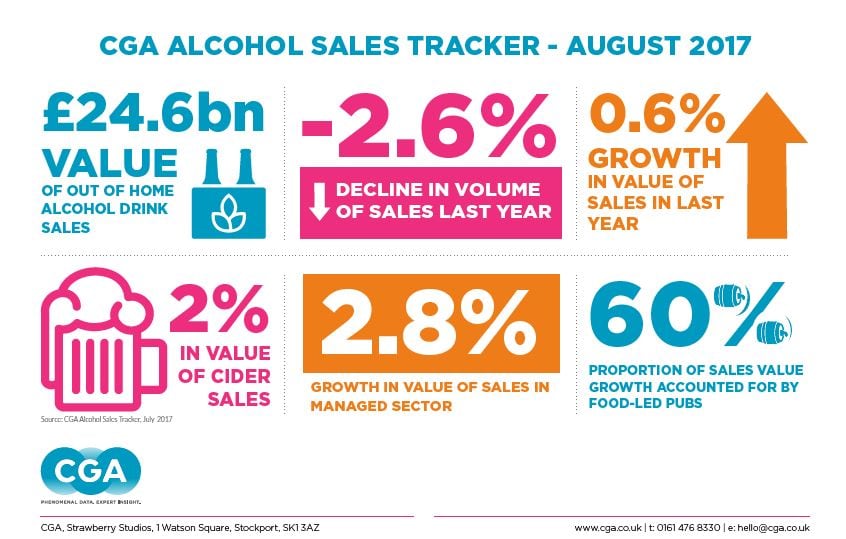

Increasingly, only the finest brands available in pub chains are acceptable to British drinkers, boosting out-of-home alcoholic drinks value sales to £24.6m for the 12 months to mid-June.

However, value sales are up only 0.6% for the period, offset against a volume decline of 2.6%, according to CGA’s data.

A drop in volume sales was seen mostly in London, but signifies the increasing trend of Brits cutting back on their drinking occasions.

Leased and tenanted pubs

Leased and tenanted pubs experienced a drop in alcoholic drinks sales, while independents marginally grew their sales.

CGA said: “Consumers are increasingly opting to drink at premium bars and managed pubs, often combining their visits with eating.”

More than a third (35%) of the out-of-home drinking market is classified as premium by CGA, and accounts for 47% of all value sales.

One of the stand-out performers is cider, which increased sales by 2% partially thanks to warm spring and early summer. In contrast, spirits sales growth halved compared with the same period last year.

CGA chief executive Phil Tate said: “Our figures reveal the increasing complexity and sophistication of Britain’s out-of-home drinks market.

“The small fall in volume sales rebuts the much-publicised idea that levels of unhealthy drinking are soaring, suggesting instead that consumers are continuing to demand better quality when they choose to drink out.”

Small volume decline

It was unsurprising to see a small volume decline when value had increased, said Tate and added: “Brands that can supply their customers with the right range, atmosphere and experience, and establish clear points of difference from the mainstream, will be best placed to thrive in the years ahead.”

Meanwhile, branded pub chains were deemed to be at risk by global banking giant HSBC in a special report into the state of the pub trade.

In the review, HSBC warned large pub chains faced “twin risks” from consumer weakness and rising input costs.

As a result, HSBC downgraded its ratings for JD Wetherspoon and Greene King.