JDW confirms extra seven sites to be sold

Comprising of a mix of five freehold and two leasehold units across England and Scotland, the pubco has announced the seven pubs joining the 32 already put on the market in September.

JDW also confirmed the appointment of CBRE and Savills to sell the venues, either individually, in small packages or as a portfolio.

Savills’s director Paul Breen said: “Despite the volatility in the current market interest in the properties which went onto the market in September has been encouraging with terms now agreed for several of the sites. We expect these additional properties to be equally appealing.”

Broad appeal

Confirmed for sale, are the Coronet in Holloway; the Cross Keys in Peebles; the General Sir Redvers Buller in Crediton; the Lord Arthur Lee in Fareham; the Plough & Harrow in Hammersmith; the Saltoun Inn in Fraserburgh and the Thomas Leaper in Derby.

CBRE senior director Toby Hall added: “These additional properties are all substantial, well-located pubs which are fitted to a high standard.

“Most of the properties are coming to the market for the first time in many years which should give them a broad appeal to both local and national buyers”.

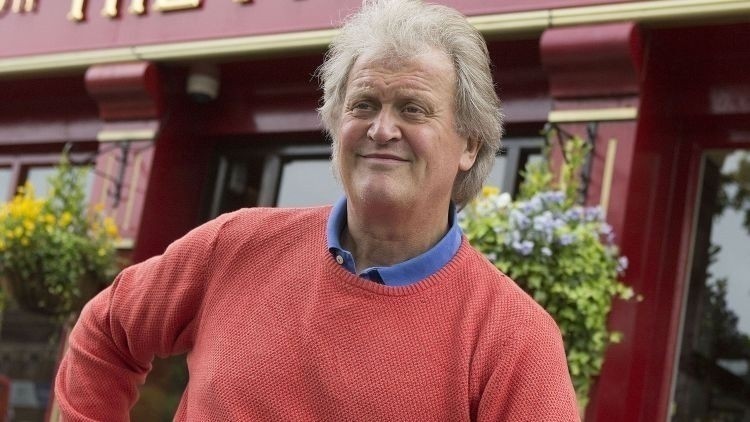

This comes as last week saw JDW, which currently operates 847 pubs across the country, announce its like-for-like sales had been slow throughout October though JDW chair Tim Martin claimed the pubco remained “cautiously optimistic” for the future.

Cautiously optimistic

He said: “Sales have improved since the ending of restrictions in the early part of this calendar year and are considerably above the same period in the last financial year.

“The company reported a return to positive cash flow in FY22 and anticipates a positive cash flow in the current year.

“In my comments on the full year results released on 7 October 2022, I set out various threats to the hospitality industry and these continue to apply.

“Those caveats aside, in the absence of further lockdowns or restrictions, the company remains cautiously optimistic about future prospects.”