ADVERTISEMENT

Effect of Covid-19 on Occupational Agreements

By Tony Hunter, director in the licensed leisure team at Savills Manchester

There are many times in life when we see things go full circle, from fashion to music, we often see concepts that we perhaps thought were confined to history re-emerge and become popular once more.

The pub industry has shown similar reinventions over the three and a half decades in which I have been involved with in managed and tenanted sectors, with the two frequently changing positions when it came to being ‘top gun’. Pub companies’ acquisition teams have adjusted to become disposal teams, only to morph a few years later into another acquisitions team as the industry shifts once again.

With the impact of Covid-19 shaking up the sector in a way we couldn’t have imagined 12 months back, I have inevitably found myself pondering how fallout from the pandemic will affect the way in which public houses are operated.

It is clear going forward that there needs to be a greater collaboration between landlords and tenants if we are to see our great industry initially surviving and thereafter thriving.

Clearly high volume and high turnover public houses will always be preferred by the pub companies as managed houses and I cannot see that changing but I can see the tenanted sector being more affected.

Tenants will undoubtedly be more cautious moving forward not to commit themselves into agreements whereby in a ‘lockdown’ situation in the future they are left with major outgoings despite not being able to trade their business either fully or partially.

For this reason, we expect to see the revival of what is known as a ‘MANTEN’ agreement, a mix of manager and tenant with the latter taking a percentage of turnover to pay staff, retaining the rest as income, and the pub owning company paying all other costs. The operator is therefore incentivised to maximise turnover with a very efficient level of staff.

MANTEN agreements have been used in exceptional circumstances throughout previous decades, generally with ‘problem’ pubs. However, such agreements were very few and far between back in the 80s and 90s, probably used in less than 5% of pubs.

The formula has been adopted in more recent years by several pub companies, not due to the need of incentivising a manager, but simply as an efficient way of maximising revenue. For instance, by adopting more strategic opening hours linked to when the pub will be in demand, rather than opening throughout the day, which, in some locations, is not efficient.

As the repercussions of Covid-19 take their toll on the industry, I can see an increasing use of this sort of agreement as it gives the operator security against sudden lockdowns or restrictions on trading, be it related to Covid-19 or a future unknown reason, and it also gives flexibility to the pub company. If such lockdowns do happen, it is less of a problem for the pub company as there is no back rent and other costs building up and it is far less stressful for the operator.

We have already seen the industry turned on its head once again with the 10pm curfew, followed by the complete closure of wet-led pubs in some areas. The need for flexibility, and an agreement which is mutually beneficial for both pub companies and their tenants, is vital to secure the long term future of establishments.

The industry is going through a torrid time but is known to be resilient and as we’ve seen the ways the sector has adapted and reinvented itself in the past, I am sure that we will pull through and thrive again.

Bids made for Stonegate and Ei pub package

A number of interested parties have submitted bids for a 42-strong pub package placed on the market to address concerns raised by the Competition and Markets Authority (CMA) over Stonegate Pub Company’s £3bn acquisition of Ei Group.

It’s understood that bids for the 30 freehold and 12 leasehold pubs comprising 32 Ei-owned properties and ten Stonegate sites were due on 19 October.

Marketed by CBRE, the pubs need to be divested in a maximum of three packages unless otherwise agreed in writing by the CMA.

According to reports, Admiral Taverns and real estate investment company Aprirose – which launched pub management company Blackrose in 2019 – are among the interested parties. Last year, Aprirose launched Blackrose, its pub management company.

As previously reported by The Morning Advertiser (MA), Blackrose plans to build an estate of close to 250-sites by the end of 2021 by purchasing 200 pubs across the UK.

“Our pub management company, Blackrose, has a clear and ambitious strategy which we look forward to continuing to support,” Manish Gudka, CEO of Aprirose, said in June.

“As they identify new investment opportunities and expand the brand, Aprirose is committed to growing this arm of our business as we seek to add 200 new locations to Blackrose’s portfolio by the end of 2021.

“While Covid-19 has undoubtably been a difficult time for all, we continue to seek the right opportunities for investment across all of our platforms.”

Revolution Bars Group to close six sites

Nationwide bar operator Revolution Bars Group has launched a company voluntary arrangement (CVA) of subsidiary Revolution Bars Limited in a bid to improve the wider group’s long-term financial position.

