The pub giant saw revenue climb 4.5% to £2.13bn, while profit before tax rose 10.1% to £81.4m. Operating profit also increased by 4.9% to £146.4m across its estate.

Bar and food sales increased by 5.1% and 5% respectively, while slot/fruit machine sales jumped 11% and hotel room sales fell 11.9%, attributed to the removal of third-party booking platforms.

After accounting for separately disclosed items, profit before tax surged 47.4% to £89.3m, and basic earnings per share jumped 48.1% to 60p.

However, operating profit was broadly flat at £142.2m, down slightly from £142.6m last year.

Compared to pre-pandemic levels, sales in FY25 were up 17%, to £2.13bn (FY19: £309m), despite operating 85 fewer pubs.

Cost pressures

Sales per pub were 29% higher than FY19, outpacing inflation, however, energy costs rose 57.8% and wages increased 34.5%, meaning profits and earnings were below pre-pandemic levels.

During FY25, JDW opened three managed pubs and sold nine, generating £8.1m in cash inflow. It now operates 794 managed pubs, with plans to open around 15 more in the current financial year.

The company also expanded its franchise model, opening five new sites, bringing the total to eight. Total capital investment for the period stood at £117m, including £24.1m for new pubs and extensions, and £62.5m for refurbishments.

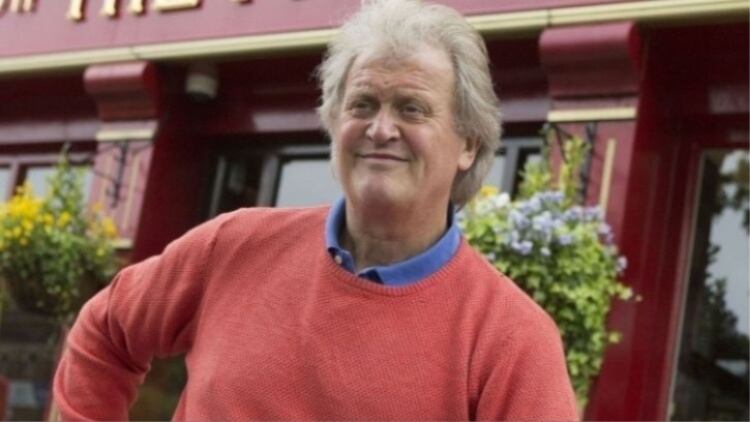

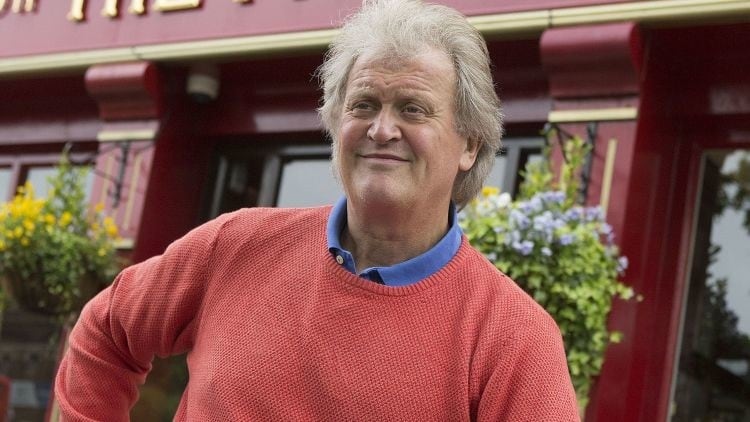

JDW chairman Tim Martin added like-for-like sales in the last nine weeks, to Sunday 28 September 2025, had increased by 3.2%.

Though he warned rising costs across the board, and disparity between the on and off-trade, continue to put pressure on the hospitality sector.

He continued: “Cost increases such as these will undoubtedly add to underlying inflation in the UK economy, although Wetherspoon, as always, will endeavour to keep price increases to a minimum.

Reasonable outcome

“The company currently anticipates a reasonable outcome for the financial year, although Government-led cost increases in areas such as energy may have a bearing on the outcome.”

The chairman estimated National Insurance and rising labour rates would cost JDW £60m per annum while energy price hikes would cost £7m and Extended Producer Responsibility taxes would add £2.4m a year.

Martin said: “In the last financial year, Wetherspoon, its customers and employees generated a total of £838m of taxes for the UK Government. The total tax raised by the Government in the last financial year was £858.9bn.

“Therefore, Wetherspoon generated approximately £1 in every £1,000 of all UK tax revenue. In other words, the country only needs about one thousand companies like Wetherspoon and no one else would have to pay any taxes at all.

“Wetherspoon is confident that it will provide more tax revenue for the Government in the current financial year, while aspiring to increase earnings per share at the same time.”