Premiumisation. It’s an ugly word. Linguistically, anyway. For a pub business, that grotesque polysyllabic shell conceals an elegant beauty within: less is more.

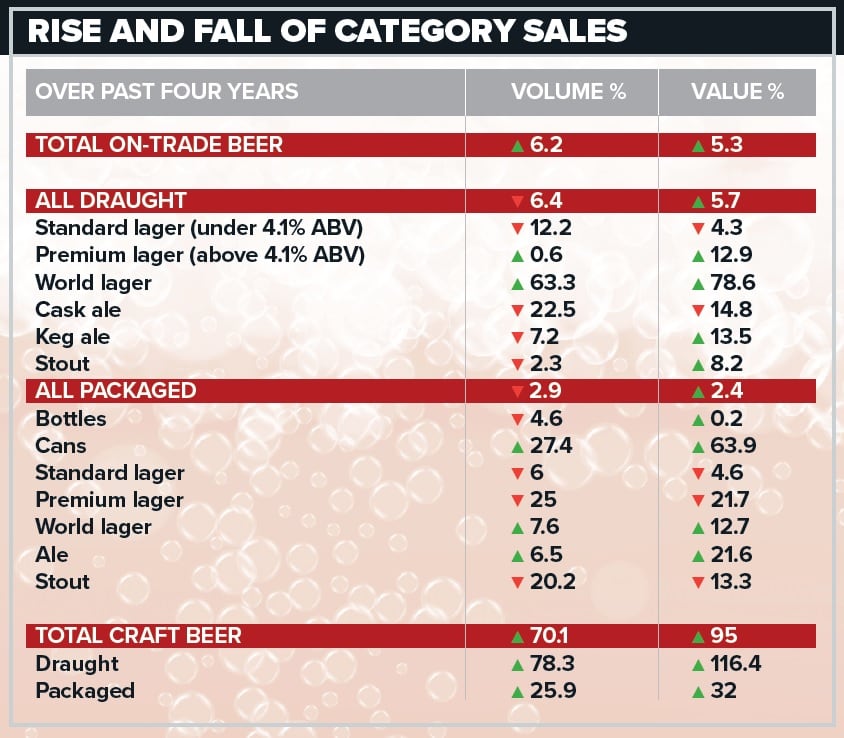

Just look at the stats. Over the past four years, on-trade beer volumes have, according to CGA’s research, fallen 6.2%. The value of those sales, however, has risen 5.3%. Heineken UK calculates premiumisation is driving £380m extra cash sales through pub tills.

Yet there’s even more pubs could do to premiumise their beer offer, essential in a market that’s never going back to the days when publicans lined up pints on the bar every night for thirsty industrial workers coming off shift. Success now is about value, not volume.

“People might not be going to the pub a few times a week for a pint. But when they do, they want a premium experience, and they will spend more,” explains Paul Bolton, senior client manager at CGA.

“So we’ve seen the huge success of spirits, especially gin, and we can see the same effect in beer. It’s happening across the board.”

When it comes to beer, the word ‘premium’ has traditionally meant ‘stronger’. CGA, for instance, defines standard and premium lager by ABV. But there’s a case for breaking out of the mindset that boozier means better. ABV has never bothered wine drinkers.

World beer commands a higher price than premium lager no matter its alcoholic strength and, of course, we now have craft, a category that embodies the idea that some things cost more because they are more interesting.

Even standard draught lager, which has lost 12.2% of volume sales during the past four years, down only 4.3% by value, thanks in large part to 4% ABV brands such as Amstel and Coors Light, “which are a bit more premium and to some extent compensate for the loss of standard lager volumes,” says Bolton.

Then there’s the example of Carlsberg, reformulated and relaunched to create “a more premium feel for the brand that consumers are willing to pay more for,” says Carlsberg UK as it reports that Carlsberg Danish Pilsner, as it is called now, has improved rate of sale, increased price per litre and is in 3% value growth in the on-trade over the last 12 weeks of recorded figures.

All this is important, since standard lagers still claim 45% of the draught beer market and are an automatic choice for many pubgoers.

Despite its continuing decline, cask beer, too, has been buoyed to a degree by a modest return to growth at the premium end.

