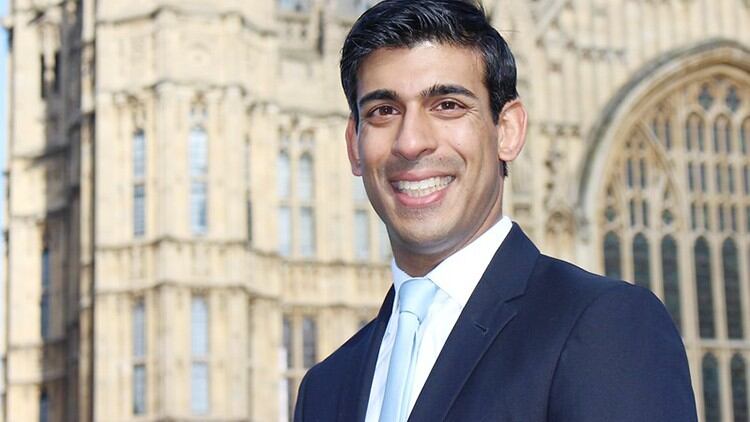

Sunak delivered the Summer Economic Update in the House of Commons where he set out the measures as part of the Government’s three-phase ‘Plan for Jobs’.

He also said the rate of VAT applied on "most tourism and hospitality-related activities" will be cut from 20% to 5%.

The Treasury has also confirmed to The Morning Advertiser this includes the supply of non-alcoholic beverages.

Sunak added: "At the moment, VAT on hospitality and tourism is charged at 20%, so I’ve decided for the next six months, to cut VAT on food, accommodation and attractions.

"Eat in or hot takeaway food from restaurants, cafés and pubs; accommodation in hotels, camp sites, B&Bs and camp sites; attractions like cinemas, theme parks and zoos; all these and more will see VAT reduced from next Wednesday (15 July) until 12 January 2021 from 20% to 5%.

"This is a £4m catalyst for the hospitality and tourism sectors, benefiting more than 150,000 business and consumer everywhere, all helping to protect 2.4m jobs."

In a bid to encourage people to return to eating out, the Government's Eat Out to Help Out discount scheme will provide a 50% reduction for sit-down meals in pubs, restaurants and cafés across the UK from Monday to Wednesday every week, throughout August 2020.

The Chancellor said: “Meals eaten at any participating business, Monday to Wednesday, will be 50% off, up to a maximum discount of £10 per head for everyone, including children.

“Businesses will need to register and can do so through a simple website, open next Monday. Each week in August, businesses can then claim the money back, with the funds in their bank account within five working days.

“[Some] 1.8m people work in this industry. They need our support and with this measure, we can all eat out to help out.”

The Government will also introduce a Job Retention Bonus, where UK employers will get £1,000 for each furloughed employee who is still employed as of 31 January 2021.

In addition, there will also be a £2bn Kickstart Scheme, in a bid to create hundreds of thousands of new, fully subsidised jobs for young people across the country with those aged between 16 and 24, claiming Universal Credit and at risk of long-term employment, will be eligible.

Funding available for each six-month job placement will cover 100% of the national minimum wage for 25 hours a week and employers will be able to top this wage up.

Retain and hire

Operators will also be given £2,000 for each new apprentice they hire under the age of 25 and this will be in addition to the existing £1,000 the Government already provides for new 16 to 18-year-old apprentices and those aged under 25 with an education, health and care plan.

Sunak said: "Our plan has a clear goal: to protect, support and create jobs.

"It will give businesses the confidence to retain and hire. To create jobs in every part of our country.

"To give young people a better start. To give people everywhere the opportunity of a fresh start."

He added that following this second phase focusing on jobs, there will be a third phase focusing on rebuilding with a Budget and Spending Review in the autumn.

Commenting on today’s announcement, UKHospitality chief executive Kate Nicholls said it was reassuring the Chancellor singled out hospitality and tourism as a vital part of the UK's economy and a pillar of social life around the UK.

She added: "It is also good to see the Government acknowledges our sector has been uniquely hit by this pandemic. Customer confidence is key to our sector’s revival and our ability to help Britain’s economic recovery. Applying every precaution to provide safe venues will count for nothing if customers are not coming through our doors.

"This significant VAT cut, heightened ability to retain staff and incentives for consumers to eat out together amount to a huge bonus. We hope the UK public rightly sees it as sign that we are ready to welcome them back safely. The future of many businesses and jobs depends on it.

“The measures to support job retention and recruitment are very positive. Even after the reopening of some venues, we estimate that around 1.5m workers in our sector are still furloughed. With revenues likely to be down for the foreseeable future, the support measures to get workers off furlough and back into work will be greatly appreciated.

“Support to retain our workforce with a retention bonus, kickstart employment and bring on trainees and apprenticeships should also be a huge boost to our sector as we begin our long recovery. Businesses have been closed for months and, with the possibility of a difficult winter ahead, support to create jobs will be vital if hospitality is to play the significant role we hope it will in helping boost the economy."

Significant challenges

Nicholls went on to warn there were still more challenges to come with the largest being rent issues.

She added: “This doesn’t mean we are out of the woods, and there are still significant challenges ahead. The biggest of these is the spectre of rent liabilities which many businesses are still facing from their closure period. Rent bills have piled up over the past few months even though venues were closed, and businesses are now facing huge rent debts with prospects for the future still in the balance. We are going to need Government support on this before too long.

“The measures announced today are extremely positive, though, and they should give many businesses in our sector much-needed help to get going again in earnest. We thank the Chancellor for recognising the importance and value of our sector, and for acting so decisively.”

However, the Campaign for Real Ale (CAMRA) was concerned the announcement forgot about community pubs.

Chief executive Tom Stainer said: "While a six-month cut in VAT for food served in pubs and the Eat Out to Help Out voucher scheme in August is welcomed, we are concerned pubs have been left behind by the Chancellor's statement, which contained little support for community pubs.

"It is also disappointing to see no direct support for independent brewers and producers, who will not benefit from a VAT cut that specifically excludes beer and cider.

“CAMRA will continue to campaign for greater support for all pubs - including those that don’t serve food. We are calling for long-term support measures – business rate reform and a tax reduction for draught beer – to encourage people back to the supervised setting of the community pub.

“Lockdown has shown just how valuable our pubs are to local communities and the pivotal role they play in tackling loneliness and social isolation. It is absolutely right that they receive extra support during the difficult months ahead to ensure their continued survival.”