These included aid with paying workers’ wages, tax reductions and delayed repayments of loans, in a bid to help the trade while it was closed or trading with restrictions over the past year and a half.

The Morning Advertiser takes a look at when these schemes are due to end and which ones have already closed.

Furlough

The Coronavirus Job Retention Scheme, more commonly known as furlough, will end in September, after numerous extensions.

However, in a change from its introduction in March 2020, from May 2021, employers had to pay national insurance and pension contributions for furloughed workers.

Furthermore, from 1 July 2021, employers then had to contribute 10% of furloughed workers’ wages, with the scheme funding the remaining 70% up to the amount of £2,187.50.

At the beginning of August, this changed again to employer contributions being 20% up to £625 and wages from the scheme at 60% with a cap of £1,875.

Then from September, the scheme will continue to pay 60% up to £1,875, with the 20% employer contribution up to also to £625.

VAT cut

The Government announced a reduced rate of 5% (down from 20%) VAT on food, soft drinks and accommodation for the sector, which was initially a temporary measure between 15 July 2020 and 12 January 2021 before it was extended.

Until 30 September 2021, the 5% reduced VAT rate on will remain in place for hospitality businesses. However, from 1 October, a new rate of 12.5% will be introduced, set to end on 31 March 2022.

Business rates holiday

The 15-month exemption period for business rates ended at the end of last month (June). However, rates have not returned to standard but are reduced by about two thirds (67%) up to £2m for closed businesses with a lower cap for those who have been able to reopen.

This reduced rate is in place for nine months, until March 2022.

However, according to real estate experts Altus Group, from 1 July, the discounted rate is expected to cost the Treasury a further £3.3bn – taking the total cost of relief including this and the business rates holiday to £17.1bn.

The tapered support for this year will mean total business rates bills across the retail, leisure and hospitality sector will be £5bn overall, Altus Group estimated.

Self-employed income support scheme

Amid the pandemic, there have been four grants available for self-employed licensees with funds of 80% up to £7,500 each.

The fifth grant is open to self-employed individuals or a member of a partnership that has also traded in both tax years – 2019 to 2020 and 2020 to 2021.

You must also have submitted your 2019 to 2020 tax return on or before 2 March 2021, have trading profits of no more than £50,000 and have trading profits at least equal to your non-trading income.

Self-employed operators can claim the grant if they think their business profit will be or has been impacted by coronavirus between 1 May 2021 and 30 September 2021.

However, limited companies or trusts cannot claim the grant.

HMRC was aiming to contact those eligible in mid-July, based on tax returns, to give a date self-employed workers can claim from. This would be by email, text, letter or within the online service.

The online service to claim the funds will be available from late July and those wishing to apply must confirm they meet other eligibility criteria when claiming.

The claim must be made on or before 30 September 2021.

The fifth grant is different from the other four as to make the claim, HMRC will need turnover figures from April 2020 to April 2021 and either 2019 to 2020 or 2018 to 2019.

The Government department will compare these figures to work out how much will be provided.

If turnover is down by 30% or more, recipients will get 80% of three months’ average trading profits up to £7,500.

If turnover is down by less than 30%, recipients will be given 30% of three months’ average trading profits, up to £2,850.

Loans

While there have been many different loans with varying criteria, the most recent one businesses can apply for is the Recovery Loan Scheme.

It aims to help firms of any size access loans and other finances to help recover from the pandemic.

Up to £10m is available, per business with the actual amount offered and terms at the discretion of the participating lenders.

The Government backs 80% of the finance to the lender but borrowers are always 100% liable for the debt.

The scheme is open until 31 December 2021, subject to review, indicating it could be extended.

The list of accredited lenders is available on the British Business Bank website.

Meanwhile, in February, the Government announced the Bounce Back Loan Scheme borrowers were given the option to delay repayments for a further six months under its Pay As You Grow initiative.

Entries for other loan schemes such as the Coronavirus Business Interruption Loan Scheme and the Coronavirus Large Business Interruption Loan Scheme have now closed as of 31 March 2021.

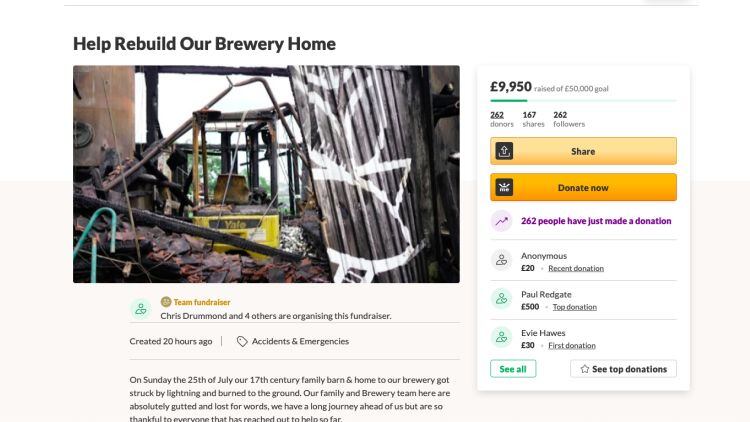

Grants

Similarly to loan schemes, most grant initiatives have now closed for entries however, the Government website does list the Additional Restrictions Grant as a source of support for businesses.

This provides local councils with grant funding to support businesses severely impacted by restrictions and may or may not be in the business rates system.

Firms can be excluded from this though if the business is in administration, insolvent or has been struck off the Companies House register or has exceeded the permitted subsidy allowance.

Companies should visit their local council’s website for more information and to find out how to apply for the grant.