Last week, JDW reported a 5.1% rise in like-for-like sales for the financial year ending July 2025, with total revenue up 4.5% to £2.13bn and pre-tax profit climbing 10.1% to £81.4m.

Bar and food sales both saw growth of around 5%, while slot machine revenue surged 11%.

However, hotel room sales dropped 11.9%, attributed to the removal of third-party booking platforms, and operating profit remained broadly flat at £142.2m.

The pub chain highlighted rising employment and energy costs, along with tax increases from the previous autumn Budget, as key pressures on profitability.

Despite operating 85 fewer pubs than before the pandemic, FY25 sales were up 17% compared to FY19, with sales per pub 29% higher.

Though with energy costs up 57.8% and wages rising 34.5%, profits and earnings were below pre-pandemic levels.

Ahead of the game

Despite this, consultancy firm Begbies Traynor partner, Julie Palmer, described the results as a “refreshing return to form” in the face of ongoing pressures.

She continued: “Serving up such a performance while also being hit hard by higher wages and tax costs post-Budget is no mean feat.

“While many smaller pub chains are falling by the wayside, Wetherspoon’s scale and loyal fan base are clearly keeping it firmly ahead of the game.

“In a sector drowning in closures and cost pressures, Wetherspoon is proving it can adapt and grow, without alienating its price-conscious punters.”

Though Palmer cautioned the upcoming Budget could add further financial strain to the business: “With more tax rises expected, the pressure is far from over.

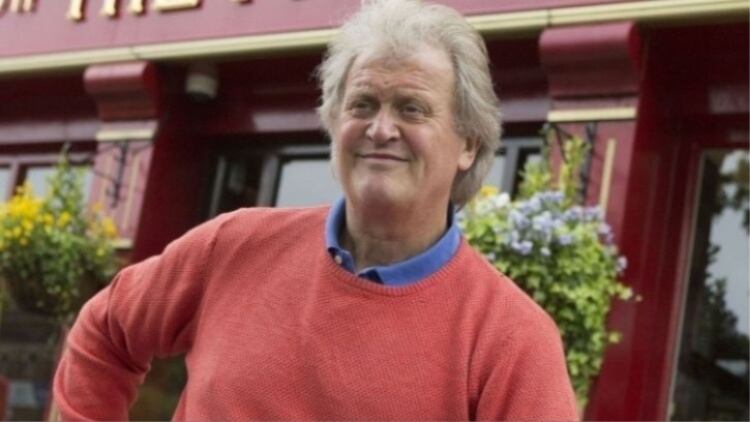

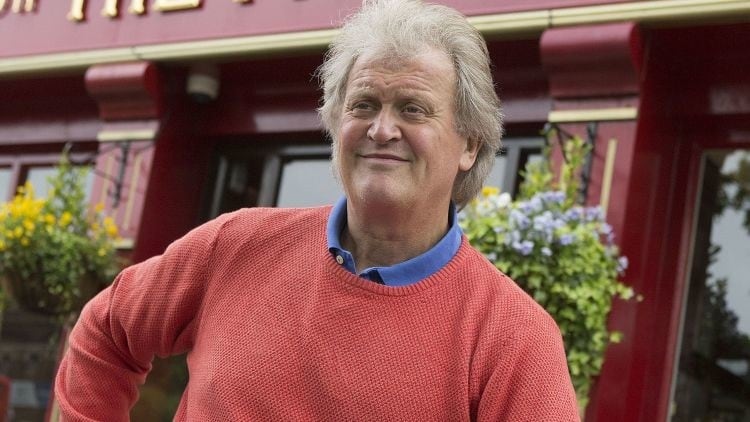

“Tim Martin’s outspoken stance on taxes may win headlines, but it’s unlikely to change the political tide.

“Even so, Wetherspoon’s has shown it has the right formula to roll with the punches and keep moving forward for now.”

Well-placed

RSM UK consumer markets senior analyst Robyn Duffy added JDW’s “unique value proposition” was at the heart of its success and that its diverse mix of revenue streams served the business well.

She also said the group had benefitted from wider contraction in the pub sector

However, while value-driven consumers continue to favour the pub chain, Duffy too warned economic challenges could put margins under strain.

The senior analyst continued: “Drinks sales remain robust, while the food division continues to broaden its appeal across the day, with all-day breakfasts and other affordable staples proving especially popular. Hotel stays dipped this year, but that hasn’t dented overall performance.

“Capital investment remained a priority this year, with a focus on maintaining the comfort and appeal of its estate.

“At the same time, the group explored new growth avenues through franchising, with partnerships at Haven Holiday Parks and university student unions highlighting the potential of this low-capital, captive-audience model. Expansion into the Isle of Man further signals its intent to reach underserved markets.

“With its clear positioning as the best-value operator, consistent outperformance of the market and plans to double its franchise estate over the next year, JDW looks well placed to extend its lead in the year ahead.”