Sales within the business continue to pick up, particularly in the City and West End of London.

In the first 16 weeks of the new financial year, total sales are up 3% on pre-pandemic levels and up 81% on the same period last year. On a like-for-like basis, sales for the 16 weeks to 16 July 2022 are up 27% on last year.

Net debt reduced

The company said it is well-financed, with total available facilities of £226m and with net debt reduced from £131.9m at the start of this financial year to £123.6m at 17 July 2022, demonstrating the healthy recovery in free cash flow generation.

It added the underlying strength of its long-term business is reflected in its implied net asset value per share of £13.80, based upon the directors’ valuation of the estate undertaken as at 26 March 2022.

During the period, the company has acquired one new site – the Queen’s Arms, landside at Heathrow Terminal 2 – which will open in early August 2022 and joins its airside counterpart, London’s Pride. A further three sites are in advanced stages of negotiation.

Momentum building well

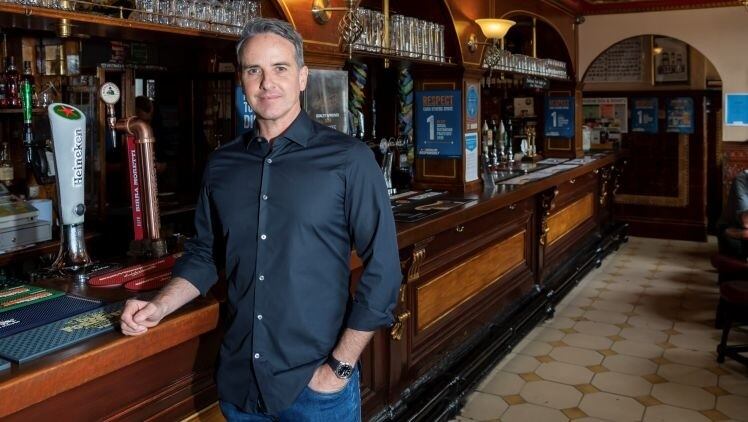

Chief executive Simon Emeny said: “We are pleased with our sales growth trajectory, particularly in our central London sites where momentum is building well.

“The industry-wide inflationary cost pressures around food supply, labour and particularly energy are showing little signs of abating. Our premium offer and effective supply chain management provide a degree of protection, but we are not immune from its effects on costs or consumer behaviour.

“Fuller’s is a long-term business with a strong balance sheet, a clear strategy, and great people to execute it. Hospitality continues to bear the brunt of many challenging external factors, but we remain confident that Fuller’s is well placed to continue to prosper.”