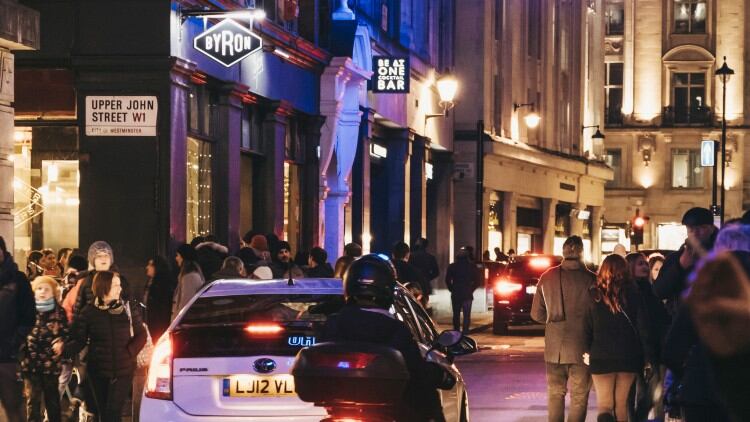

Late-night hospitality businesses including pubs in areas subject to a late-night levy continue to be liable for the tax despite the fact that many have been shuttered since March and those that have reopened have been subject to a 10pm curfew since 24 September.

However, UKH, the BBPA and BII have written to Crime and Policing Minister, Kit Malthouse MP demanding that he give them the power to do so and called for confirmation that businesses will receive refunds for payments made while they were closed or unable to operate as late-night businesses.

Under current legislation, local authorities are not permitted to cancel or freeze late-night levy payments, though, as reported by The Morning Advertiser, Greater London night czar Amy Lamé wrote to each of the capital’s local authorities in April requesting they suspend collection of annual licence and late-night levy fees for a year amid the ongoing pandemic.

What’s more, Newcastle City council also called on the Government to change control of levies on licensed businesses to allow them to offer a reprieve in June.

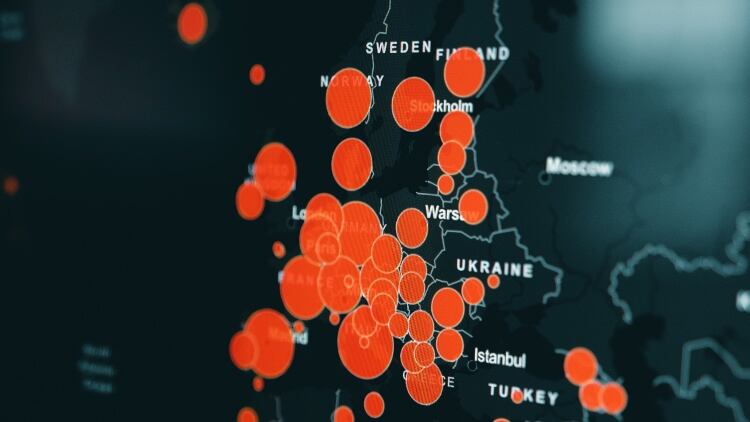

More than half of the total number of levies adopted in England are within London – covering Hackney, Tower Hamlets, Islington, the City of London, Camden and Southwark – with levies also adopted in Newcastle and Liverpool, Southampton, Chelmsford and Nottingham.

Unjustified tax

The levy, which costs between £299 and £4,440 depending on the rateable value of a license holding venue and whether the property is used exclusively or primarily for the sale of alcohol, is based on the notion that “the polluter pays”, according to Cornerstone Barristers’ Philip Kolvin QC – though there are permitted reductions for social responsibility schemes and for low-rated properties.

“With businesses mandated to close at 10pm and with many late-night premises still unable to reopen at all, there is no way the late-night levy is justified,” a joint spokesperson for UKH, the BBPA and BII said. “A tax that was spurious at the best of times, is completely unnecessary and potentially very harmful in the midst of this crisis.

“This has been acknowledged by some local authorities and we have had pragmatic discussions about how late-night hospitality and pubs can be supported. Unfortunately, as the powers are set under national legislation, late-night levy payments cannot be frozen or cancelled.

“We need the Government to act on this issue as a matter of urgency. Late-night venues are either closed altogether or operating at a fraction of their normal revenue. All the while, they continue to bleed money.

“The Home Office must recognise that the levy no longer applies when much of the sector is still closed and those that are open cannot do so after 10pm in England, or at all in Wales currently. Local authorities must be given the power to cancel levy payments. That is the first step. We then need confirmation that businesses will receive a refund for fees that they have been forced to pay, even though they were closed.”