Understanding what consumers are drinking, especially on a macro level, is invaluable insight for any operator targeting on-trade success.

The Morning Advertiser’s annual Drinks List in association with data experts CGA gives a clear view of how some of the bigger brands are performing, but also how tastes, diets and trends in general are changing.

Some of the bigger stories in the list this year include a slow in the decline of the behemoth lager brands such as Carling, Foster’s and Carlsberg. Although still dropping sales, the three brands combined account for almost 6m hectolitres (HL) worth of volume sales between them. Yes, consumers are still turning away from these stalwarts of the bar, but it appears the rate at which they are doing so is slowing.

Carlsberg has seen the biggest shift in fortunes, with last year’s drop of 13.1% in volume sales halving to just 5.3% this year. Its value drop of 12% last year is now just a fraction at 2.1%. is shift could be down to the work by the brewer to modernise the brand in the past few years in a bid to shift perceptions and elevate its image in the consumer’s eye. For example, rebranding it from Carlsberg to Carlsberg Danish Pilsner raises perceptions with consumers a little.

Although the biggest brands continue to drop volume and value sales, much of the lager category is in a positive place, with Amstel and Birra Moretti seeing the largest spikes in both volume and value sales. Birra Moretti’s volumes spiked by 38.7% to 356,943HL, while values rose by 40.6% to £295m. However, this still wasn’t enough to bring the beer into the top 10 .

Sticking with beer, specifically craft, the story is nearly all positive, with significant volume and value growth across the segment. The biggest story is BrewDog Punk IPA’s continued rise. Although the uptick in the brand’s volume change is less than half of what it was last year (47.6%), it has grown volume sales by 19.7% to 66,172HL.

Another positive story lies within Camden, which sees both Hells, which has remained in second spot, and Pale make it into the top three. Both brands have seen sales rise significantly in volume and value terms and together outweigh Punk IPA significantly. Hells’ volumes increased by 37.9% and its values by 44.4%, while Pale increased by 40.8% in volume and 42.6% in value. Camden, owned by Budweiser Brewing Group (the newly named UK arm of AB InBev), could put its increase in sales and rising fortunes to a hefty advertising campaign this year. Its presence has also increased in the off-trade and the brand is now better represented in many pubs and bars.

That’s the spirit

Although the top 10 craft beers in this year’s Drinks List have changed little since last year, two names have dropped off – Fuller’s Frontier and Innis & Gunn Lager – being replaced by Greene King East Coast IPA and Beavertown Neck Oil Session IPA. Beavertown, which is partowned by Heineken, wasn’t on the list last year, but has grown its presence in the segment by 156.5% in volume terms to 23,546HL, compared to 9,178HL last year. Its value now stands at near £23m compared to just £9m in 2018.

Moving into spirits, there is a mixed bag when it comes to performance. Even those with little insight into the industry would know gin is doing well, with nearly all of the top 10 brands in this year’s list increasing in both volume and value terms, with the exception of Bombay Sapphire which dropped 5.5% in volumes and 2.6% in values and Gordon’s, which lost volumes at 2.4% but increased its value by 0.8%.

Gordon’s Pink is the hero of the category, up from its place in third position last year to an impressive number one spot in the 2019 Drinks List. e product has grown both volume and value sales significantly (185.3% and 380.4% respectively) in the past 12 months. To put that into perspective, last year Gordon’s original sold 316,680 nine-litre cases and this year’s data shows its pink equivalent sold 379,883 nine-litre cases.

Rum, despite much talk about it being ‘the next gin’ shows quite a negative story, with much of the volumes and values across the top 10 dipping. Growth, however, seems to be coming from the bottom of the pack, with the likes of Wray & Nephew White Overproof Rum, Captain Morgan White Rum and Havana Club Anejo seven-year-old each showing strong volume and value growth.

