In a small town in the far south of England, a 134-year-old family-owned soft drinks business has been tinkering with the design of its range to give it more adult appeal.

Hartridges, which is based in Hambledon in Hampshire, is the ninth most popular soft drinks brand in the on-trade [CGA Brand Index], but has long been criticised for looking too much like a cheap J2O knockoff. Not any more though, says marketing director Ed Hartridge, who is also the son of managing director Martin Hartridge.

The company has spent a considerable amount of time and money putting Hartridges’ heritage on to the bottle, “to make it more premium, crafted and appealing to adults”.

This is not a new phenomenon and it’s something brands have become increasingly good at doing over the years — portraying a story and history to help sell a premium product to customers.

While soft drinks brands are pros at this, pubs are yet to capitalise on all that the category has to offer their businesses by pushing their premium credentials and treating them like the grown-up drinks they have become.Premium and craft have been bandied around by the beer, cider, spirits and wine categories for years now, but softs are only just starting to tap into the language.

Sales of softies in the on-trade and leisure channels grew last year by 3.2% in volume to 1.9bn litres, compared with a hefty overall decline for the category as a whole, according to the 2016 Britvic Soft Drinks Review.

The soft-drinks category last year was the fourth-most-valuable beverage segment in the licensed trade after beer, spirits, and still and sparkling wine. It delivered the second-fastest growth of all drinks categories at 4.3%.

It all sounds rosie, but the uptick in volumes has been delivered through very little effort from pubs, which means there’s a lot more scope for growth.

While volumes and sales values of soft drinks are on the up in the licensed trade, the hero is premium, a segment that has seen a 75% year-on-year increase, according to Britvic’s review.

Mintel’s Attitudes Towards Premium Soft Drinks report 2015 points out there are lots of boxes for the on-trade to tick in order to make the most of this newly grown-up segment.

Seven in 10 adults are drinking from the segment in the home, while six in 10 are choosing to do so in the on-trade. Just three in 10, though, are drinking them as an alternative to alcohol, which suggests a need from the operator to shift customers towards the category with a more exciting offer.

It’s widely reported that the younger adult generation aren’t visiting the pub as often as their parents and grandparents. Tempting younger drinkers to the pub could be done through a better premium soft drinks offer, as that demographic is more likely to consume products from the category, the Mintel report adds.

It says: “Younger generations are more likely to drink premium soft drinks and are also more frequent users than the older cohorts. The decline forecast within the 16 to 24-year-old age group and growth of the over-55s between 2014 and 2019, therefore, pose a challenge to the industry.

“This should, however, be partly offset by the predicted growth among 10 to 14-year-olds, given that parents are also among the highest users and highest-frequency users of premium soft drinks.”

Stocking premium soft drinks that mimic alcoholic drinks can also help tick one of the many boxes, advises Mintel, although the amount of new soft products that mimic alcoholic drinks are few and far between so, instead, a varied offer would be better.

“A strong range should go some way to offering a point of difference, given that these are so widely seen as lacking, particularly for venues looking to build an image away from the typical ‘male bastion’,” the report continues.

Very late to the party

But softs have come very late to the premium party and it’s going to take pubs some time to grow it to a level that has been achieved in other on-trade categories, according to Hartridge. “Getting the premium soft-drink offer right is going to be more profitable for the on-trade than the traditional post-mix offer,” he adds.

“Customers want to try special flavours, they want something that’s new and unique, whether it’s a soft served straight from the bottle in a glass with ice or in a non-alcoholic cocktail.”

People don’t want to be part of the crowd when it comes to buying into premium, according to Franklin & Sons brand controller Justin Horsman.

The increasing trend of consumers drinking premium in this category should give rise to a bigger range in the pub, he adds.

Simon Green, marketing director for Franklin & Sons, adds: “The drive for premium and craft are massive and the trend of people looking for something of interest gives scope for huge growth.”

Choosing products that have provenance and a story is key. While premium is the word that currently holds

a lot of interest with consumers, whether something is ‘crafted’ or not is also a term that is beginning to pique interest, he adds.

Dave Ward, national on-trade controller for Fentimans, agrees. “Soft drinks have always tended to be the last category that gets any focus.

It’s now following on from the beer trend and the spirits trend – with craft and premiumisation.”

He continues: “People are looking for more interesting products so the soft-drinks category is following that.”

As the Mintel report advises, the soft-drinks segment is starting to look at the success of alcohol and cherry-picking the key lessons learned in that sector, Ward explains. As a result of this, he believes there will be a rise of new product launches on the market to help pubs build their offer the same as they have with alcohol.

“We’re already seeing a lot of the bigger companies bringing out premium products,” he explains. And, just like Hartridges, Fentimans plays on its heritage and story to attract customers. “The market is going to become more competitive, but that’s good because that allows the whole trade to build on it, rather than it becoming a passing trend.”

