Contents

Things are changing fast on the bar, from premium to super-premium, to low- and no-alcohol and cocktails that all make an impact for the right reasons. It is becoming almost too hard to keep up with. Brand loyalty, too, is also at a low as consumers are becoming increasingly promiscuous with what they choose to drink in the pub.

In this year’s Drinks List: Top Brands to Stock, which has been compiled by The Morning Advertiser (MA) in conjunction with CGA data, it is clear to see the bar is vastly different from what long-serving publicans and bar staff will have been familiar with even five years ago.

Yet, as a whole, sales across all categories are outstanding and where there is decline, it is only marginal. For instance, beer value sales dipped by just 0.4 percentage points, accounting for 42.15% of total on-trade value share; soft drinks dropped by 0.1 percentage points, with 14.9% value share; and wine was flat with 14.9% value share, according to CGA commercial director Graeme Loudon in a webinar launching The Drinks List.

On a more positive note, spirits sales rose by 0.4 percentage points to a 21.1% share of the market and cider grew by 0.1 percentage points, holding 6.4% of the market value.

Needless to say, the drinks synonymous with pubs – beer, wine, spirits and cider – still top the sales, even though the styles and brands that may have been popular in recent years have either fallen further down the list or dropped off.

This is especially visible in the top growing brands, which shows premium lager Birra Moretti as the fastest grower for the year (moving annual total data for the year to 12/08/17) in value terms. Strongbow Dark Fruit, which has stormed the draught fruit cider category since its on-trade rollout in 2014, showcases increased sales and is the second-fastest growing brand in terms of value. In the third spot on the top growers is Amstel which, despite being categorised as a standard lager, is viewed by many consumers as being more in the premium segment.

Lager shouts

Of the top 10 fastest-growing brands by volume, four are premium lagers, two standard lagers, two ciders, one rum and one gin. Many will let out a sigh of relief to see more than half of the fastest growing brands in the on-trade are lagers.

Premium, as is currently the message across all drinks categories now, is one of four key trends for on-trade beer sales in the year ahead, according to AB InBev on-trade sales director Rory Mclellan. Craft, Millennials moderating their beer consumption and experience-led brands are three other important areas on which pubs should focus their drinks offers.

“People expect more from their night out and they are going out less, so when they do go out they want to make it count. They are willing to try new things and they are savvy about the brands they drink,” says Mclellan.

However, the mainstream lager brands still hold much of the weight in the on-trade, accounting for 78% of lager volume sales. Lager accounts for almost 70% of all beer sales – taking £69 out of every £100 spent on beer. The category has increased value share by 0.9%, compared with a very slight overall decline for total beer, which dipped by 0.4%.

When it comes to other styles of beer, cask for instance, there has been a 3.8% decline this year. This could be because of increased brand launches within the craft lager and mainstream lager segments.

Craft, though accounting for only a small amount of overall beer sales, has the loudest voice in the category. It takes up almost 7% of beer value sales – coming from nothing just a few years ago – and is one of the most talked-about categories. Lager is well represented in the craft segment, with the likes of Carlsberg’s Brooklyn Lager making waves on this year’s list.

Seeds of hope for apple cider

Cider is another area of optimism, showing value growth of 2.8% and is one of the few long alcoholic drinks categories to show real growth. Fruit draught cider is the main force behind this surge, showing a 25m pint sales increase this year compared with last. Fruit is driving growth in the category and prompting apple’s top line volume sales dip of 4.4%. However, as more work is carried out to boost interest in the category – a focus on craft and new incarnations of apple – analysts predict apple cider will have a positive story to tell by 2020.

Thatchers’ head of marketing Phil McTeer says: “Draught cider dominates the market, with apple cider accounting for eight out of every 10 draught serves. Cider is an exciting – and changing – category, and we’d recommend landlords benefit from these trends, look carefully at their cider range to get the products on the bar that will work for them, trade up and importantly provide the perfect serve for customers.”

