This follows a drop of 3% vs 2019 last week and a 7% dip over the previous seven days when the sector was impacted by rail strikes.

CGA managing director UK and Ireland Johnathan Jones said: “Drinks sales have hovered just below 2019 comparatives for nearly all of the Spring and Summer now, though as always there have been winners as well as losers in the on premise.”

Further behind

Rising temperatures over the week helped to bring consumers out to drink, though sales fluctuated from day to day.

Monday, Tuesday, and Saturday (4, 5 and 9 July) saw modest growth, however, there were negative comparatives on every other day during the week.

This included Friday, which has struggled all year as people changed working habits, seeing its share of sales dropping by 1.3 percentage points while Saturday sales grew by 1.6 percentage point, according to CGA.

Furthermore, with inflation now running at 9%, sales were significantly behind pre-pandemic levels in real terms and rising drinks prices also meant the volume of sales was even further behind 2019’s totals than the value.

Good news

As they have been for most of 2022, spirits were the best performing category last week, with sales 5% ahead of 2019’s levels.

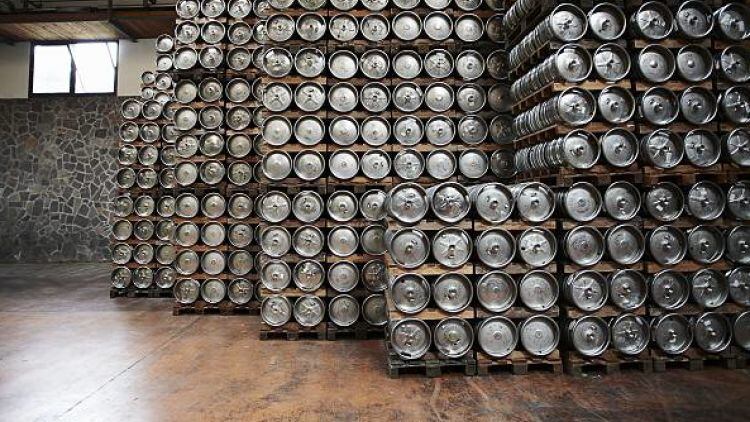

While cider (up 2%) was also in growth thanks to the warm weather, beer (down 1%), soft drinks (down 4%) and wine (down 15%) were all in the red.

Jones added: “The ongoing heatwave should be good news for operators and suppliers, especially those with outdoor space, which many have invested in over the last 2 years, but consistent like-for-like sales growth continues to be a challenge.”