A policy report Replacing business rates: taxing land, not investment suggests a commercial landowner levy that taxes landlords instead of tenants.

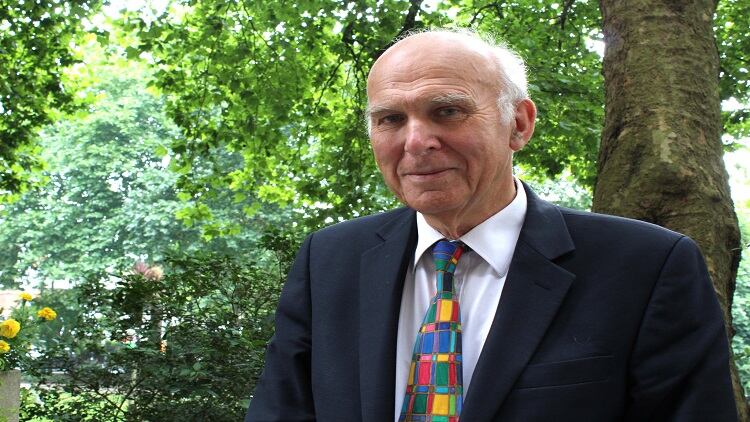

Party leader Sir Vince Cable MP called business rates “a badly designed policy” that had “become an unacceptable drag on our economy”.

Hospitality chiefs welcomed the proposals but urged for immediate reform. UKHospitality continued to call for a digital business tax suggested earlier this month and said a pub relief should be expanded across the sector.

In the 2017 Autumn Budget, a £1,000 business rates relief for pubs with a rateable value under £100,000 was continued until March 2019. However, trade groups said the relief does not go far enough and the rates system needs a total overhaul to ensure fairness for pubs.

Regional disparity

Replacing business rates with a new levy would tackle a regional inequality, with 92% of local authorities in England receiving a tax cut, the party report said.

“Business rates are a tax on productive investment at a time of chronically weak productivity growth and a burden on high streets struggling to adapt to the rise of online retail,” he said.

Many businesses experienced bill increases after a re-evaluation of rates took place in April 2017, which Cable described as having “inflicted serious harm on thousands of small businesses”.

Immediate action

UKHospitality chief executive Kate Nicholls welcomed the Lib Dems’ proposal but said immediate action was needed to rectify an unfair tax system.

“Despite Government commitments to a fundamental review of business rates, we are still stuck with an out-of-date system that unfairly hits hospitality businesses.

“The Lib Dems’ recognition that we need radical reform on rates and a complete overhaul of the system is positive for hospitality businesses.

“A move away from a property tax is positive, although any future system must also incorporate a tax on digital businesses to ensure they pay their fair share.

“We need action immediately, however, or hospitality businesses will continue to struggle against unfair taxes. In the short term, we need to see a freeze of the multiplier, expansion of the pub relief to incorporate the wider sector and positive plans to use digital tax revenue to slash rates for community businesses.”

Cable, who is rumoured to be stepping down from the party leadership next week, said for the proposal to become a reality "support will have to come from across the political spectrum".