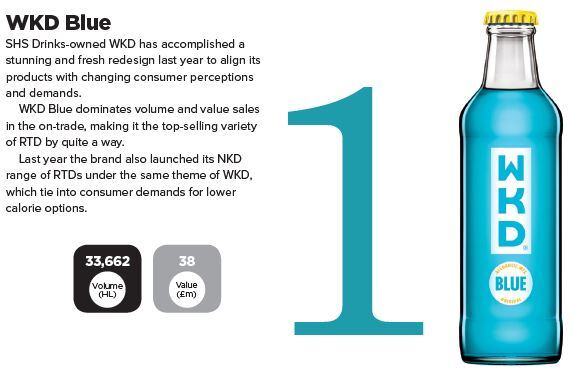

One category to really suffer at the hand of fruit cider is ready-to-drink (RTD) beverages. Volume and value sales have seen steep declines for some years now but analysts and producers predict there is scope for a turn in fortunes. Commentators believe the category remains relevant in the modern-day on-trade, especially in late night and student venues.

CGA client director Dave Lancaster says: “RTDs continue to be under threat from the likes of flavoured cider, so licensees must get the range correct for their customer base but, without doubt, there remains a strong affiliation to the market-leading brands in the category, particularly from the younger female demographic.”

He adds: “Leading brands have recently launched new packaging and flavours to help maintain their command of a decent share of fridge space.”

Win with gin

Spirits, meanwhile, have seen strong growth overall, with only a few segments experiencing something in the way of a minor decline. The top 10 spirits brands, although not signifying the key trend of premium and super-premium, have seen a modest 0.2% increase in volume sales, taking a 48.6% share of total on-trade spirits sales.

Unsurprisingly, gin is the star performer of the spirits world, growing by 18% in value year on year with 43% of that growth coming from premium brands. However, standard formats, such as Gordon’s, remain the biggest sellers as pubs and punters continue to rely on the familiar. More recently, the Diageo-owned brand launched Gordon’s Pink Gin to tap into growing demand for fruity pink gins.

That said, the future of the category is in hyper-provenance and craft, with producers honing in on their products’ heritage and ingredients to help drinkers better connect with the brands they consume.

Gin’s strength will lie with its versatility – it can be whatever you want it to be, whether that is in cocktails or as a simple gin and tonic.

Though gin is still a big conversation driver, other categories are growing in strength or are closing up behind it quickly. Rum, for instance, is expected to track above gin in the coming years. By 2020, golden rum volume sales alone will rise by 33%, says Loudon. Global rum ambassador Ian Burrell believes Brits will spend £1bn on rum by the end of 2017, up 34m bottles on 2016. He says rums aren’t promoted and shouted about in the same way as gins and other alcohol brands, mainly because rum producers in developing countries don’t have the same marketing budgets as other producers.

Softs not finding it hard

Finally, as is to be expected following continued talk about consumers reducing or cutting out alcohol consumption completely, soft drinks sales are in rude health – despite a slight overall decline of 0.1%, caused by a dip in the number of on-trade outlets.

Tonics are key in driving soft sales in the on-trade, helped by the rise of gin. Cola, whether Coca-Cola or Pepsi, demonstrates that core products are still key to a successful operation. Yet, this uptick in cola sales is being driven by sugar-free variants, as more consumers seek to lead a healthier lifestyle.

That said, the top 10 soft drinks brands do not represent the premium and super-premium trend seen across the majority of other categories in this year’s Drinks List: Top Brands To Stock. The lack of premium products in the top 10 could change next year, as small and large brands both place prominence on pricier softs.

For the future, according to Loudon, driving experience through stocking the right brands and serving them in the best way should continue to be a focus for pubs looking to succeed in a tough market over the coming years.

Top performers in the on-trade:

- All data supplied by CGA OPMS, MAT to 12/08/17, ranked in volume and covering total brand sales (unless specified otherwise)

Craft beer

Despite accounting for a minuscule amount of the overall beer category (just 6.7% of total value), craft is shouting the loudest and remains one of the most talked about categories in the on-trade and is stocked in more than 50,000 outlets.

“It is, however, key for those retailers who want to make decent gains from listing and key for those who understand the consumers who are drinking in the category,” said CGA client director Dave Lancaster.

The category, despite its stature, is vast in terms of the varieties within it, giving operators the opportunity to stock a wide range of beers from stouts to sours, he added.

“However, the vast majority of sales remain within Pilsners, IPAs and pale ales – very much the entry gate categories to help a wider consumer get into the world of craft beer.”

Many predict craft beer’s position in the market will rise significantly in the coming years, a belief that mainstream brewers have taken seriously.

This is shown in recent acquisitions, such as AB InBev’s Camden Town Brewery buyout and Carlsberg’s London Fields acquisition earlier this year.