As previously reported by The Morning Advertiser (MA), an update on 25 September revealed Revolution Bars Group was assessing the potential impact of the Government’s latest restrictions and exploring options such as the downsizing of its estate through a CVA.

Now, a statement from the operator of 73 sites under its Revolution and Revolución de Cuba brands has announced a CVA has been launched in order to scale back its portfolio and rental cost base as well as improve the group’s profitability and return on capital.

After a review identified 13 sites that were considered to be either underperforming, over-rented or not expected to generate future profitable returns going forward, the CVA proposal includes reducing Revolution Bars Group’s estate of Revolution branded bars from 50 to 44 and obtaining improved rental terms for seven others.

Revolution Bars Group confirmed ts remaining 37 Revolution bars, as well as its estate of Revolución de Cuba sites and four Revolution branded bars operated by other entities, would be unaffected by the CVA, as would the broader group’s AIM listed status.

What’s more, as part of the proposals Revolution Bars Group will write-off half of the £30.9m debt owed by its subsidiary.

If the proposals are accepted, the group estimates its annual cash flows will improve by approximately £2m per annum over the next two years.

Amity Brew Co to open first brewpub

Yorkshire-based craft brewer Amity Brew Co has announced plans to open its first brewpub before the end of the year after signing a ten-year lease on a site at Sunny Bank Mills in Farsley.

The 2,500 square foot brewery and bar, which will boast an outdoor beer garden, will launch in December to complement Amity’s new developed £2m Weavers Yard facility.

In the months since Amity launched in June, the craft brewer has created half-a-dozen jobs and produced a range of beers via partner breweries – which are stocked on draught in more than 30 BrewDog sites

“The community support over the past few months has been incredible,” Amity co-founder and director Richard Degnan said. “We can’t wait to get on-site and start brewing.”

William Gaunt, joint managing director of mill owners Edwin Woodhouse and Co, added: “We have always been interested in having a micro-brewery here at Sunny Bank Mills, and when Amity Brew Co came to us, we immediately knew they would be the perfect fit. We are about to start work and hope the brewery and taproom will be open before Christmas.”

Everards to open new home in Spring 2021

Leicestershire-based brewer and pub operator Everards has announced that new state-of-the-art brewery, beer hall and shop, Everards Meadows, will open in Spring 2021, creating 40 new jobs.

As well as great beer, visitors will be able to enjoy local spirits and a range of hot drinks. The open kitchen will offer home cooked food from full meals to a broad range of snacks.

“This really is an exciting time for us and the beginning of a brand-new chapter in our 170-year history,” chairman Richard Everard explained.

“We are still an independent family business with strong roots in Leicestershire and we are about to move into the sixth generation of the family leading the business as we commence this exciting next chapter.

“We look forward to welcoming customers to our new home where they will be able to enjoy fantastic hospitality while overlooking both the wonderful meadows but also our state-of-the-art brewery.

“We will be brewing a great range of beers and of course bringing our famous ‘Tiger’ back to Leicestershire.”

NWTC to launch second Sheffield site

Graphite Capital-backed operator The New World Trading Company (NWTC) has unveiled plans to open of a new venue under its the Trading House brand, doubling its presence in Sheffield where it already operates a Botanist site in the city’s Leopold Square.

According to reports, the 28-site company has secured a site in Charter Row as part of Sheffield’s Heart of the City II development.

As reported by The MA in April, NWTC appointed Danish bakery group boss Jesper Friis as its new chief executive, replacing Chris Hill.

Friis joined the operator of brands including the Botanist and the Florist from Ole & Steen (Lagkagehuset) where he led the bakery business’s expansion from 35 to more than 100 outlets, including in the UK and New York.

Previous to this, he spent three years running the €2.6bn (£2.27bn) Western European arm of Carlsberg Group.

On his appointment, Friis said: “I am very grateful for this opportunity. NWTC has great brands, built on strong principles and values.

“This is patently an extremely challenging time for the industry but I am looking forward to continuing the impressive work that has been done by my predecessor Chris Hill and his team.”

London Beer Factory launches taproom petition

South-east London-based craft brewer London Beer Factory has launched a petition in the hope of convincing Lambeth council to allow the beer maker to add a taproom to its new warehouse premises in West Norwood.

