Prices across the pub giant’s 800-strong estate will be reduced on Thursday 18 September to mark Tax Equality Day.

In Scotland, in line with Scottish licensing laws, prices will be reduced on food and non-alcoholic drinks only.

The pubco, which has taken part in Tax Equality Day for several years, explained the initiative aimed to raise awareness of the tax disparity between the on and off trade.

While pubs pay 20% VAT on all food and drink, supermarkets pay none on food, allowing them to offset costs and sell alcohol at lower prices.

Biggest threat

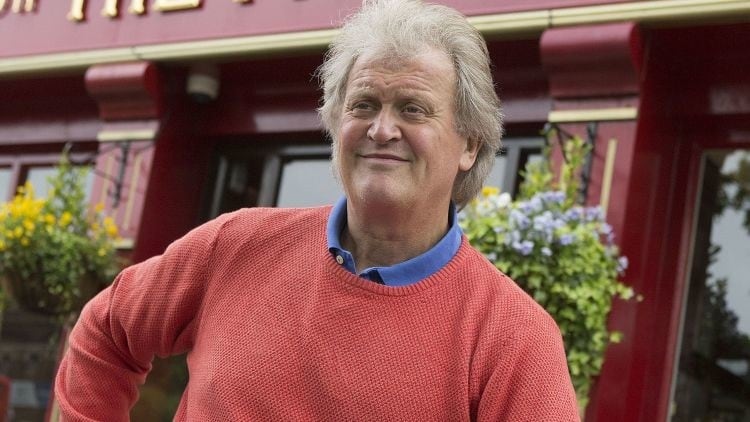

JDW founder and chairman Tim Martin said: “The biggest threat to pubs and the hospitality industry in general is the vast disparity in tax treatment among pubs, restaurants and supermarkets.

“Supermarkets pay zero VAT in respect of food sales, whereas pubs, bars and restaurants pay 20%. This tax benefit allows supermarkets to subsidise the selling price of beer.”

Calling on Chancellor Rachel Reeves to create “tax equality”, Martin added it did not “make sense for the hospitality industry to subside supermarkets.

He continued: “Pubs have been under fantastic pressure for decades because of the tax disadvantages that they have with supermarkets.

Enormous disadvantage

“A VAT cut to 12.5% is needed to ensure that pubs, bars and restaurants do not continue to close, but instead thrive, invest and create new jobs.”

Last week, the pubco boss called for the “enormous” tax disadvantage to be “fixed”, adding it was harming the businesses and high streets that are the “social fabric” of the nation.

Martin’s plea for tax equality has also been echoed by other operators and industry leaders from all corners of the sector, including trade bodies.

UKHospitality (UKH) chair Kate Nicholls said: “ A reduced rate of hospitality VAT across the UK means lower prices and more jobs, leading to the regeneration of our high streets and communities.”