Cask beer

Follow the link to see which cask ales topped The Drinks List: Top Brands To Stock

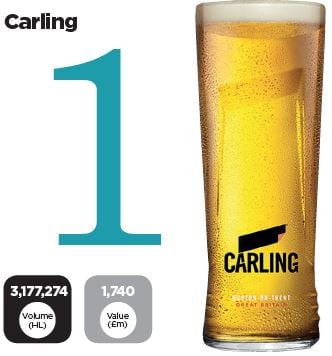

Lager

Lager accounts for almost 70% of all beer sales, taking £69 out of every £100 spent within the category.

The category has also increased its dominance in the on-trade beer market, with latest volume shares rising 1% to 67.5%, said CGA client director Gavin Humphreys.

“Lager has increased its value by 0.9%, compared with a very slight decline for beer in general, which declined by 0.2%,” he added.

“The top 10 brands in the market account for 78% of lager volume and this equates to 73.5% by value on an annual basis.

“While there has been a lot of activity and excitement surrounding the premium ‘world’ sub-category where brands are enjoying good growth, the lager market is still dominated by the core ‘standard’ category.”

That said, consumers are beginning to drink fewer mainstream lagers and are moving more towards premium products, yet the more established premium lagers have had their market share eroded by the number of ‘world’ premium lagers hitting the bar.

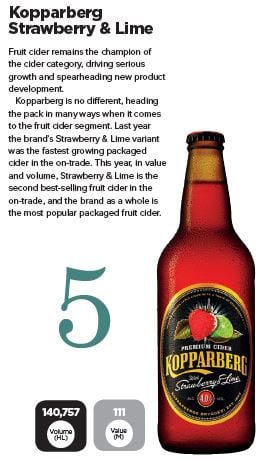

Cider

Cider remains one of the few growing categories within the long alcoholic drink (LAD) segment, growing value by 2.8%.

The category’s growth has been driven by draught cider, particularly draught fruit cider, according to CGA client director Rachael Chard.

Draught fruit cider has increased category servings by 25m pints this

year compared with 2016.

However, this does not mean apple has been forgotten, despite a topline volume decline of 4.4%.

“Apple still dominates draught and drives new product development, with small scale products largely driving these figures covering a wide range of variants, styles and regionality,” Chard explained.

CGA predicts cider will increase its share of the total LAD category volume to 14.5% by 2020, a 1.8 percentage point increase since 2016, therefore making it an increasingly important part of the licensee’s sales mix.

Wine

Follow the link to see which wines topped The Drinks List: Top Brands To Stock

Top 10 spirits

The top 10 spirits in the GB on-trade account for almost half (48.6%) of total spirits volume and have shown a modest increase versus a year ago when their share was 48.3%, said CGA client director Gavin Humphreys.

On a value basis, the top 10 are just as dominant, taking a 45% share of spirits and again this has pretty much stayed static year on year.

As expected, the top spirits are made up of mainly house pours and the mainstream brands.

The fact the mainstream brands are showing growth goes against the grain of an increase in sales of premium and super-premium in the category.

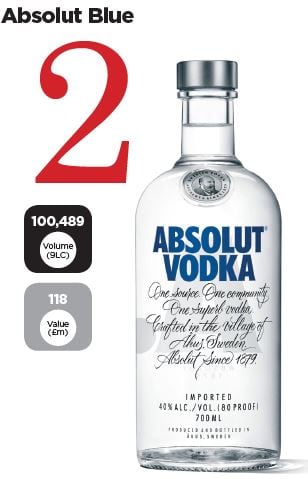

Vodka

Vodka may be the staple spirit in almost all outlets, however, it is increasingly coming under pressure from other categories such as gin and rum, leading to a decline of 3.8% compared to last year.

Premium brands are, unfortunately, bearing the brunt of the pressure, according to CGA client director Phil Montgomery.

“While lots of attention has been focused on premium growth during the past few years, the impetus for vodka has shifted toward the provision of a super-premium offer,” he said.

“Currently, super-premium vodka is in 12.1% volume growth, with brands increasing availability and becoming must-stocks in the average outlet’s range.”

However, with 65% of consumers open to the concept of paying more for a better-quality drink, this offer is satisfying an ever more demanding consumer, while providing licensees with scope to make more profit from their vodka range.

Gin

No one can get away from gin, the category has been the star of the spirits world over the past few years.

Unlike many categories that have seen similar significant growth, gin producers have churned out new product after new product to maintain interest.

