JDW profits set to ‘break even’, boardroom switch announced

The pubco, which operates more than 850 pubs, reported like-for-like sales decreased by 4.0%, in comparison with the same period in its 2019 financial year while year-to-date like-for-like sales have decreased by 6.2%, in its 13-week period up to 24 April.

It previously said like-for-like sales in the three weeks to 13 March 2022 had improved to minus 2.6% while in the following six weeks, to the end of the quarter, there was a further improvement to minus 1.6% while the last two weeks of the period, like-for-like sales were slightly positive.

Its 47 Lloyds pubs, which have music, reported like-for-like sales in the quarter up by 3.4% versus 2019 and like-for-like room sales during the quarter were up 5% at its 57 hotels.

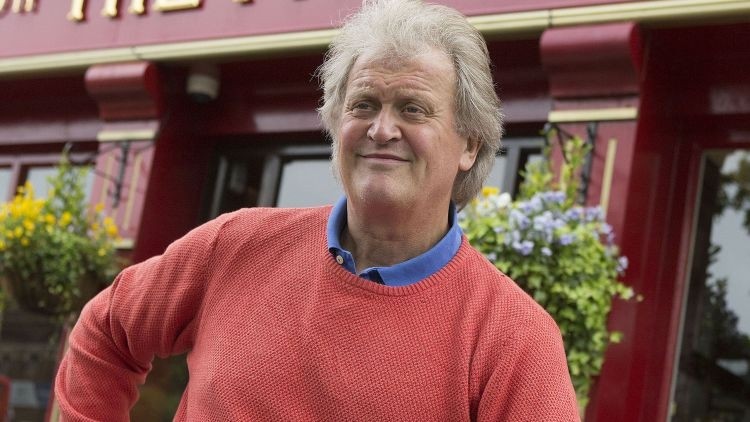

JD Wetherspoon chairman Tim Martin said: “Since Covid restrictions ended, sales have improved, as previously reported. As many hospitality companies have indicated, there is considerable pressure on costs, especially in respect of labour, food and energy. Repairs are also running at a higher rate than before the pandemic.”

Continuing improvement

Martin continued: “The company anticipates a continuing slow improvement in sales, in the absence of further restrictions, and anticipates a ‘break-even’ outcome for profits in the current financial year.

"Since 13 March, the company has returned to profitability and to a positive cash flow and is cautiously optimistic about the prospect of a return to relative normality in the 2023 financial year.

“The biggest threat to companies in the hospitality, tourism and related sectors is the possibility of future lockdowns and restrictions. These sorts of actions were never previously contemplated in the nation’s history – or, indeed, in the government’s own pre-pandemic plans.

“Many people, including those in the government and the medical establishment, believe that the UK response to Covid, which included a number of prolonged national lockdowns, was a success.

“This view is called into question by the outcome in Sweden, a more urbanised country than the UK, which did not lock down – and which appears to have had better health results.

“The collateral damage from lockdowns has yet to be quantified, but the economic cost, approximately half a trillion pounds, financed largely by “money printing” by the Bank of England, is a direct cause of the current inflationary crisis.”

Cacioppo to retire

In the financial year to date, the company has disposed of six pubs. A further five pubs have been surrendered to landlords, following lease expirations. In addition, three leasehold pubs have been closed, in anticipation of lease expirations. The disposals and surrenders gave rise to a cash inflow of £6.3m.

Net debt at the end of the quarter was £906m and liquidity was £173m. Debt is expected to be around £870m at the end of the financial year.

Meanwhile, JDW announced personnel and legal director Su Cacioppo will retire from the board and company on 7 October 2022 after 31 years’ service to the company. James Ullman, currently retail audit director, will be appointed to the board with immediate effect as personnel and retail audit director.

JDW’s current financial year comprises 53 trading weeks to 31 July 2022 and is expected to announce its next trading update on 13 July 2022.