And while premium lager is fairly flat, we have world beer volumes up 63% in four years to reach 11% of draught sales.

It’s a sign beer drinkers want a pint that delivers a little more and says something about their discernment.

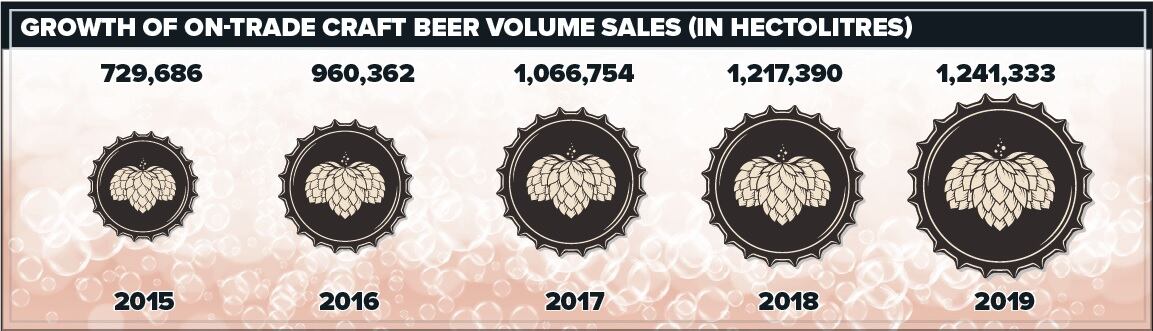

Craft beers write that trend large. Accounting for only 6% of on-trade beer they are growing fast, up 78% in the past four years. According to CGA, one in five who go out to eat and drink might choose a craft beer. That’s 9.4m people.

Their success is feeding into traditional categories. Take keg ale. Its long-term decline has suddenly reversed to record a 14% volume growth in the past year, driven not only by taps given over to trendy craft IPAs but by cask brands, like Old Speckled Hen, being reinvented as premium keg.

Back-bar fridges are also being transformed by craft, evident in a swing from bottles to cans, once rejected by pubs as a cheap off-trade package, now a sign they take beer seriously.

“Cans are growing on the back of craft, driven by brewers like Camden and Beavertown, which have made the decision to come out of bottles,” says Bolton.

“They’re cheaper and lighter and look very attractive in the fridge. Cans are still a small part of on-trade volume, but I’d expect the trend to continue.

“There’s a clamour for craft but pubs should make sure they know who their customers are and who they want to keep coming. Most will need to balance it out. Remember, standard lager is huge and still a go-to drink for many consumers.”

The cask conundrum

Cask beer punches above its weight across the pub market. It’s an experience you can’t get anywhere else, and even for people who don’t like it, pumps on the bar are a sign they’re in a ‘proper pub’.

Yet, as CGA’s Paul Bolton puts it, “cask beer is having a tough time”. Sales are down 7.7% in the past year and down 23% over the past four years.

“And the price you pay for a pint is still very low compared with what you’d expect. It’s a great story, a crafted product that’s unique to pubs, but the perception is that it can’t command a higher price. ‑ at needs a change of mindset.”

The Cask Report 2019, released in September, finds some solace in a recent uptick in premium sales (meaning beers above 4% ABV), which helped cask record a 3.5% growth in July, against July 2018. But product quality issues, exacerbated by slow throughputs, remain a block to cask gaining that premium pricing it deserves.

Pubs can help by not trying to sell too many different beers.

“The first thing they can do is make sure they’re ranging for quality,” says Louise Fleming, head of consumer marketing at Marston’s Beer Co. “That means checking weekly throughputs and having the right number of cask ales on the bar for their business.

“The second thing is to range by style. Ranging by amber, gold, amber, then dark will, we believe, appeal to the maximum number of drinkers to guarantee throughput and choice. Of course, there are regional differences but this should be a good starting point.

“Operators can then stretch their range and generate more cash through expanding choice into more contemporary styles of cask such as IPAs, pale ales and higher ABV beers.

“Innovation adds interest and appeals to younger drinkers and those who might otherwise switch out of cask in search of refreshment.”

That innovation now includes ‘chilled cask’ brands that try to address the continuing problems with serving temperature identified by Cask Marque which warns, in The Cask Report, that consumer satisfaction drops off a cliff when a pint nudges above the optimum 11-13°C.

