The new currency, similar to decade-old Bitcoin, has been created to offer billions of people the option to exchange currency for products and services through the tech company’s apps including Facebook, WhatsApp and Instagram.

What is Libra?

- A cryptocurrency

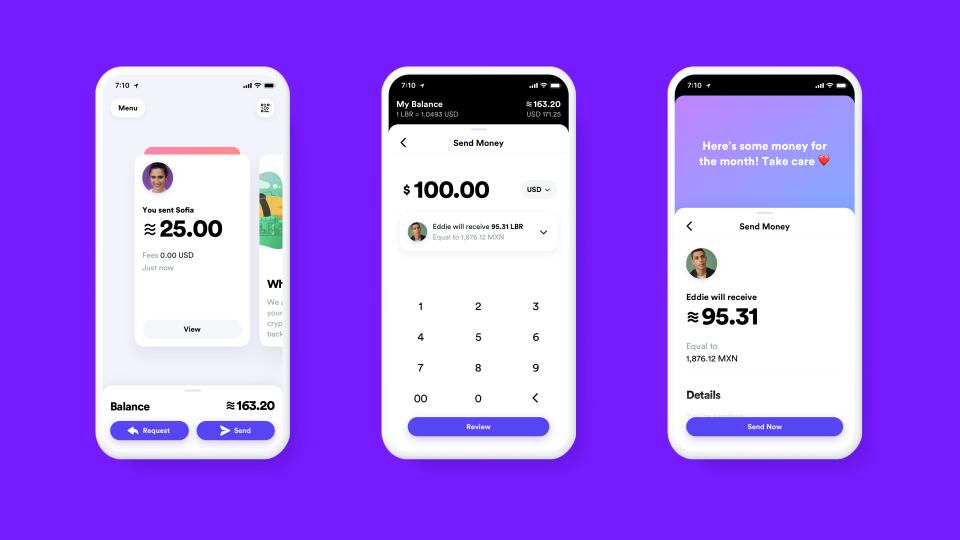

- It can be kept in a digital wallet

- Transactions will be handled through the digital wallet Calibra

- Traditional currency can be exchanged for Libra in the wallet

- Its value will be backed up by a financial reserve made up of several international currencies to ensure stability

- Used through apps like Facebook, WhatsApp and Instagram

- It will run on an encrypted network

- Facebook won’t have full control of the Libra, but will be one member of the 28 organisations currently signed up to the Libra Association

- Expected to launch in 2020

It will operate on the blockchain, a digital system that records transactions, like Bitcoin, but it will be backed by several currencies to ensure the stability of its value.

Details about the currency

There are few details about the new currency, how to access it or how it will work in full.

However, with many businesses, including pubs, and consumers already having a presence on the company’s apps, there is potential to make spending within these networks more fluid.

For example, customers could make low-fee transactions for food and drink using Libra on a pub’s Facebook or Instagram account through Facebook’s digital wallet Calibra.

Currently there are 28 groups working on the project, including former PayPal executives, credit firms like Visa, Spotify and organisations with an interest in Libra’s ability to give 1.7bn people globally without banking facilities better access.

Reshape the banking sector

Commentators believe, if successful, Libra will have the ability to reshape the banking sector, which has operated in the same way for decades.

Yet, national and global banks have already criticised the proposed currency, claiming consumers don’t want to mix their social and financial lives using apps.

Other sceptics claim the new currency is just another moneymaking tool for tech firms like Facebook to control consumer spend, by linking personal data with advertising.