Legislation

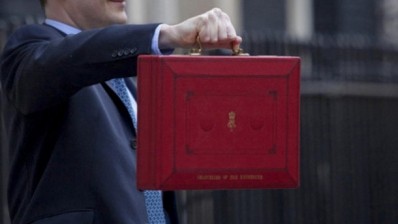

Autumn Statement reaction: Punitive tax hike risks endangering livelihoods

While the industry widely welcomed the extension of small business rates relief, a restriction of an apprenticeship levy to large businesses and the decision not to make further police cuts, the lack of an extension of retail relief has led to fears for the future of pubs.

Some say the positives are outweighed by the negatives as the Government gives with one hand and takes with the other, a move which is “endangering businesses and livelihoods”.

The relief scheme is currently worth £1,500 a year for pubs and restaurants, but will now end in March 2016.

Real estate advisory business Gerald Eve estimates the average pub/restaurant to have a rateable value of £29,500, leading to a current annual rates bill of £14,543 – reduced to £13,043 as a result of the discount scheme.

But with bills next year set to rise to £14,661 in line with RPI, and the Government refusing to continue the retail relief scheme, the average location will see a rise in its bill of £1,618, or 12.4%, Gerald Eve claims.

And some industry bodies fear the apprenticeship levy may have the unintended consequence of businesses reducing their training budgets.

The Publican’s Morning Advertiser looks at how trade bodies have reacted to the chancellor’s statement.

The Society of Independent Brewers

Managing director Mike Benner said:"Fifteen thousand pubs across the UK will benefit from the announcement that Small Business Rates Relief is to be extended for a further year, something which SIBA has called for together with the BBPA and ALMR.

“However the Government are giving with one hand and taking away with the other, as the decision to do away with retail relief will land seventy five per cent of pubs with a £1500 tax increase. SIBA would urge the Chancellor to introduce new measures in next year's budget to support both British pubs and the growing British brewing industry that supplies them."

Gerald Eve

Head of business rates Jerry Schurder said: “Publicans and restaurateurs will be distraught that this relief has been removed, and it is the smallest and most-vulnerable locations on the most down-at-heel high streets that will be affected the most. For these, the £1,500 could be the difference between the life and death of the business.

“With operators in many locations already being hammered by their rates bills, a 12.4% increase could be catastrophic, further endangering businesses and livelihoods. What this shows is just how excessive and inequitable the current business rates system is.

“The tax rate, known as the Uniform Business Rate, will rise to just shy of 50%. Even at current levels it is a punitive and regressive tax well in excess of comparable local property taxes across the globe, so the very idea it should be increased beggars belief. It is about time the Government started listening to businesses’ calls for a fairer, less onerous system.

“We were promised just weeks ago that the results of the Government’s review into business rates structure would be concluded by the end of the year, but today it was announced that the report will not be made until the spring budget. This isn’t good enough. Pubs and restaurants –especially smaller operators – need reform and clarity as soon as possible over their future business rates liabilities.

“By delaying the announcement in this way, the Government has yet again moved the goalposts. We can only hope that the delay means the calls of businesses will at last be noticed and incorporated into the future structure of the business rates system; sadly, recent experience suggests the nation’s under-pressure pubs and restaurants shouldn’t hold their breath.”

British Hospitality Association

Deputy chief executive Martin Couchman said: “We are pleased that 98% of businesses will not be paying the apprenticeship levy because of the £15,000 payroll threshold announced in the Autumn Statement.

“We await details of how smaller businesses will be supported in training apprentices. We are pleased to see that a new employer led body will set apprenticeship standards and ensure quality, but note that the hospitality industry has already made a lot of progress in developing apprenticeship standards.

“The introduction of the NLW from April 2016 will have a major impact on hospitality businesses’ finances so we are pleased to see a slight softening of costs through the decision to delay increases in auto enrolment pension contributions by 6 months from autumn 2017 and again in autumn 2018.”

British Beer and Pub Assocaition

Chief executive Brigid Simmonds said: “The extension of Small Business Rate Relief for another year is welcome, and is worth £25 million, and is something we had specifically requested. One third of pubs will qualify, 15,000 premises, in total.

“However, it is very disappointing that the Chancellor has not extended retail relief for a further year – this is effectively a £1,500 tax increase for the majority of pubs, and will add £46 million to pubs’ rates bills.

“Retail relief was providing a discount for pubs with a rateable value of £50k or less, which is 75 per cent of all pubs. This is a particular problem in the run-up to the revaluation in 2017 as rates bills have become out of kilter with the value of individual businesses.

“Britain’s pubs face a total tax bill of £7.3 billion per year, so we will be keeping up the pressure for further measures, such as more action on both beer duty and business rates, as we move towards the Budget in March.

“I do welcome the announcement that small businesses like pubs will typically not be burdened with the Apprenticeship Levy, as this would have placed an excessive burden on what are mostly small businesses. It is crucial that the Levy system is straightforward and allows those that pay into the Levy fund to access their full contribution to support apprenticeships.

“I also welcome the £40 million for Visit England to fund product development, given the vital role that pubs play in the wider tourism industry.”

The Association of Licensed Multiple Retailers

Chief executive Kate Nicholls said: “The extension of the small business rate relief for another year is certainly welcome as this is something the ALMR has consistently pushed for. It is disappointing, however, to see that once again we are in a position of urging the Government to hasten with real and meaningful change to the business rates system and to bring about root and branch reform.

“This is increasingly a system that sees business relying on multiple discounts and allowances and is a recipe for confusion or avoidance, something the Treasury has already highlighted. The licensed hospitality sector is carrying an enormous burden in the shape of business rates, with pubs accounting for 2.8% of all UK tax receipts; a situation that is plainly unfair and unsustainable for some businesses. The Chancellor indicated that the review of business rates will report at next year’s Budget Statement and we are hopeful that it will bring with it good news for the sector.

“We are also concerned that the forthcoming apprenticeship levy will place further costs burdens on businesses already facing shrinking margins. The ALMR’s Benchmarking Report shows that in labour intensive businesses such as pubs and bars, payroll costs often account for over half of all operating costs and almost one-third of turnover. This extra tax is may well have the effect of distorting payroll costs even further and is likely to undermine in-work investment and training in staff.

“We are pleased to see that there will be no cuts to police budgets at this time. Any reduction in police budgets or numbers may have seen the licensed hospitality faced with the prospect of covering any security shortfall, with added responsibility for managing the UK’s night-time economy, without any real indication of how this was to be achieved. "