The Financial Reporting Council (FRC) delivered the ruling against KPMG also imposed further sanctions including a ‘severe reprimand’ and also fined audit engagement partner Michael Frankish £35,000 who led the audit on behalf of KMPG.

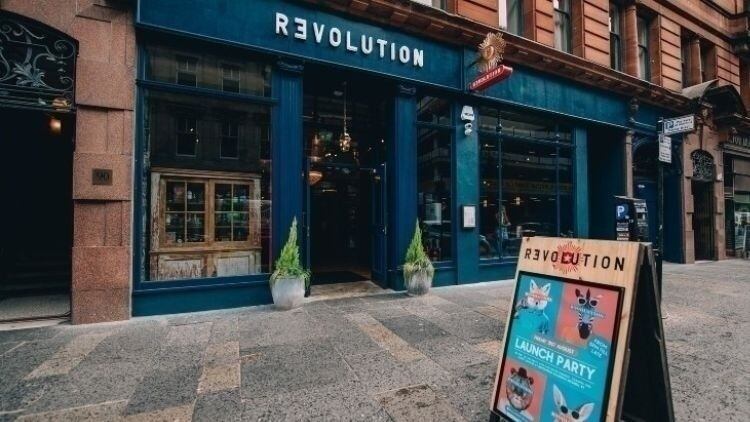

KPMG and Frankish accepted failures in their work on the audits of Revolution Bars Group – which operates brands Revolution, Revolución de Cuba, Founders & Co and Playhouse – which related to three specific areas of the audits: supplier rebates and listing fees, share-based payments and (for financial year 2016 only) deferred taxation.

Misstatements made

Revolution Bars Group’s financial statements for its 2015 and 2016 financial years contained various misstatements that had to be corrected, some of which arose from the three areas mentioned, and some of which were material to the financial statements as a whole.

The errors were made despite the FRC previously making auditors aware complex supplier arrangements were an area of particular audit risk, through publications in 2014 and 2015.

Serious breaches

In determining the sanctions to be imposed, the FRC took into account these were serious breaches but were not intentional, dishonest, deliberate or reckless, and that KPMG and Frankish provided a good level of co-operation during the investigation, including making early admissions in respect of the breaches.

FRC deputy executive counsel Jamie Symington said: “KPMG’s failings in this case persisted for two years and across multiple areas. They included complex supplier arrangements that the FRC had previously identified as an area of regulatory focus, albeit that in this case their impact on the financial statements was minor.

“The audit client was a newly listed and relatively small company, but the breaches were nevertheless serious, including lack of professional scepticism. The FRC has required KPMG and Mr Frankish to take action to mitigate or prevent breaches recurring. The package of financial and non-financial sanctions should help to improve the quality of future audits.”