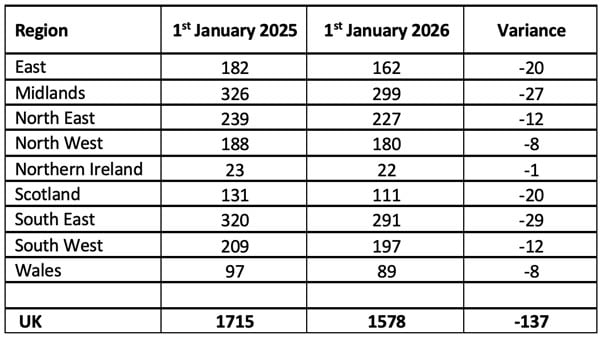

Some 137 breweries have closed in the past 12 months, according to the latest UK Brewery Tracker from the Society of Independent Brewers & Associates (SIBA).

It means the total number of operational breweries in the UK as of 1 January 2026 stood at 1,578, compared to 1,715 in 2025.

The pace of closures represents a 37% increase on the previous year, making it one of the sharpest annual declines recorded by the Tracker.

Survival crisis

Closures were recorded across all regions, but the south east was hardest hit with 29 independent breweries lost, closely followed by the Midlands, which saw 27 breweries close during the 12-month period. The east of England and Scotland also saw sharp declines.

SIBA warned the figures highlighted the scale of pressure facing small and independent brewers, despite huge consumer demand for locally produced beer.

Chief executive Andy Slee said: “Britain is extremely lucky to have such a broad range of passionate, independent breweries brewing beer locally across the UK; but if we don’t act soon to reverse closure rates then we could be facing a survival crisis for British brewing.

“Research published in the SIBA Independent Beer Report 2025 showed independent brewers’ production returning to pre-covid levels and independently brewed cask beer in double-digit growth, yet market pressures and an increase in brewery mergers and acquisitions mean that overall the UK now has 137 less breweries than twelve months ago.”

Tax burden

He added the tax burden on small breweries, market consolidation and restricted access to pubs were compounding the pressure.

In addition, Slee warned the current chaos surrounding business rates for pubs threatened to “derail” the industry even further, with around 80% of the beer products by small independent breweries sold in pubs.

“The pub and beer industry is waiting with bated breath to hear how the Government is going to fix the hike in business rates for pubs, but even reversing the changes still only puts the sector back to where it was and doesn’t deliver the promise of much-needed reforms to address the tax imbalance between traditional and online businesses”, the chief executive continued.

“We also believe there is a need for globally owned and independent beers to coexist on bars across the UK. We await the outcome of the Department of Business and Trades investigation into how this could happen and look forward to working with all parties to better meet drinker demand.”