet numbers

59%

proportion of licensees predicting turnover increase

8.33

consumer score out of 10 for pub food quality

24.7%

pubs’ share of total eating-out market

Tempering this optimism slightly, increases to business running costs, such as wages and utilities, are a key future concern. Higher beer prices, greater levels of red tape and worries about the general economic climate were also cited as main concerns.

Importance of food

An improved food offering was noted to be driving turnover growth at pubs.

- A quarter (23%) of licensees say food makes up more than 50% of sales, up significantly from 2015

- For those who have experienced turnover growth in the past 12 months, an improved food offer has been cited by 19% of respondents and rated ahead of events, at 18%

- Licensees are seeing the value of developing their food offer. A quarter of respondents say the kitchen was the main target of investment over 2015, up from 17% in 2014. Only ‘general fabric’ was ahead of kitchens, mentioned by just over one third of operators.

Further growth in this area is expected, with quality, the choice of food available and value for money rated the most important factors in influencing consumers’ decision of which pubs to visit. These are ahead of beer prices and range.

The majority of consumers polled for the research agree that the quality of pub food has improved significantly over the past few years and offers great value for money.

Positive growth

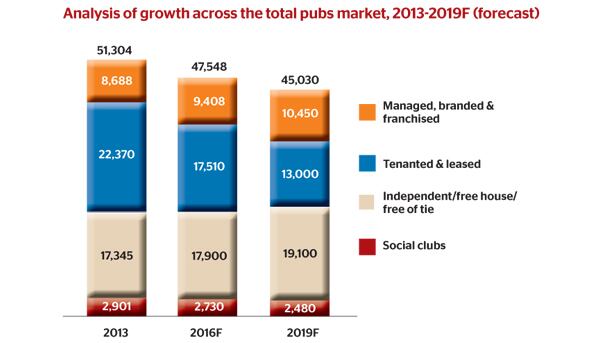

Overall, the pub market is forecast to see turnover growth rates increase to about 2% annually over the next three years to hit £22.8bn. Closures will continue, but at a slower pace, as major pubcos approach their disposal targets. The number of outlets is forecast to be about 45,000 by 2020.

“Independent and freehouse pubs are now seeing positive outlet growth, driven by pubcos releasing assets into the market that are bought up by independent operators,” the report states.

MCA expects this segment to account for 42% of total pub outlets by 2020, with tenanted and leased pubs dropping to 29% from today’s 37%.

For more details on the report, visit the MCA website.