This net loss of 29 sites is, however, a notable slowdown in decline from the 611-site dip seen between December 2018 and December 2019.

The Lumina Intelligence Operator Data Index, which tracks the performance of hospitality operators and provides market rankings based on turnover and outlet numbers, highlights pub groups including Greene King, Mitchells & Butlers and Marston’s refurbishing managed pub estates over the past few years, transforming older branded pub restaurant sites into more modern managed venues with a focus on creating more unique establishments.

As such, the top 10 branded pub & bar restaurants by outlets are set to see a decline of 10 net sites in 2021.

However, Chef & Brewer (+3.1%) and Loungers’ Lounge concept (+8.6%) are the two brands forecast to experience the fastest growth in 2021, with Loungers harbouring ambitions to continue its expansion of 25 sites a year across both it’s the Lounges and Cosy Club brands.

Commenting on the results, senior insight Manager at Lumina Intelligence, Katherine Prowse, said: “Over the last 18 months, pub and bar restaurants have had to transform the way they operate in order to remain open and survive.

“This inevitably resulted in casualties, however, with restrictions easing, we expect outlet decline to continue to stabilise versus the steep declines seen in 2018-19.

“This slight decline will be driven by pub groups continuing to dispose of and transfer sites into unbranded estates.”

‘Torrid time’

These figures from Lumina come after some 384 pubs – on average six per week – were revealed to have “vanished” during the Covid-19 pandemic up to May 2021, having either been demolished or converted for different use, according to new figures from Altus Group.

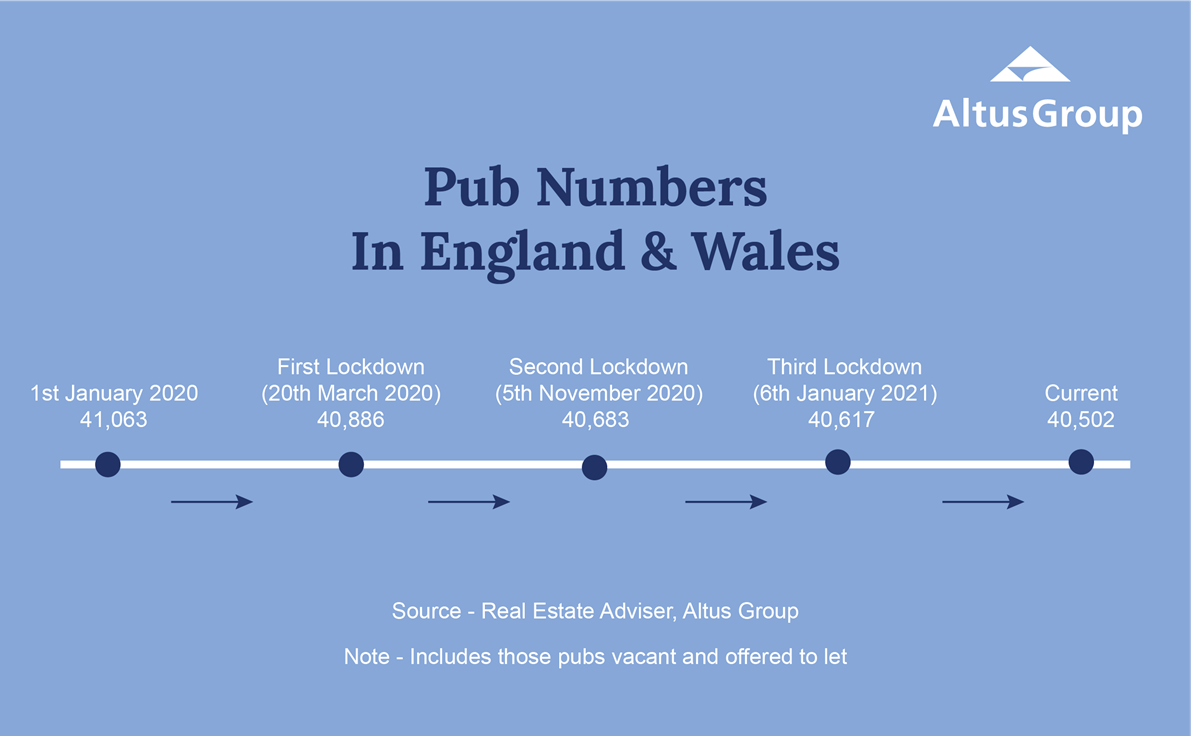

According to the real estate adviser’s research, when Prime Minister Boris Johnson called last orders in pubs, restaurants and cafes on 20 March 2020 in a bid to prevent the spread of coronavirus there were 40,886 pubs in England and Wales – including those vacant and being offered to let.

However, in light of three national lockdowns and tiered local restrictions over the last 14 months, that number has fallen by 1% to 40,502, with a total of 384 sites shuttered.

“Pubs have endured a torrid time during the pandemic but have proved remarkably resilient aided by Government interventions such as furlough, grants, rates relief and liquidity in the form of cheap loans helping to keep the ‘pilot light on’ for their reopening,” Robert Hayton, UK president of expert services at Altus Group, explained.

- The Lumina Intelligence UK Eating Out Market Report 2021 is the definitive report on the sector, covering the market and competitive landscape, consumer attitudes and behaviours and future outlook. Find out more about the report here.