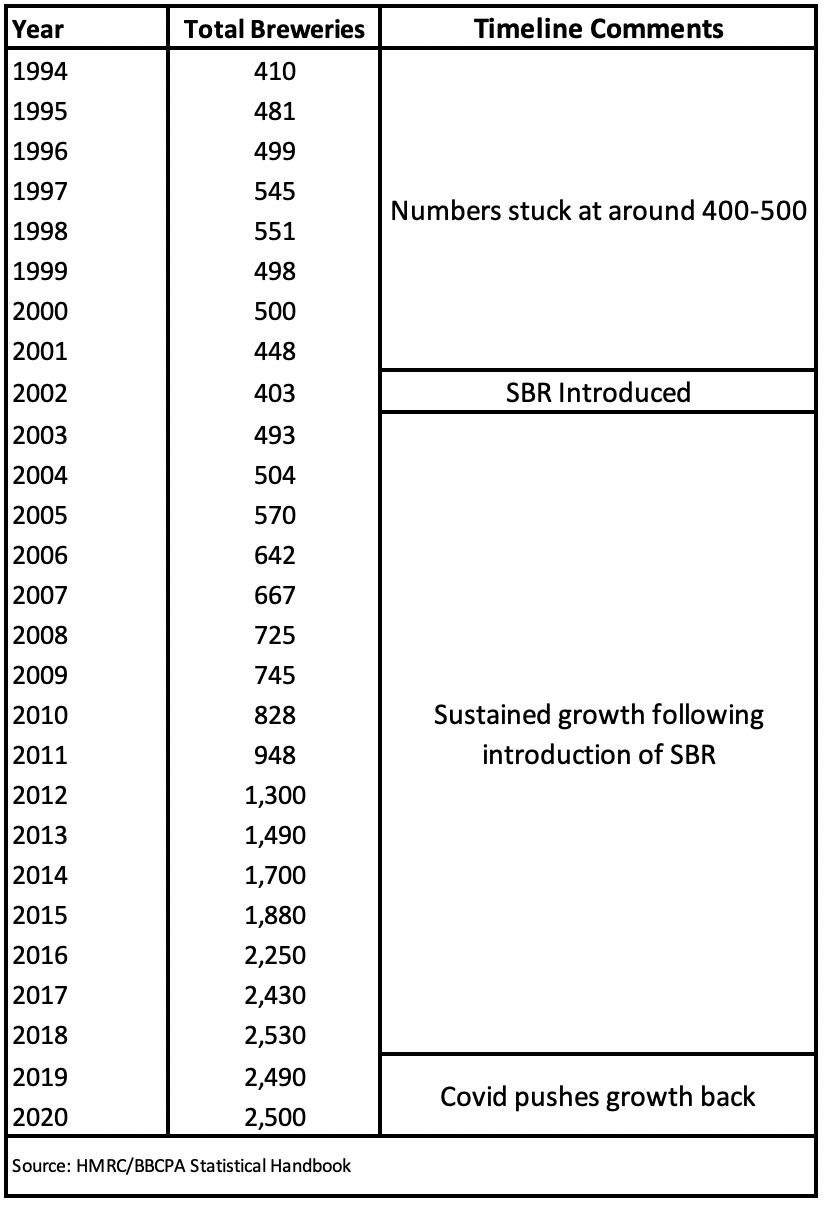

Twenty years ago a small line from the Chancellor’s budget became the catalyst of a brewing boom that is still being felt today, with an independent craft brewery now rooted in virtually every community, across every corner of the UK.

When Gordon Brown stood up to tell MPs “to encourage one group of small businesses, the nation's small breweries – often village pubs, some two centuries old – I have decided that the duty paid on their own beer will be halved,” he transformed the British beer industry, providing an opportunity for small independent breweries to set up and compete with the Global beer giants.

Today (Wednesday 1 June), we celebrate the introduction of Progressive Beer Duty, now known as Small Brewers Relief (SBR) – a piece of policy which has endured the test of time and proved its worth over a now twenty-year history.

Like all good ideas it’s a simple one; allow small brewers to pay a more proportionate amount of beer duty to the Treasury, just like income tax. For the smallest breweries it means paying 50% of what the largest mega brewers would pay, which we can then invest and use to compete against the handful of Global companies that continue to dominate the beer market.

And it means that 20 years later we can celebrate having more breweries since the 1930s, the highest number of breweries per head of any country in the World and tens of thousands of new jobs created from field, to supplier, to brewery, to pub.

Innovation history

With new blood came innovation, a diverse range of beers and a huge uptick in consumer choice. Today hundreds of beer styles to appeal to all palates mean the demographic of beer drinkers is broader than ever before. Who would have thought in 2002, we would today have a choice of World class White Stouts, Hazy IPAs or fruited sour beers alongside our traditional Best Bitters and Pale Ales?

But this is also the last year of Small Brewers Relief in its current form as Chancellor Rishi Sunak has announced bold steps to create a “simpler, fairer and healthier” structure with reforms to an alcohol duty system that is “outdated, complex and full of historical anomalies”. There are some really positive aspects to the changes, which aim to address historic imbalances in the system and reflect the changing landscape of drinks production in the UK.

However there is a danger that independent brewers are going to be muscled out by the Global drinks manufacturers who dominate the cider and Ready to Drink markets - both of which will benefit from the new system.

For example, changes to the lower alcohol band will encourage the largest brewers to reformulate their recipes to benefit from the lower 3.4% ABV duty rate, eroding small brewers’ competitiveness and costing the Treasury millions of lost revenue. They will use this added revenue to secure further market access, dominating space at the bar and pushing independent brewers further to the margins.

At the opposite end stronger beers like Imperial Stouts and Double IPAs (most often consumed in small third of a pint measures, or in cans and bottles designed to be shared) will be taxed much more, making them more expensive and unaffordable for independent brewers to produce, stifling the innovation that has flourished in recent years.

In a positive move Government will also be extending Small Brewers Relief to other kinds of alcohol such as cider, so Small Brewers Relief becomes Small Producer Relief. We support this move – helping independent producers is a principle we like. But it isn’t perfect. Cider will continue to benefit from the ‘farmgate exemption’ (where 60% of cider makers pay no duty at all) and big cider makers only paying 46% of the rate brewers pay.

Looking ahead

How can this be fair when five Global companies produce around 87% of the cider volume sold in our pubs? Given cider and beer are substitutes on the bar and on the shelves – they should pay the same.

What’s more, instead of ushering in a simpler system, the new Small Producer Relief is going to be highly complex for independent producers. Rather than using the previous system where a simple percentage is applied to everything a brewery makes, the tax relief is going to be based on the strength of the alcohol being produced – a never before tried or tested system. This roll of the dice means that the Government is gambling with 20 years of positive gains in the craft beer industry, which could be detrimental to businesses and consumers.

For beer that will be sold in pubs, the Chancellor announced a 5% discount (similar to the 5p cut in petrol duty announced) would be applied. And while the new beer draught duty rate could be a game changer, it currently does not include the sizes of kegs and casks often used by community pubs and independent brewers to ensure that the freshest beer is served. And it wont be applied till next year, unlike the petrol duty cut, which was enacted overnight.

With two key changes - including 20 litre kegs and casks in the new draught duty rate and introducing a truly level tax rate for beer and cider the Chancellor can ensure that the future of Small Producers Relief is as long and fruitful as that of Small Brewers Relief.

So let’s raise a glass to the 20th birthday of Small Brewers Relief – a scheme that has endured different Governments and achieved so much for independent brewers – and let’s hope the next 20 years are just as fruitful for all independent drinks producers across the UK.