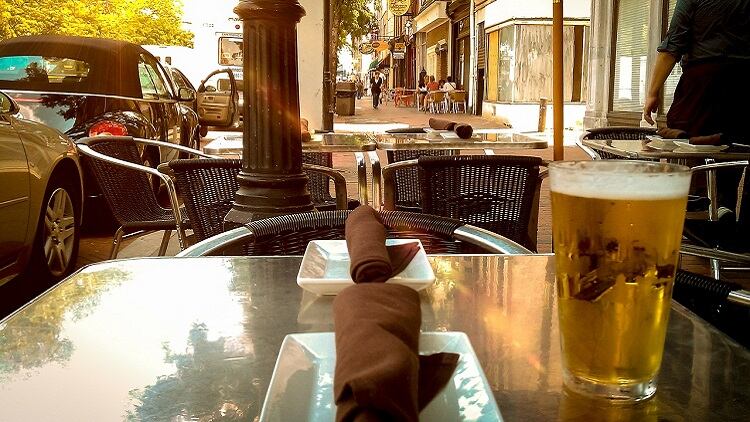

The Market Growth Monitor from CGA and AlixPartners found that across Britain, about 24 pubs and bars a week have closed in the past week alone.

At September 2018, there were more than 6,000 fewer pubs and bars than there were five years ago.

It wasn’t all bad news – food-led sites have been in growth over this five-year period, however, wet-led has reduced by 17.3%.

The report stated that with more pubs successfully turning to craft beer, premium spirits and talk of ‘peak food’ increasing, there were signs the tide was turning for drink-led pubs – but the trend of closures won’t end soon.

The research also found Britain’s total number of licensed premises, including pubs, bars, clubs and hotels as well as restaurants, was 118,905 at September 2018 – a 3.2% fall year on year.

Pubs and bars have closed at a faster pace than restaurants, with numbers dropping 11.3% in the past five years – equivalent to 24 closures a week.

However, CGA research discovered evidence that pubs and bars with a strong drinks offer are now performing better than for some time, following a summer boosted by warm weather and the football World Cup.

Pace of closures

Other findings from the report unveiled the pace of closures over the year has been higher in rural areas of Britain (3.6%) than on high streets (2.6%).

The north of England saw a 2.8% drop in licensed premises in the past year – significantly lower than the fall of 4% in the south.

CGA vice president Peter Martin said: “The eating-out sector has been one of the UK economy’s biggest success stories of the past decade, with casual dining brands growing at a phenomenal rate.

“But as our latest Market Growth Monitor shows there are clearly limits to the country’s capacity. We have seen a steady flow of pub and bar closures for many years now, but the restaurant sector is now going through its own clear out.

“The bulk of closures are from independents, while managed groups remain in growth and this trend is welcome news for some of them, since it eases over-capacity and frees up more property.

“But these figures are a reminder that all restaurant brands need a well defined and brilliantly executed offer if they are to succeed in the 'survival of the fittest' in 2019.”

The research highlighted there were still areas of growth, with some city centres continuing to increase the number of pubs, bars and restaurants – including Birmingham, which added 25 in the 12 months to September 2018.

Space for innovation

Manchester, London, Liverpool and Leeds saw net increases in sites of 16, 15, 10 and seven respectively, when compared with September 2017.

AlixPartners' managing director Graeme Smith said: “The figures in this edition of the Market Growth Monitor again illustrate that space remains for ambitious and innovative businesses to expand in areas outside London.

“Pockets of growth are still to be found for businesses with a highly differentiated offer and strong focus on the guest experience.

“As ever, for operators to succeed, they need to show a deep understanding of their local communities and what will work for their customer base.

“Those who fail to meet these expectations will inevitably fall by the wayside. But for businesses in the sector looking to grow, there will remain a multitude of options across equity and debt and investors continue to see attractive opportunities.”