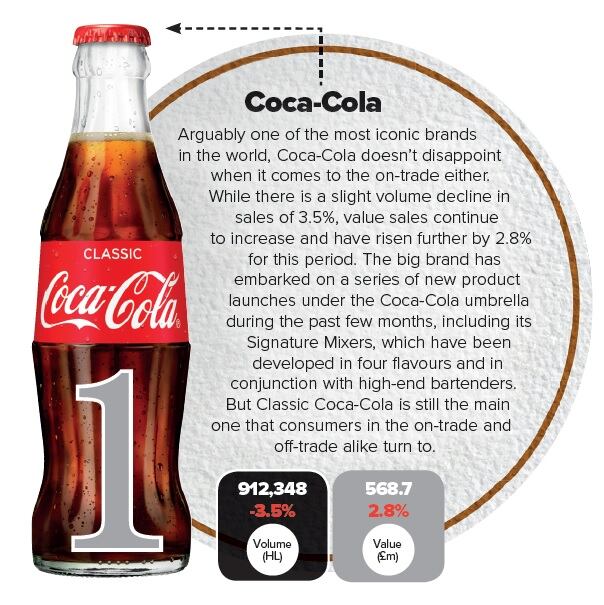

A sign of changing consumer demand, legislation and new strategies from producers has had an impact on the soft drinks category over the past 12 months. For example, standard Pepsi has switched positions with Pepsi Max after the former’s volume sales started to drop significantly last year by 21.6% and the latter’s began to increase by 285.9%. This year’s figures show Pepsi Max’s rise to third position in the list was driven by an uptick in volume sales of 71.7%.

Surprising perhaps for some, the ready-to-drink category is also showing signs of volume growth but, more interestingly, value growth too. Each of VK’s variants, for example, have all seen volume and value growth, making the brand the biggest-selling RTD in this year’s Drinks List, accounting for 51,723HL in volume sales.

Sugar-free movement

The movement towards sugar-free and lower sugar in the soft drinks category can clearly be seen in the performance of Coca-Cola Classic, which saw a volume sales dip of 3.5% and Pepsi, which saw volumes drop by 31.4%. These drops are, however, being managed by the producers, which are focusing on pushing the sales of their sugar-free alternatives for social and corporate responsibility reasons.

And this health conversation has encouraged further growth in the no and low-alcohol beer category, with each of the top five brands experiencing volume and value growth.

The biggest winner in the segment this year is Heineken 0.0 which saw volume sales spike by 123.1% to 17,316HL, showing the brand is gaining significant ground towards long-standing top spot holder Beck’s Blue.

Position shifts this year, as well as brands entering and exiting it, have been few, but the Drinks List reflects which categories are in growth and where operators should look to invest their time and energies in drinks menus.

- All data provided by CGA for the 12 months to 7 September 2019

Lager

Carling retains the top spot – more than 1m hectolitres of sales ahead of its nearest rival – despite marginal drops.

No-and-low alcohol beer

Beck’s Blue is still improving volume and value sales at the top of the tree but Heineken 0.0 is pursuing hard after a great year.

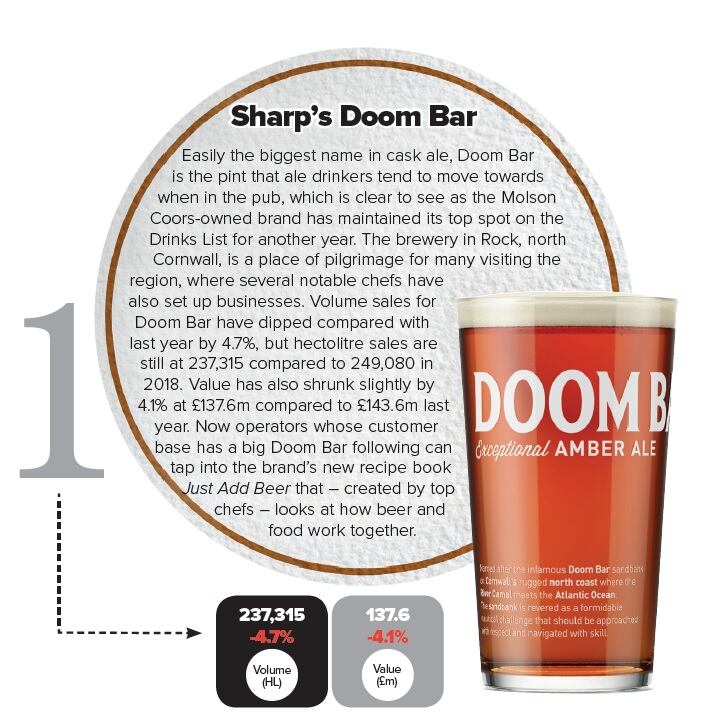

Cask

Doom Bar from Sharp’s continues to lead the pack by a huge margin despite a decline in the category.

