According to CGA by NIQ, stout has been the standout performer within the Long Alcoholic Drinks (LAD) category - which includes beer and cider - in 2025, with 10.6% year-on-year growth.

Stout now accounts for 9.5% of all beer volumes, up 0.6 percentage points from 2024, and is stocked in more than 70,000 venues across Britain.

Nearly a third of stout sales now come from food-led pubs, and the proportion of drinkers aged 34 or under has jumped to 32% - proof that this most traditional of styles has found a new audience.

Stout used to be the preserve of old boys like me. But things have changed. Fashion models, the glitterati, influencers, footballers’ wives and Brexiteers are all quaffing the black stuff.

JD Wetherspoon chairman Tim Martin

‘Firing on all cylinders’

At JD Wetherspoon, founder and chairman Sir Tim Martin says demand has soared.

“Stout sales have rocketed since pre-pandemic and are up, this year, on the already high volumes achieved a year ago. Stout is firing on all cylinders.”

And the drinker base, he says, is evolving fast: “Stout used to be the preserve of old boys like me. But things have changed. Fashion models, the glitterati, influencers, footballers’ wives and Brexiteers are all quaffing the black stuff.”

While Wetherspoon “mainlines Guinness,” Martin says guest stouts from local brewers are widely available on handpump. Even the seasonal divide is breaking down. “Strangely, stout is now also a summer drink… If current trends continue, anything is possible.”

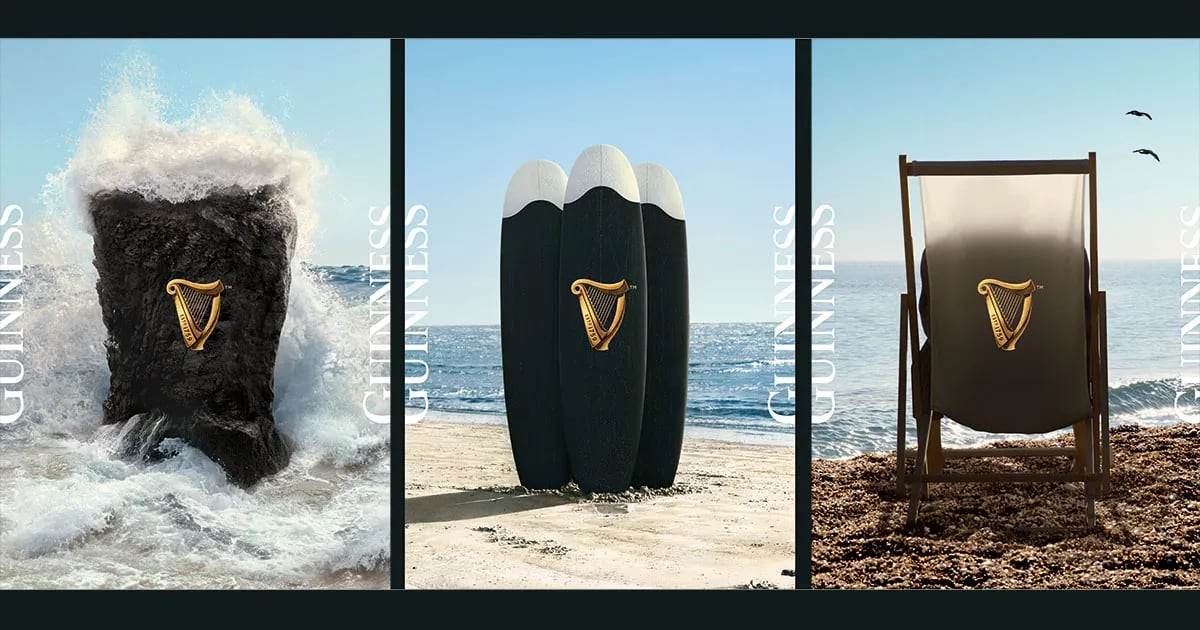

Guinness itself leaned into that shift with its 2022 campaign, which playfully inserted pints of the black stuff into classic summer scenes - from barbecues to beach days - reminding drinkers that “good things come to those who wait,” even when the weather’s warm.

‘A firm favourite all year round’

At Marston’s, head of drinks category management Mark Carter says stout remains “a firm favourite among many guests,” with its role expanding beyond winter.

“Though seasonality still plays a role, demand is no longer so heavily skewed towards the colder months,” he said. “Guests are showing a growing appreciation for it year-round.”

More choice

Greene King senior category manager Andrew Carpenter says the company’s managed pubs have seen stout sales rise 14% over the past year, now representing over 13% of draught beer and cider sales.

“While Guinness remains popular, we’re seeing increased interest in other stout alternatives. Belhaven Black has been particularly successful in our Scottish pubs, with some central Edinburgh sites opting for it over Guinness due to its strong local heritage.”

Greene King is also seeing “more pubs offering house stouts alongside Guinness to give customers greater choice.”

Guinness shortages over Christmas 2024 highlighted the risks of relying on a single brand. Supply chain challenges left many operators short on stock during one of the busiest trading periods of the year, prompting pubs to seek out alternatives.

For beer-led venues, stout diversity is now part of the experience. At Hoxton’s Wenlock Arms, licensee Heath Ball says the Guinness supply issues of 2024 prompted a rethink.

“We decided to move away from the brand and look at other options on keg. After some trial and error, we’ve landed on O’Hara’s Irish Stout from Carlow Brewing, an independent family-owned business that makes stout the way it used to be made.”

