The performance was driven by strategic delivery and business transformation. Greene King’s revenue rose by 62.2% to £2,176m versus a prior period of £1,342m, with revenue growth across all five divisions.

Furthermore, an adjusted operating profit of £192.6m, compared to a previous period of £18.6m, was delivered, with statutory operating profit of £249.2m, compared to the prior period of £63.8m.

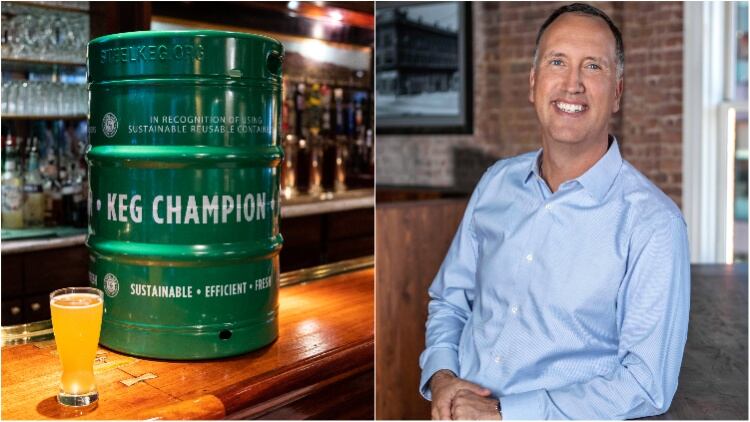

Greene King chief executive officer Nick Mackenzie said the company delivered a strong operational and financial performance during 2022 despite the challenging macroeconomic backdrop, with progress made in all its businesses.

He added: “This was only made possible by our hardworking and committed team members and tenants, who I would like to thank.

“We also continued to invest in the business, which meant we made important strategic progress, particularly in new format and brand developments, targeted acquisitions and through driving our cultural transformation.”

The implementation of proactive measures reduced the impact of inflationary pressures and supply chain disruption on the business, including successful energy hedging and focusing on cost efficiencies.

Making progress

Capex and business acquisitions hit £242.3m versus a prior £144.5m, reflecting a time of hiked investment across the business.

The pubco also continued to be cash generative from operating activities, with free cash flow of £13.1m in the year after significant investment, in comparison to £7.2m in the prior period.

Furthermore, it successfully refinanced its balance sheet by £915m and repaid the A5 Spirit debenture and A5 Greene King securitisation bonds to maximise the strength and flexibility of the balance sheet and maintain the business’s robust capital structure.

Greene King also achieved progress against all of its key strategy drivers during the period, which are: brands, culture, people, operational excellence, digital, assets & expand and environment & social.

Its portfolio was also optimised and expanded. An investment in the American-style smokehouse brand Hickory’s opened up opportunities for nationwide expansion. The Venture Hotels brand was also creation, which consists of 39 hotels that previously traded within Destination Food Brands.

Expanding portfolio

Despite a challenging period for Destination Food Brands, a further 80 sites benefited from capital investment in the year with a big focus on gardens, and new premium beer brands Flint Eye and Level Head were launched.

Mackenzie continued: “Looking ahead, we expect the tough backdrop to continue, and we have planned for this.

“We now have a stronger platform to deliver sustainable growth against a strategy that is working and with a strong balance sheet.

“By focusing on the things we can control and supporting our team members and customers, we will continue to do what Greene King does so well, playing a meaningful role in supporting the communities we serve and leading the way in making our industry a better place to work.”

The pub company also supported staff through launching the Team Member Support Scheme, providing one-off grants of up to £5,000 to help team members in need.

It also expanded its apprenticeship programme with 1,173 added individuals joining the scheme, which includes offering apprenticeships to prisoners for the first time.