Both Marston’s, with Wainwright Altitude, and Greene King, with a new cool serve system for Yardbird Pale Ale, are experimenting with brews meant to be served below cellar temperature.

Perhaps the first decision pubs should be making, though, is whether they should be stocking cask beer at all.

Beer writer Pete Brown, speaking at the launch of The Cask Report, made the point that quality is chiefly driven by publicans who have a passion for the cask-conditioned product, and probably drink it themselves.

If that’s not you, the craft revolution means it’s now possible to serve an interesting range of beers without bothering with cask at all.

“While cask remains a core proposition for pubs that champion our national drink, we know that pubs with a younger clientele are stocking more, or even exclusively, keg beer,” says Matt Starbuck, managing director of Greene King Brewing & Brands. “With IPAs and pale ales in strong growth, this is good news for the market.

“That’s not to suggest it’s doom and gloom for cask, far from it; but pubs that succeed in selling cask are the ones whose licensees understand it as a live, fresh product, who know how to care for it and can sell it because they love to drink it themselves.”

Sour beer, anyone?

When people think of craft beer, it’s usually a pale, highly hopped brew they have in mind. But there are signs the market is maturing into a greater diversity of styles.

At Brick Brewery, in south-east London, the best-seller is a Pilsner lager, and it’s also making a name for itself by releasing a series of sour beers, arguably the most challenging of styles.

Recent creations have included Nordic Sour, with sea buckthorn and juniper; Preferred Pronouns, a sour New England IPA; and an apricot and vanilla saison in collaboration with Brighton brewer Unbarred.

“We’re seeing a significant shift towards high-quality Pilsners and lagers,” says Brick founder Ian Stewart.

“We brewed our first Pilsner six years ago and it’s a nice gateway into craft beer.

“We’ve also become known for our sour beers. We produce a new one every four to six weeks using unusual adjuncts, bringing something a bit unique.

“Our sours are between 2.5% and 3.5% ABV and a lot of people are going that route – they’re more health-conscious. They might be a difficult sell in a traditional pub, but we’ve noticed more women are drinking them, so there might be an opportunity there.

“There’s always going to be a place for pale ales and hop-forward beers, though,” he adds. “Brewers might be a little tired of making them, but the consumer isn’t tired of drinking them.”

The next big thing

What happens in America, happens here next, they say. Which means Bob Pease, CEO of the Brewers Association, currently seeing 16.6% of members’ exports coming to the UK, can claim some insight into the future.

“IPAs are still the rock stars of American craft beer and account for almost a third of all sales, but sessionable beers and lighter styles are growing because they allow the ageing craft beer drinker to support their favourite brewery while limiting alcohol consumption, and they provide an entry point for new craft drinkers.

“Craft lager will be the next big thing. Lagers have not been popular with brewers because they’re harder to make and take longer, but more breweries are trying to provide a beer that can be enjoyed many times over in one sitting.

“Sour beers are also popular because they’re light in alcohol, refreshing and fit a healthy lifestyle.”

A world of opportunity

With world lager a star performer in pubs, the category is attracting newcomers like Bavaria’s ABK, owned by British-American company ROK Drinks, which is importing a range of beers into the UK, led by the 5% ABV Hell Lager, and has so far secured 1,000 on-trade listings.

ROK chief operating officer Graham Higgins pins the brand’s strategy on a 700-year brewing heritage.

“Provenance is such an interesting trend and we are seeing momentum around Bavarian beers in particular,” he says.

“Brands like ABK can capitalise because they sit between mainstream lagers and craft beers. As people move away from major brewers’ core draught beers, they’re looking for interesting brews with a great story. Many, though, don’t yearn for craft beers with high ABVs and testing flavours. ABK, from a trusted part of the world for lager, is able to take them on the journey into craft.”