Craft beer

Still a relative newbie in the market, the craft sector is making serious inroads and BrewDog still holds top spot in both volume and value sales.

Whiskies

Despite a dip in volume and value sales, legendary Jack Daniel’s remains the undisputed frontman.

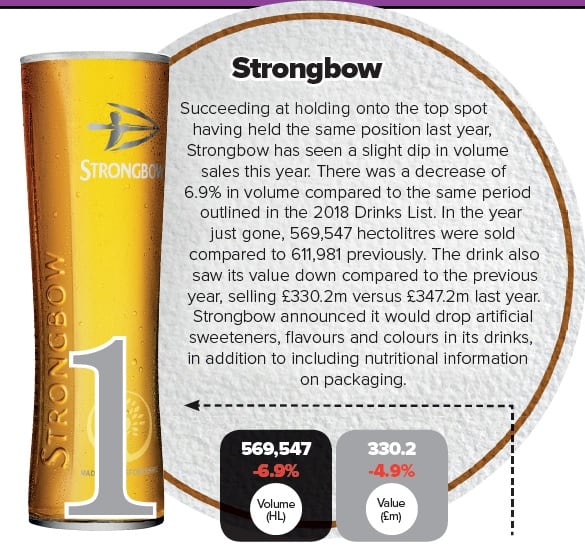

Cider

Category leader Strongbow held its position as the number one and two ciders despite a dip in volume and value sales this year.

Spirits

Vodka giant Smirnoff Red is outstripping its rivals in this category but Gordon’s Pink Gin has enjoyed a great year in second.

Vodka

Sales of both volume and value have dipped for category leader Smirnoff Red but only Ketel One and Grey Goose have recorded sales increases this year.

RTDs

The top nine ready-to-drink brands recorded overall growth thanks to brands such as VK.

Wine

Top bunny Jack Rabbit retained first place in the wine category and enjoyed impressive lifts to both volume and value sales for the Drinks List 2019.

Rum

Captain Morgan Spiced continues its dominance at the top of the charts – and has enjoyed growth spurts in terms of volume and value sales.

Gin

Pink gin has truly come of age as shown by Gordon’s version in this incarnation of the Drinks List. Impressive figures have forced its sister tipple into second spot.

Softs

Classic Coca-Cola has retained top spot and continues to outsell other category competitors by some distance.

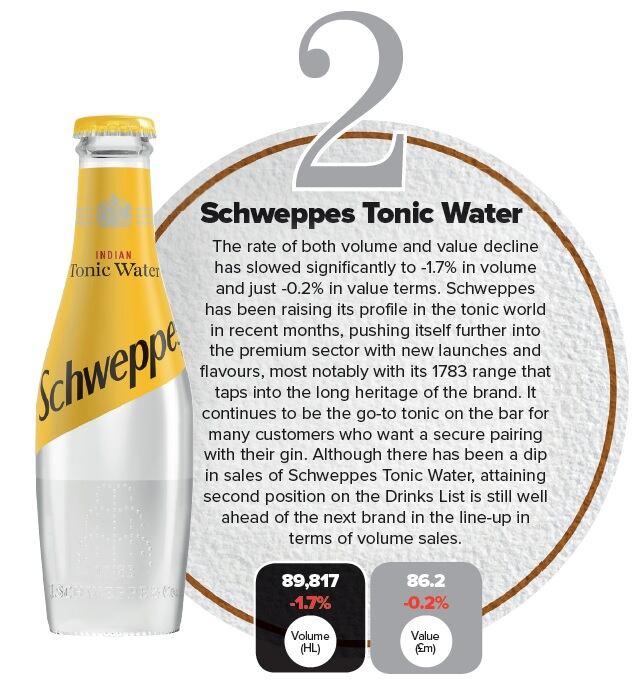

Tonics

This category is in great health and brands like Schweppes and Fever-Tree continue to dominate.