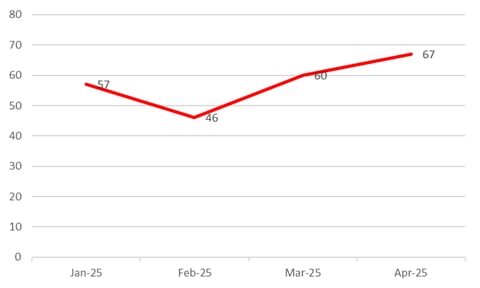

Analysis of official data by accountancy firm Price Bailey revealed 67 pubs were lost for good in April 2025. The figure marked the highest level since last July, when 74 entered insolvency.

The insolvencies were attributed to a rise in the rate of National Insurance Contributions in April alongside the threshold for the tax being slashed from £9,100 to £5,000 a year.

The National Living Wage (NLW) for workers aged 21 and over also increased in April, to £12.21 per hour up from £11.44—a 6.7% increase. For workers aged 18–20 NLW increased to £10.00 per hour (up 16.3%)

Energy prices and inflation were also found to be putting pressure of the sector, with figures from the Office for National Statistics (ONS) showing the Consumer Prices Index (CPI) had increased to 3.5% in April 2025, up from 2.6% in March

Previously, there had been signs the number of pubs entering insolvency had “peaked” in 2024 and was starting to decline, but early indications for 2025 show they are “ticking upwards” again, the accountancy specialists said.

Price Bailey also analysed the credit risk scores and balance sheet information of all 38,036 pubs and bars in the UK.

Tipping over the edge

It found 8,156 (21%) have negative net assets on their balance sheets, meaning there were “technically insolvent” and were at risk of going bust.

Of the 8,156 pubs which are technically insolvent, 4,604 were in the ‘maximum risk’ category, equating to 12% of the total number of pubs in the UK and an increase of 552 pubs compared to 12 months ago.

Price Bailey head of insolvency and recovery Matt Howard said: “The early signs are that the tax and minimum wage hikes which took effect in April are already tipping some struggling pubs over the edge.

“It was widely believed pub businesses would initially find ways to absorb the additional payroll costs and that the full impact would only be felt much later in the year.

“That the impact has been so immediate shows many pubs had already exhausted their financial buffers.”

“One in five pubs are technically insolvent, and while it is possible to keep trading and salvage the situation, being hit with sharp payroll and energy price rises will prove too much for many of them.”

He added: “Workers in the pub trade have been among the chief beneficiaries of rises to the National Living Wage, which has been hiked by more than 40% in five years.

“Even when pubs see improved turnover, wage costs mean many remain in the red for large parts of the trading week.”

Shaking up the industry

According to Price Bailey, this means those businesses would also find it difficult to access funding without personal guarantees from directors and were “highly likely” to be subject to winding up petitions or intention to dissolve notices in the next year.

In addition, a growing numbers of pubs are operating at reduced capacity due to high staff and energy costs. In many cases this means kitchens are open for shorter hours, reducing their ability to capitalise on improved demand.

Howard continued: “Pubs are increasingly restricting opening hours to the most profitable times of the week.

“Many are having to sacrifice long-term customer relationships on the altar of profitability as they focus on the busiest hours.”

This comes as data from CGA by NIQ last week showed business confidence in the sector had dropped 19 percentage points year-on-on year due to rising staffing costs.

However, Price Bailey said while many large pub chains and small independent pubs are continuing to close in significant numbers, new types of pubs are thriving.

The more successful craft breweries are taking advantage of the craft beer boom to open their own pubs in large numbers and there has been an increase in the popularity of theme pubs.

Howard said: “Even though many of the large pub chains and independent pubs are struggling, innovative new market entrants, such as pubs owned by craft breweries, and theme pubs, such as the Boom Battle Bar chain, are successfully shaking up the industry.”