Sales in the second quarter were affected by the “Plan B” restrictions announced by the government in December and in the 12 weeks to 16 January 2022, like-for-like sales decreased by 15.6% and total sales by 16.6%.

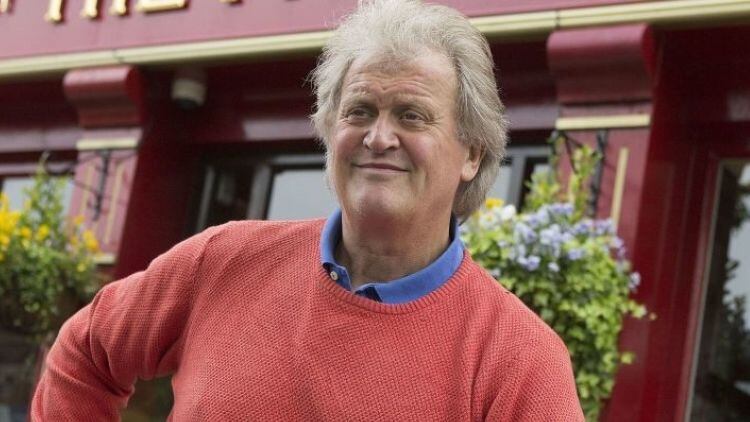

JDW chairman Tim Martin, said: “As mentioned in our update on 13 December 2021, the uncertainty created by the introduction of plan B Covid-19 measures makes predictions for sales and profits hazardous.

Hope for a stronger performance

“The company will be loss-making in the first half of the financial year, but hopes that, with the ending of restrictions, improved customer confidence and better weather, it will have a much stronger performance in the second half.”

The financial update from the operator came after it was reported investment company Blackrock, which owns 3.51% of Wetherspoon shares on behalf of its clients, made around $1.7 billion of profits in its last quarter.

Another impact on the sector was the amount of tax on-trade businesses pay in comparison to off-trade.

Rebalancing of the tax system

A trading update from JDW stated pubs pay 20% VAT on food sales whereas supermarkets pay nothing and pubs pay around 20p per pint of business rates, but supermarkets pay around 2p, which enables them to subsidise beer selling prices, using their tax advantage.

Reduction in VAT over the course of the pandemic helped many businesses, however the Chancellor has announced it is due to go back to 20% in April.

The trading update added the far more onerous taxation of pubs and restaurants, often located next to tax-favoured supermarkets, is unfair and inequitable - and leads, paradoxically, to lower employment and taxes, making the end of the pandemic an excellent opportunity for a sensible rebalancing of the tax system.