The pub also rotates cask stouts to keep drinkers engaged. “We’re seeing a mix of younger drinkers and seasoned drinkers experimenting with different stouts. Plus, how many times can anyone honestly talk about splitting the G?”

Challengers shake up the category

BrewDog’s Black Heart is among a wave of new entrants bringing competition to Guinness. Chief operating officer Lauren Carrol says the brand’s goal was to “recruit new shoppers into stout.”

Within its first year, 21% of Black Heart buyers were completely new to the stout category, bringing an estimated 210,000 new drinkers into the segment through one major UK supermarket alone.

“Black Heart has opened the category to a younger, more affluent drinker and given venues genuine choice within the sub-category.”

The category is also seeing renewed attention from larger brewers. Shepherd Neame has leaned in with permanent NPD. Its 4% Iron Wharf launched into the Kent brewer’s estate in spring, adding a smooth, ruby-tinted stout with local heritage cues to bars across the South East.

Heineken’s Murphy’s Irish Stout, long a cult favourite in Ireland, returned to UK bars this autumn through new distribution deals.

The relaunch follows growing demand for authentic Irish stouts and gives operators another mainstream alternative to Guinness, particularly as interest in heritage brands resurges.

Smaller players

Smaller brewers are also tapping into stout’s rising popularity. Devon’s Otter Brewery recently introduced Otter Black (4.2% ABV), a smooth, sessionable stout made with locally sourced barley and traditional English hops. The beer debuted at the Devon County Show and has since been rolled out to pubs across the South West.

Managing director Patrick McCaig said the beer had been in development for some time and was designed to “showcase great local ingredients” while appealing to the growing interest in dark beer styles.

In North Yorkshire, T&R Theakston has teamed up with Ireland’s Brennan’s Brewery to refresh the look of Brennan’s Irish Stout, part of a wider partnership between the two family-run brewers. The 4.2% ABV stout, brewed in County Wexford, has seen a near 200% uplift in sales over the past year, reflecting growing demand for heritage dark beers.

Theakston managing director Richard Bradbury said the new design “reflects the quality of the beer and its heritage,” while founder Peter Brennan added that the collaboration “has helped bring Brennan’s to new audiences across the UK.”

The stout momentum has even reached the value end of the market. Aldi launched its own-label Mulligan’s Stout this autumn, capitalising on rising interest in dark beer styles. While its debut has divided opinion, the move reflects how stout’s appeal now spans from premium craft brands to supermarket shelves.

Low and no

Diageo is also evolving. Guinness 0.0 now represents 14% of all beer brewed at the brand’s St James’s Gate brewery in Dublin, underlining the scale of demand for alcohol-free options.

The company plans to roll out the variant on draught in every UK pub that serves Guinness once approved by the UK’s Food Standards Agency, following successful London trials.

Currently responsible for around £50m in annual retail sales, Guinness 0.0 is central to Diageo’s strategy to tap into the growing ‘zebra striping’ trend, where drinkers alternate between alcoholic and non-alcoholic pints.

Even as demand surges, affordability remains a pressure point. OakNorth Bank’s senior director of debt finance Mohith Sondhi said “pre-Covid, a pint of Guinness in Soho cost less than £5, whereas now it’s £7.70.”

For many pubs, the challenge is balancing the pull of premiumisation with price sensitivity - especially as stout finds new audiences in younger and more diverse drinkers.

From Netflix to fashion collabs

Cultural visibility is also high. Netflix’s House of Guinness has introduced the brand to a global audience, blending drama with the mythology of Ireland’s most famous export and giving stout an unexpected pop-culture moment.

Meanwhile, Guinness’ recent collaboration with British menswear label Percival turned the black pint into a fashion statement, appearing across limited-edition shirts, jackets and accessories during London Fashion Week.

The campaign tapped into Guinness’ growing lifestyle cachet, showing how the brand’s appeal now stretches far beyond the bar, with younger audiences embracing its design, heritage and visual identity as part of modern culture.

Adding to Guinness’ momentum, Diageo is set to open the long-awaited Guinness Open Gate Brewery London in Covent Garden on 11 December.

The £70m, 54,000 sq ft microbrewery and culture hub will feature limited-edition brews, restaurants and interactive experiences such as pint-pouring and tasting sessions.

Guinness GB marketing director Deb Caldow said the site will serve as the brand’s “home in the UK” and a place to “celebrate heritage, embrace innovation and invite visitors to discover new flavours, experiences and stories.”

The venue is expected to attract up to half a million visitors annually, creating 250 jobs and further embedding Guinness into the capital’s beer, food and cultural landscape.

What next?

Stout’s evolution from winter indulgence to year-round staple brings clear commercial lessons for pubs and bars:

- Widen the range: two stouts on the bar - a category leader and a local or challenger pour - can increase rate of sale. CGA data shows outlets that stock two or more brands see higher return per tap

- Think beyond winter: trade into sport, after-work drinks and summer sessions

- Back no and low: Guinness 0.0’s rise suggests a growing appetite for premium alcohol-free draughts

For veteran operator Sir Tim Martin, the shift reflects the pub sector’s ability to adapt and follow customer taste: “Anything is possible. If we see a bandwagon, we might jump on it.”

The bandwagon, it seems, is already rolling. And, this year, stout is firmly in the driver’s seat.