The brewer hopes to add the warehouse taproom to its Barrel Project site on London's Bermondsey Beer Mile.

"Help us to petition Lambeth council in allowing a taproom at our new warehouse premises in West Norwood," the statement accompanying the petition read.

"We are aiming to create a relaxed, family-friendly brewery taproom within our newly leased warehouse unit on Beadman St, West Norwood. However, our application for license has been impeded meaning we cannot serve the people of our neighbourhood or sustain our site.

"As with many in the brewing industry we have been acutely effected by the recent Coronavirus pandemic and are looking to every possible source as a means to weather this storm. By supporting us and signing you'll be helping to bring an independent, modern, and progressive space for all to our new neighbourhood. As well as allowing us to continue to innovate, serve, and make great craft beer accessible to the people of West Norwood, Crystal Palace, Tulse Hill, West Dulwich and the surrounding areas."

At the time of writing, the petition on Change.org had received 222 signatures of the 500 sought.

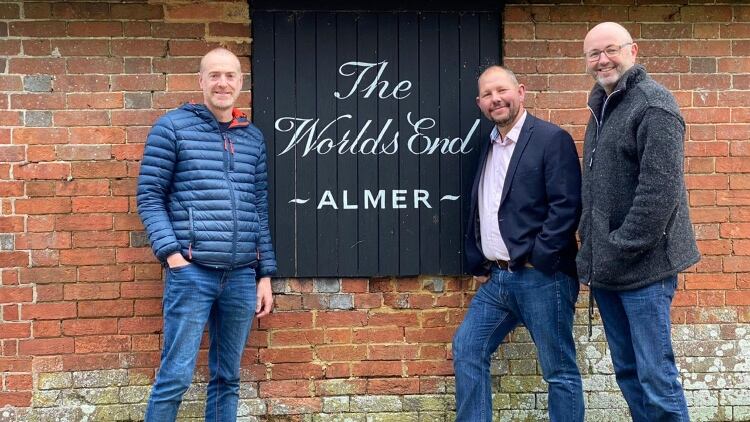

Electric Pubs to reopen the World’s End

Dorset-based pub operator Electric Pubs has announced that it plans to re-open the World’s End in Almer after acquiring the site which has been closed since the spring of this year.

“We are delighted that Electric Pubs will now be operating the World’s End,” Richard Drax of Charborough Estate, said. “They share our vision for the pub and how it can develop going forward. We look forward to working with them for many years to come.”

Electric Pubs adds the World’s End, which was rebuilt around 30 years ago following a fire and is rumoured to be the oldest pub in Dorset, to the handful of sites it already operates.

“Given its location, the World’s End is one of the best known pubs in Dorset,” Alasdair Warren, the operator’s chairman, said. “We are very excited to work with the Charborough Estate and realise its full potential in the years to come.

“We look forward to reopening and welcoming back our locals as well as passing visitors from further afield”.

Steve Killingbeck, a director at Electric Pubs, added: “Over time, we plan to expand the food and wine offering. We will have a largely British menu with a strong emphasis on Dorset produce, meats and fish, and bespoke wines supplied by Morrish & Banham. We also plan to significantly expand and upgrade the outside areas, developing a large country garden in the fields to the rear, which we hope to open in the summer of next year.

Drake & Morgan and Antic alumni launch Badger Badger

According to reports in Hot Dinners, Calum McKinnon, previously of London-based operator Drake & Morgan, and James Ross, formerly of Antic Pubs, have launched Badger Badger in Deptford, south-east London.

Found on Deptford High Street, the new site will offer a yakitori and fried food menu alongside a selection of beer, a Tanuki Gaming run games room featuring more than 100 board games and a dedicated remote working space including secure wi-fi, power and USB sockets as well as bespoke food and drink packages.

“A new, independent venture in Deptford, Badger Badger is the unholy creation of co-founders and hospitality veterans Calum and James,” the new venue’s website explains.

“Its unorthodox design is inspired by the fiercely independent personality of Deptford: unique, diverse and a little bit odd.

“Our purpose is to create a communal space that reflects and celebrates the local community, welcoming everyone with rich Japanese street food, fantastic booze, board gaming and a bit of general silliness.”

To find out more about pubs for sale, lease and tenancy visit our property site