Spotlight

Property of the week

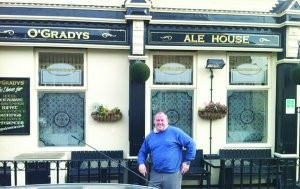

BERKSHIRE - RENOVATED PUB WITH FOUR LETTING BEDROOMS

Village position close to Reading and Newbury Extensively renovated public house Bar, conservatory, snug and function room (80-90) Four en suite letting bedrooms Two bedroom owner/staff accommodation Part-covered trade garden...