It is no longer enough to offer only a basic gin, instead, consumers want new flavours and botanicals to learn about.

This can especially be seen in Diageo brand Gordon’s, which launched its fruity gin earlier this year, tapping into the trend for pink gins with easy to identify flavours.

Year on year, gin has grown in value by 18%, with 43% of that growth coming from premium brands.

However, looking at The Drinks List: Top Brands To Stock, Gordon’s remains the heavyweight in both volume and value terms, driven by its dominance as a house pour.

Yet, the trend towards premium is clear in those brands that sit just behind, with strong plays by Tanqueray and Hendrick’s.

The future of the category will be all about hyper-provenance and craft, with producers honing in on their products’ heritage and ingredients to help drinkers better connect with the brands they consume.

Gin’s strength in the future will lie with its versatility – it can be whatever you want it to be, whether that’s in cocktails or as a simple gin and tonic.

More importantly, it has a gender-neutral image, as well as being a drink for the more mature.

Rum

It has long been hailed as the next spirit to inherit the success experienced by gin in recent years, but analysts close to the on-trade drinks segment have put their heads above the parapet and finally declared rum will indeed overtake gin as the next big trend in spirits.

Golden rum volume sales will rise 33% by 2020, according to CGA commercial director Graeme Loudon at The Morning Advertiser’s Future Trends: Spirits event in October.

Golden rum sales will rise faster than gin did within the next three years, which will help other brown spirits boost their sales too.

Sales of rum will reach £1bn this year, according to global rum ambassador Ian Burrell, who added Brits will end up buying 34m bottles by the end of 2017.

Burrell said: “There are just as many rums [as gin] on the market. The problem is they are not promoted and shouted about in the same way.

A lot of rums are made in developing countries so don’t have the marketing budget.

There are amazing rums out there that haven’t emerged yet, but they are coming.”

Whiskies

Sales of whiskies are up and down. The ups are coming from imports from the US, with the likes of Jack Daniel’s performing well, shown by its leap to the top as the world’s best-selling whiskey last year (2016).

However, recent figures from CGA claim American whiskey volumes will fall 1% by 2020, with malt whisky set to rise by 9%.

As a category, whiskies accounts for 16.4% of total spirits volume sales and 17.6% of value, according to CGA client director Gavin Humphreys.

Blended Scotch remains the largest sub category within the segment but has been struggling to attract new drinkers, with annual volumes down 7%.

“American whiskey ranks second by volume but leads category rankings by value, taking a 6.7% share of overall spirts,” said Humphreys.

“Within the US category, we are also experimenting and moving upmarket with the premium brands seeing strong growth, a trend we are likely to see continue.”

Irish whiskey grew in volume (2.8%) and value (8.2%), and malt whisky volume rose 3.7%.

Tequila

Despite many spirits commentators predicting a dramatic rise for Tequila, the category has actually dipped by 1.4% as a whole.

However, according to CGA client director Phil Montgomery, sales of premium Tequila have grown by 2.7%, outperforming the non-premium brands.

“With availability on the up and the category’s general mixability an advantage, the key challenge for licensees now is how to define the best approach around serve,” he added.

“Notably a single serve offer, Tequila needs to build on the explosion in cocktail culture because, currently, only 12% of cocktails contain Tequila.”

There is appetite among Brits for cocktails made with Tequila, with 29% of cocktail consumers saying they do drink them, according to CGA.

“If Tequila can achieve a multi-serve provision more sustainably, this will then help to drive momentum and facilitate growth,” added Montgomery.

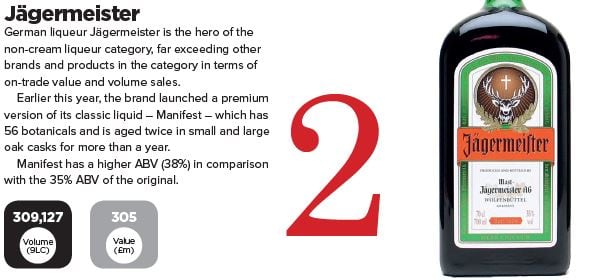

Non-cream liqueurs

Non-cream liqueurs is a category that receives little attention, but has been quietly growing its sales, with volumes up 1.2%.

“The challenge for non-cream liqueurs is the single serve/shot category that declined 2.1% in volume terms,” said CGA client director Phil Montgomery.

