The channel was estimated to be worth £6.7bn in 2015, with the value rising by 6.6% over the 12 month period, it showed.

Although there was a continued decline in consumer visits to wet-led pubs last year, over 1m more adults chose to eat out in a food-led pub, a restaurant or a hotel compared with 2014.

As a result, there was an increase in demand for premium soft drinks among consumers, who wanted more sophisticated and discerning beverages. Consumers also increasingly sought authenticity, craft and elevated serve experiences from their soft drinks, the review showed.

Didn't want to consume alcohol

Also, as more consumers were eating meals such as breakfast and lunch out-of-home, but didn’t want to consume alcohol, premium soft drinks were set to become more important options, said Ruth Scullin, Britvic’s licensed and leisure category manager.

Almost half (45%) of breakfasts eaten out-of-home last year were served with a soft drink and 55% of lunches featured a soft drink, she added.

A back story, as with alcoholic drinks, was now just as important for consumers looking for a soft drink, she said.

Pubs should consider developing a high-quality mocktail offer to fit with consumer demand for premium soft drinks at breakfast and lunch, added Scullin.

‘Surge in customisation’

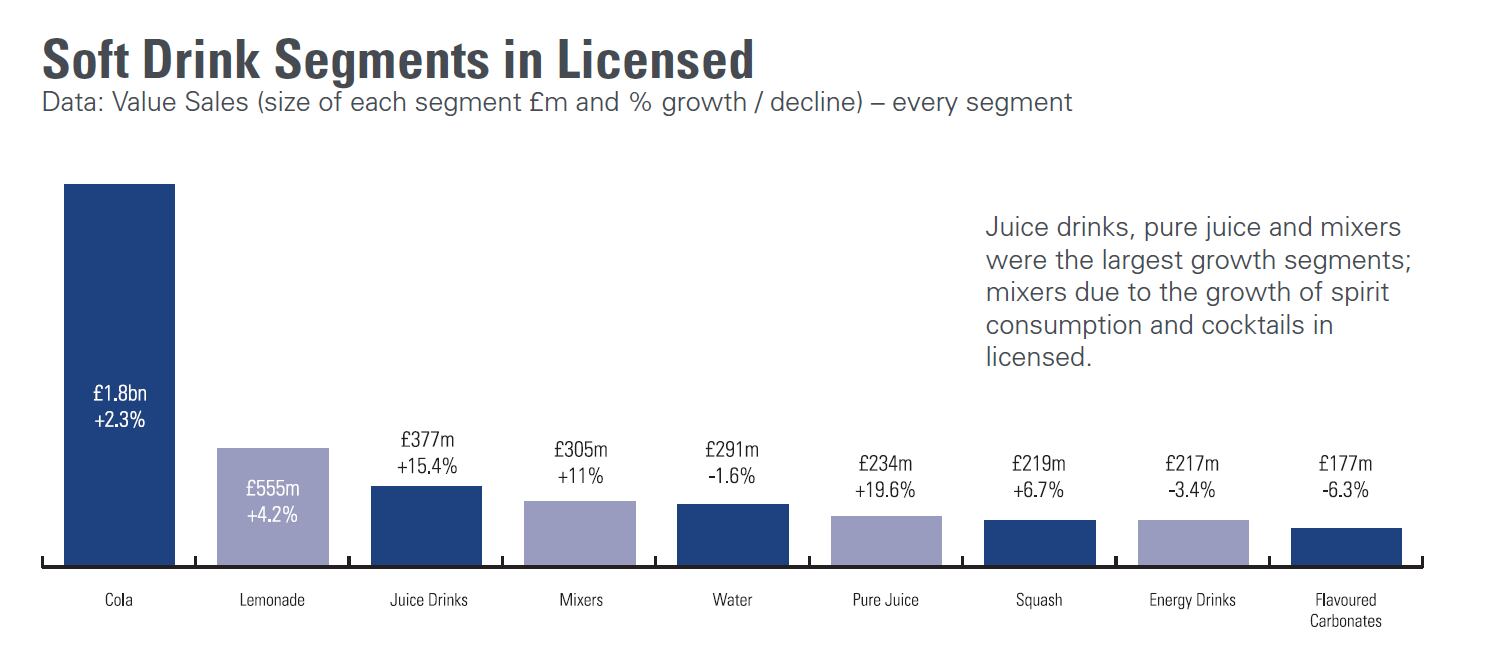

The review said: “The drive for more discerning drink experiences also led to a surge in customisation through cocktails and mixing, both inspirational experiences that consumers couldn’t easily replicate at home.

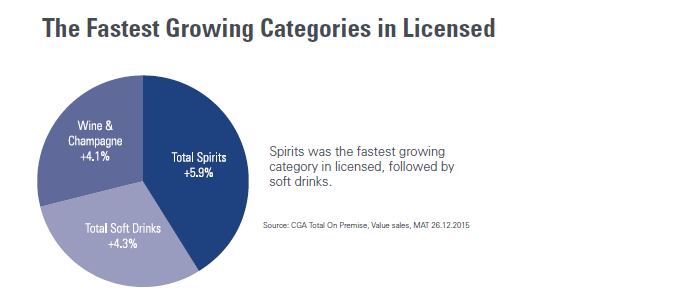

“As part of this, premium spirits was the growth segment of the spirits category in licensed outlets, growing by 19% compared with 1.9% for mainstream spirits.

“As a consequence, strong growth was also seen for premium mixers (14%) which highlighted the need for soft drinks to deliver high taste and quality credentials to be able to stand alongside their premium spirit partner.”

Meanwhile, Britvic GB managing director Paul Graham said the company would continue to reformulate and launch new products, despite the Government’s announced sugar levy on water-based soft drinks.