Red Lion Holdings acquires majority stake in Red Mist Leisure

Red Lion Holdings LLP - a joint venture between industry investors David Ramsey, Jason Myers and leading European real estate private equity investor Revcap – has acquired a majority stake in Surrey and Hampshire-based pub company Red Mist Leisure.

The deal is intended to accelerate the expansion of the Red Mist’s portfolio of managed gastropubs across the south of England and further afield.

“This investment is an exciting and very positive development for our company, our teams and our customers,” Mark Robson, managing director at Red Mist Leisure explained.

“I am so proud of what Red Mist has achieved since we started in 2004 and this new equity injection provides us with the capital to expand our business in the future.”

Oxford's Lamb & Flag to close as 'not currently financially viable'

A historic pub is to close after four centuries after the pressures of the pandemic rendered it unable to break even.

The Lamb & Flag in St Giles, Oxford, will close after poor trade in the past year, according to its owner Oxford University’s St John’s College.

The pub has served the city since at least 1566 and hosted historic figures including writers JRR Tolkien, CS Lewis and Thomas Hard. It is a Grade II listed building.

The Lamb & Flag (Oxford) Limited, “will close and cease operations at the public house on 31 January 2021,” the college said in a statement.

Rowton Brewery purchases third pub

Telford-based Rowton Brewery has acquired the Wrekin Inn in Wellington, Shropshire – it’s third site after the Pheasant, also in Wellington, and the Old Fighting Cocks in Oakengates, Shropshire.

In a Facebook post shared on 15 January, the brewer announced: “It gives us great pleasure to announce we have purchased the Wrekin Inn in Wellington.

“The Wrekin has for a long time been associated with live music which we plan to continue, as well as offering a selection of our own Rowton ales and other craft beers.

“We will be running it alongside our other pubs, The Pheasant and The Old Fighting Cocks.”

Pub market recovery from 'seismic shock' will not be uniform

Christie & Co’s annual business outlook report forecasts that the pub market’s recovery from Covid-19 in 2021 will be ‘pretty quick’ but varied as one-in-three operators plan pub sales.

The specialist business property adviser’s ‘Business Outlook 2021: Review. Realign. Recover’ report revealed two-thirds of operators expect it will take the pub sector up to three years to recover from its Covid symptoms.

What’s more, while almost every pub operator (98%) from a surveyed pool stated that Covid-19 had a high degree of impact on trade over the past year, around half (49%) feel optimistic about seeing some recovery in 2021.

While Stephen Owens, managing director of pubs and restaurants at Christie & Co told The Morning Advertiser (MA), he believes the sector’s “bounce back” will be reasonably fast, he doesn’t think it will be a blanket experience across the industry.

JDW rebukes Guardian ‘smaller pubs on the cheap’ spree claims

Pub giant JD Wetherspoon (JDW) has dismissed reports by The Guardian on 19 January that the operator is planning to “buy smaller pubs on the cheap amid Covid crisis" and that "it is targeting pubs in central London” as “completely untrue”.

JDW claimed that it operates pubs which are three or four times larger than average and rarely "targets" existing pubs in a news release on 22 January.

While JDW highlighted that its press release on Tuesday said that the company is "considering a number of properties in central London, the freehold reversion of pubs of which it is the tenant, and properties adjacent to successful pubs", it claimed that all the company's pubs in central London had other uses before Wetherspoon's occupation.

Examples given included the headquarters of the Hong Kong and Shanghai Bank, the former Marquee Club and the former ballroom of the Great Eastern Hotel.

"The Guardian should avoid legends and stick to the truth," chairman Tim Martin commented in JDW’s news release.

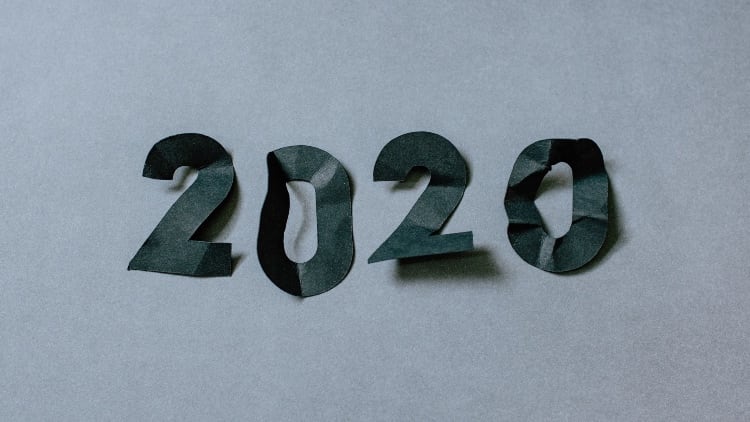

2020 cost trade 6,000 licensed venues

The UK lost in the region of 6,000 licensed premises in 2020 – almost three times the number closed in 2019, new figures have revealed.

The latest Market Recovery Monitor from CGA and AlixPartners revealed a net decline of 5,975 sites in 2020 – a 5.1% contraction in the market since the end of 2019 and a 175% increase on the 2,171 drop in sites during the same period.

The research found that 9,930 sites permanently closed last year with 3,955 opening for the first time meaning for every one new opening, there were 2.5 closures – nearly double the ratio of 1.3 in 2019.

When broken down into the different areas of the hospitality trade, the community, food and high street pub segments saw venue numbers fall by between 3.9% and 5.1%.

Former Revolution and Liberation leaders seek pub deal backing

The former bosses of Revolution Bar Group and Liberation Group, Mark McQuater and Mark Crowther respectively, are seeking backing for pub deals according to The Times.

Crowther, who ran Channel Islands-based Liberation for 11 years, has been named chairman of Portobello Brewery, operator of 17 pubs in London owned by Downing Corporate Finance.

He told The Times “the phone has been ringing off the hook from private equity firms saying they want to get into the sector”.

He added that Portobello had built an infrastructure and management team capable of expanding and was keen to pick up packages of at least a dozen pubs across London and the southeast.

“We could probably raise anything from £10m to £50m, but that’s not to say that if somebody came along and offered me £200m and said go out and buy some pubs we couldn’t do it,” he said.

Crowther added there was particular interest from investment firms in freehold pubs, although there was “not much out there”.

“People seem to be waiting for cheap deals, but I’m not sure there will be that many,” he continued. “I think pubs will bounce back very quickly and strongly when they’re allowed to open.”

How do pubs code rights apply when a pub is sold?

The pandemic is having an effect on many lives and businesses across the whole pub trade – one outcome of this could be pub acquisitions by investors with long-term confidence in the recovery of the sector.

This may involve both existing operators and new ones, and there has been recent coverage in the press about new entities readying themselves for investment when the time is right.

I therefore thought it would be topical to talk about how pubs code rights apply when a pub is sold and discuss some related issues.

I am basing this column on theoretical acquisitions – I have no inside information.

- To find out more about pubs for sale, lease and tenancy visit our property site