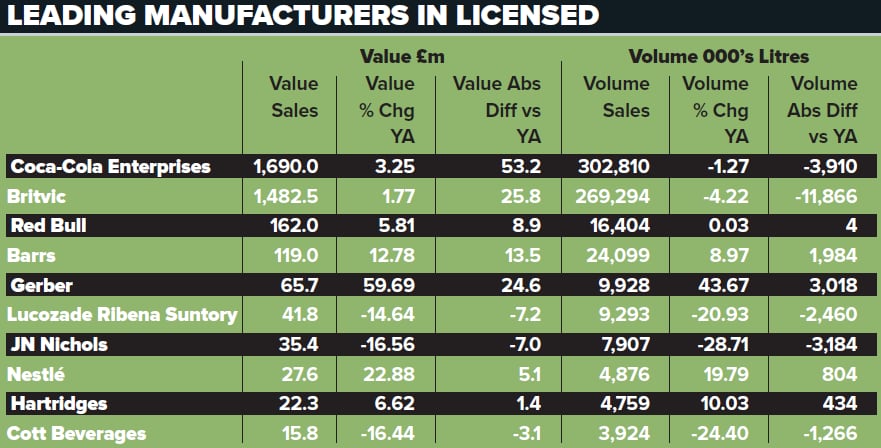

The bigger brands, such as Coca-Cola, Britvic, AG Barr and Lucozade Ribena Suntory (LRS), are tapping more and more into the premium and craft categories, Ward says, in response to the rising trend for premium.

Coca-Cola, for instance, has long positioned its Appletiser brand at discerning adult consumers who are looking for a more sophisticated non-alcoholic alternative.

Coca-Cola European Partners trade communications manager Amy Burgess says: “Statistics show that one-in-five people are now choosing to be teetotal, the category is arguably more important to licensees than it’s ever been before.

Increased demand for premium

“This is leading to increased demand for premium or craft soft-drinks options as consumers seek drinks that look and feel more sophisticated while out of the home. Offering a more adult option to replace a bottle of beer or glass of wine can only be good.”

Consumers are looking for more sophisticated options within the category and stocking a more diverse range can help pubs capitalise on this, she adds.

Yet, it’s not just the products. Burgess points out that getting the serve right requires just as much attention as the products you select for your bar. “For a long time, licensees have been aware of the impact that serving beers in branded glassware can have on increasing their sales, and adopting the same practice with their soft drinks range can also create incremental growth.

“Licensees should consider making the most of this opportunity by investing time in training their staff in order to achieve the best possible serving for their soft-drinks range and to increase the likelihood of ordering a second drink.”

Britvic’s premium and craft soft-drinks offering grew earlier this year with the launch of its WiseHead Productions’ Thomas & Evans range, which is a gently sparkling and aromatic softie. The liquid is a blend of more than 20 ingredients, including steam-distilled botanicals and silver birch charcoal-filtered green fruit juices.

The methods used in the production are akin to those used in the gin process and allow bar staff to talk about the product in a similar way they would an alcoholic drink.

Britvic senior shopper marketing manager Russel Kirkham says: “The trend for premium — not just soft drinks — is being driven by consumer expectations. Within the on-trade there’s massive growth and operators need to move with that trend by boosting their offering to fit.

“The on-trade has to stay ahead of the curve when it comes to premium soft drinks. They have to deliver the right products to the engaged consumer expectations. You have to keep your finger on the pulse.”

Discerning drinkers, as they have already done with craft beers, may also look towards American products. As it is with ale, America is something of a market-leader when it comes to soft drinks.

Graham Richardson, general manager for Heathwick, importer, distributor and brand builder of beverages, believes craft soft drinks, such as American root beers, could offer pub operators the opportunity to attract a more experimental customer base.

He says: “Craft soft drinks offer an exciting and interesting alternative to the mainstream, ubiquitous big brand colas or juices, and root beer and cream soda are good examples of the growing trend.

“To make the most out of your soft-drinks sales, pub operators should combine a mix of well-established, popular brands with innovative and different new products that are versatile enough to be enjoyed on their own.”

Part of keeping your finger on the pulse means approaching the category in a different way, says Jamie Nascimento, head of marketing for LRS-owned Orangina.

“Premiumisation will continue within the category and will support growth, with consumers focusing on natural ingredients, high-quality ingredients, production and enhanced taste qualities versus cheaper alternatives,” he adds.

“Operators should consider including soft drinks on drinks menus, and linking with meal deals in outlet. They should also consider soft drink and food pairings (see boxout).”

So, demand for premium soft drinks from consumers is ripe and manufacturers are producing ranges that fit this call, but is your soft drinks offer reflective of the trend?

If 134-year-old producers such as Hartridges are changing their ways to tap into the growing demand for premium softies from adults, then pubs should too.