Trade bodies have reacted to the news with "disappointment", having campaigned for a permanent reduction of the rate before the Statement.

For UKHospitality (UKH) chief executive Kate Nicholls, the news came as a "real setback" for hospitality businesses still suffering from the repercussions of Covid, and the removal of the lifeline of a lower VAT rate "might prove fatal".

Before the statement, UKH had repeatedly urged the Government to keep the lowered rate, including spearheading a letter which hundreds of leading voices in the sector signed, calling Sunak to hold the 12.5% VAT rate. An inquiry by the All-Party Parliamentary Group for Hospitality and Tourism also called for the lower rate to be secured.

Nicholls said: "For a heavily, disproportionately taxed sector a return to 20% dashes the hopes that many businesses could begin to recoup some of the losses of the last two years.

“Operators in the sector, large and small, have several hurdles to clear on the road to recovery: huge accumulated debts; unprecedented rising costs for energy and raw goods; a chronic shortage of staff; and a fundamentally unfair and crippling business rates regime we’re desperate to see reformed."

VAT of some hospitality supplies was reduced to 5% in July 2020 to support businesses to alleviate some of the financial impact of Covid. It moved to 12.5% in October, and will rise to the standard rate of 20% next month.

“Locking in VAT at 12.5% would have given hospitality businesses a major boost, and helped the sector in its ambition to lead the UK back to post-Covid prosperity. As it is, thousands of jobs could be lost, the UK will remain uncompetitive versus international rivals, and already hard-pressed consumers in the midst of a cost-of-living crisis will see price rises in their favourite pubs, bars and restaurants, further fuelling inflation.

“Despite today’s disappointment, UKH will continue to work closely with government to achieve the best possible trading conditions for the hospitality industry – which remains the sector best placed to turnaround the economy – and is buoyed by recent support for our 12.5% VAT call from a significant number of MPs.”

The Night Time Industries Association chief executive Michael Kill said it was "very disappointing" the Chancellor did not mention an extension of the VAT lowered rate in the Statement.

He said: "It’s important to be clear about what cost inflation means for businesses in the Night Time Economy: many are likely to reach a tipping point in the next 12 months as they face a perfect storm of challenges. These include the fact that nightlife continues to trade below pre pandemic levels; that businesses face debt hangovers from the pandemic; all coupled with soaring cost inflation.

"What should have been a key period to in part recover losses last Christmas was hampered by the fiasco in the message on socialising being communicated by the Government. This has left the sector in a fragile situation as it looks to rebuild, and will mean that much public money that has been spent keeping viable businesses afloat will be wasted if they go under."

JD Wetherspoon founder and chairman Tim Martin had previously slammed the Government's proposal to increase VAT. He said: "It doesn't make senses that food bought in pubs, restaurants and cafes attracts VAT of 20% when food is VAT-free in supermarkets."

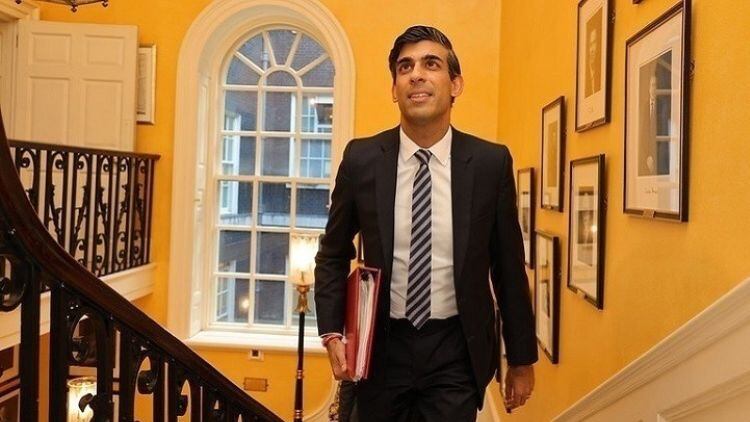

Chancellor Rishi Sunak said the Statement would aim to "build a stronger more secure economy for the United Kingdom". He spoke of the UK's support for Ukraine, and said sanctions placed on Russia came at a cost to the UK.