“The key for brands that rely on this serve is how they create that special on-trade experience to drive repeat purchase?”

However, there is a silver lining for the category within the growing cocktail volumes, which have increased 10% compared to last year.

Jägermeister’s top appearance can be credited to the popularity of the Jägerbomb, as well as the brand’s work to drive sales of the drink in cocktails, such as its Route 56 serve.

Disaronno, too, has succeeded with clever marketing, its easy use in cocktails (such as the Disaronno Sour) and its premium appeal.

One liquid making more noise since new brand owner Sazerac took over is Southern Comfort, which ranks sixth in the top 10 non-cream liqueurs category. Southern Comfort volume sales stand at 61,093 9LC and value sales at £60.8m (CGA MAT w/e 09/09/17).

A spokesperson told MA: "The brand offers consumers an accessible yet premium gateway into the whiskey category and CGA Peach data shows that Southern Comfort drinkers are extremely valuable to the on-trade with the average Southern Comfort drinker spending more per visit and visiting the on-trade more often than the average spirit consumer.

"With weighted distribution sitting at 86% of all outlets (according to CGA data), Southern Comfort is an iconic American Whiskey brand that consumers expect to see in any reputable outlet."

Ready-to-drink

On-trade ready-to-drink sales may be in decline, but the category remains relevant in late-night and student venues especially, and retains its position in the repertoires of some consumers.

Global Brands-owned VK, in particular, has experienced success this year, claiming the titles of fastest-growing RTD and the number one student RTD.

Of the category, CGA client director Dave Lancaster said: “Leading brands have recently launched new packaging and flavours to help maintain their command of a decent share of fridge space.”

Yet, despite glimmers of hope, the category still faces threats from other sectors.

Lancaster continued: “RTDs continue to be under threat from the likes of flavoured cider so licensees must get the range correct for their customer base, but without doubt there remains a strong affiliation to the market-leading brands in the category, particularly from the younger female demographic.”

Soft drinks

A reduction in the number of on-trade outlets led to a tiny 0.1% decline in volume sales of soft drinks, however, the growth in sales of rum and gin are providing a sales boost to the category, said CGA client director Rachael Chard.

“With tonics being a key area of new product development, which is offering a diverse flavour product range to licensees, we are now starting to see this trend filter down to other mixers, such as ginger ale,” she said.

“Cola’s growth demonstrates the importance of a core range to operators; however growth is driven by sugar free and we expect this to continue as health and sugar tax drives consumers to these products.”

CGA Consumer Research shows value for money is a key decision-maker for punters not drinking alcohol when visiting a pub, as well as the quality of softs on offer.

Operators should take note, as 81% of consumers would choose a soft drink when not drinking alcohol in the on-trade, the research showed.

Chard added: “As a result we do see soft drink menus evolving across on-premises, including a broader range of sophisticated, premium, adult-focused soft drinks, where consumers can get the same quality offer in line with an outlet’s spirits or beer menus.”

No- and low-ABV beer

Who would have thought the no- and low-alcohol beer category would be an area of growing interest?

Yet, there is a real demand for high-quality low- and non-alcoholic drinks.

Recent statistics from CGA show that, in the past six months, 12% of legal drinking age adults who visited a licensed venue claimed not to drink alcohol.

“Therefore, there is a clear consumer need for a good non-alcoholic offer, which in 48% of outlets includes no- and low-ABV products,” said CGA client director Rachael Chard.

Some 9,000 additional outlets now stock no- and low-alcohol beers in their sites

compared with three years ago.

“These products are becoming more prevalent within on-premises as a result of health/taste and lack of appeal causing consumers to reduce alcohol consumption or abstain from drinking alcohol,” said Chard.

The category is also expanding outside of the mainstream and into craft, providing pubs the opportunity to stock a variety that suits their customers’ requirements.

Lager, however, is not the main story when it comes to no- and low-ABV beer. St Peter's brewery has seen big success with its Without alcohol-free beer.

CEO Steve Magnall told MA sales in the on-trade exceeded 4,000 HL, technically making it the second biggest no-ABV beer in the on-trade. However, sales are not monitored through CGA, though there are plans to change that according to Magnall.

St Peter's Without is stocked in 750 Mitchells & Butlers sites, as well as several hundred independent venues, including on draught.

- All data supplied by CGA OPMS, MAT to 12/08/17, ranked in volume and covering total brand sales (unless specified otherwise)