Going low

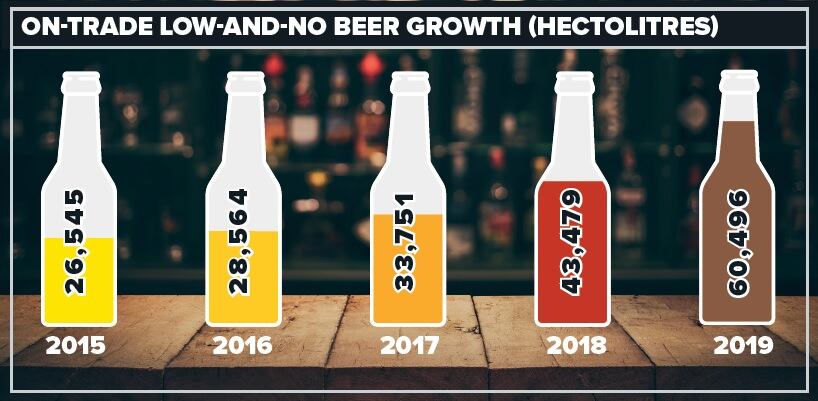

The most dramatic growth in the on trade beer market, according to CGA, is coming from the low and no-alcohol sector. At only 0.3% of total volume, it may not make it particularly visible on a pie chart, but its progress cannot be ignored.

“Distribution is up, and it ties into moderation trends,” says CGA’s Paul Bolton. “It’s a market that’s crying out for more choice.”

Specialist brewers such as Big Drop and Nirvana are looking to provide that with craft-inspired styles, but the UK’s best-seller is a lager, Budweiser Brewing Group’s Beck’s Blue.

“Moderation is more than a passing fad; it’s a way of life for an increasing number of consumers,” says Sharon Palmer, Budweiser’s head of trade marketing.

“Beers and ciders under 3.5% ABV have grown 37.2% in volume and 46.4% in value over the past year.” That includes the ‘premium light beer’ category, represented in Bud’s portfolio by Michelob Ultra, which is growing nearly 50% year on year.

Heineken UK, meanwhile, claims the fastest growing alcohol-free beer with its Heineken 0.0 variant.

“As people moderate their alcohol intake, low-and-no options are crucial to any beer range,” says category and trade marketing director Jerry Shelden, who points out that most of those making an effort to be healthy still go out drinking at least once a week.

“With 15% of consumers more likely to visit pubs with a better non-alcoholic range, it’s important operators offer different options.”

Home in on the range

Recent years have brought a proliferation of beer styles, offering countless ways for operators to engineer their range to maximise profitability. But selecting what’s right for your pub isn’t so easy.

“Beer is a broad church,” says Martyn Cozens, on-trade sales director at Carling’s brewer Molson Coors.

“Mainstream brands form the vast majority of sales, so you need a balance between well-recognised big brands, premium world beers, inspirational craft brands and local crafted ales.

“Choice will continue to be important and styles will continue to evolve. But it’s important we energise the mainstream, too, investing in well-known brands to keep them relevant and contemporary.

“There’s less space on bars, so pubs have to make choices, perhaps to stock only one, or possibly two, mainstream lagers.

"It’s important not to over-range. Quality is so important across all draught products. If you have too many, quality can deteriorate.”

Heineken UK category and trade marketing director Jerry Shedden sees pubs “rationalising their classic lager range in favour of sessionable and quality premium 4% brands”.

He adds: “These beers are contributing an extra 30p per pint in the tills – but it’s important not to remove classic lager altogether because it still accounts for 55% of draught lager volume.”

Craft beer can help attract younger drinkers who are shying away from the pub. “Craft has done a great job at repopularising and engaging consumers”.

But don’t forget mainstream keg ale, he warns.

“It has an army of loyal drinkers who’d rather opt for a different establishment than choose a different beer. When it’s removed from the bar we see total draught sales drop by 25%.”

Marston’s Beer Co works on a ‘breadth before depth’ model for keg showing the different categories a pub should stock plus options to trade up, setting out the relative price per pint of different styles.

“It’s important licensees stock a broad range of styles to give drinkers the ability to upgrade and make more money for their pub,” advises head of consumer marketing Louise Fleming.

For Sharon Palmer at Budweiser Brewing Group, “the most important things we’ve learned this year is one size does not fit all”.

She concludes: “What works for one beer drinker may not work for another, and today’s consumer preferences continue to evolve. It’s vital pubs offer a strong range that caters to different tastes.”