An apple a day keeps the doctor away, as the well-trodden saying goes, but it is the latest trends in cider that operators must train their eyes on to keep their punters coming back.

According to Heineken UK, owner of cider brands including Strongbow, Bulmers and Old Mout, the cider segment has changed dramatically in just a few years.

The category now accounts for about 9% of total wet trade across Great Britain, figures from CGA show, with growth expected to continue.

Decline in traditional cider

Cook’s world tour

Ciderologist Gabe Cook outlines craft, dry flavours, cans and bars as the main trends in the scrumpy category.

After whistle-stop tours of Australia, New Zealand and the US, Cook highlights the lessons he learned.

He says: “There are some amazing things happening all around the world that bring such vitality, life and breadth to the category and really emphasise the quality in cider.

“There is an association with craft being a drier, more challenging product, which is also really on-trend right now.”

However, when it comes to canning, Cook says just because a cider is in a can, it doesn’t equate to it being craft.

He adds: “It has to be of the right standard and it has to be telling the right story.”

Total cider volume is marginally up by 0.2% across the on-trade, but when the cider category is broken down into variants, traditional apple cider has seen a drop of 3.1% in volume (moving annual total – MAT – to 27 January 2018) and 0.8% in value.

The story is similar for pear cider, which has seen a huge drop of 23.6% in volume and 22.5% in value. However, fruit-flavoured cider has seen a rise of 9.1% in terms of volume and 10.6% in value.

The dispense story

Splitting the sales of each variant into dispense method, however, tells a different story. For instance, draught apple cider volumes dropped by 1.9% but value rose by 0.5%. It is good news for pear and fruit-flavoured draught ciders, as the volume and value for both rose.

Draught pear cider saw a 30.2% increase in volume and a 33.5% rise in value. Draught fruit-flavoured cider was the biggest winner, with an increase of 33.8% for volume and 37% in value.

On the whole, packaged cider value and volume sales both fell, according to the data – apple by 11.6% and 7.8% and fruit flavoured by 5.5% and 1.1% respectively. Packaged pear cider also dropped by more than a quarter (27.4%) in volume and 25.8% in value.

As a result, packaged cider needs a bit of a kick to boost its volumes, having seen sales fall away by 9.3% last year, the latest figures show.

Statistics from CGA show that total cider volume rose marginally by 0.2% over the past 12 months measured as moving annual total, while draught cider volume increased by 4.6%. Draught cider also accounts for 71% of all cider volume sales and its share grew by 4.6%.

When it comes to value, the total cider category is up by 2.3% but, when separated into draught and packaged, draught is on top again.

Packaged cider value dropped by 5.3%, which is in stark contrast with draught cider value, which is up 7%.

CGA GB drinks team client director Dave Lancaster says: “Cider remains a key player in the stocking portfolio of pubs and bars up and down the country, though now with a vastly different sales mix within the category versus 10 years ago.

“Long gone are the days of solely draught pumps of traditional apple brands as, in recent years, we have seen waves of first pear then fruit flavours hit our fridges, targeting our ever more promiscuous taste buds.

“This, however, is nearing full circle with the more recent, and very successful, emergence of draught flavoured cider bringing draught cider into 4.6% growth over the last MAT.

“Growth in draught has come at the detriment of the fridge, however, as packaged cider is now in 9.3% decline over the MAT, where we have seen consumers switch to the new draught flavoured options.”

Packaged cider’s challenge

While packaged cider is seeing a decline, it is not time for pubs to ostracise those customers who call for the products.

Heineken UK category and trade marketing director Jerry Shedden says: “Looking at packaged cider, the biggest challenge is the outlet committing to the segment, despite the challenged volumes.

“Without question, packaged cider has lost consumers to other sweeter drinks like cocktails, sparkling wine or Aperol Spritz.

“However, there remains a loyal customer base and outlets removing apple cider from their fridges as a whole are challenging their choice.

“Since 2014, about 9,000 outlets (according to CGA data) have stopped ranging any apple cider in their fridges and while flavoured cider certainly leads packaged sales, a consumer wanting a bottle of apple cider is not interested in a mixed berry one and is, therefore, unsatisfied. This can lead to a decrease in loyal customers.”

Gender appeal

When it comes to consumers, cider is a tipple that appeals to a plethora of age groups as well as genders.

According to Westons Cider Report 2017, which included data from CGA, the split between male and female cider drinkers is a close one at 53% versus 47% respectively. Men are more likely to drink draught, while women prefer packaged.

Women cider drinkers are on the rise, thanks to one variant in particular, according to Thatchers on-trade sales director Rob Sandall. “Cloudy cider definitely has a long way to go and it is preferred by the female population, which is great,” he says.

“Though cloudy is still small at the moment, we have projected massive growth for it and believe it will be the fruit-flavoured equivalent.

“It is opening up the cider category to people who don’t necessarily drink cider and we are projecting it to be massive in the next two years.

“Sales of our ‘craft’ varieties in the on-trade are relatively small, but people are increasingly trying it and understanding it, meaning single variety, artisan cider could take off.”

This is something CGA echoes and Lancaster outlines the current patterns that operators need to tap into, in order to keep up with the latest trends.

He explains: “The next trend looks to be some of the more premium cider makers investing in ‘hazy’ and ‘cloudy’ products to add further volume through their draught offerings.”

Craft’s driving force

All mapped out

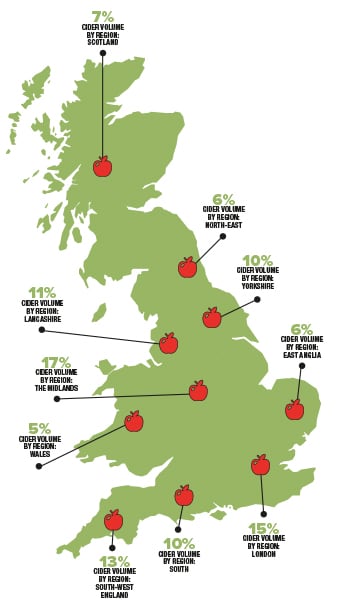

When it comes to cider volume by region, the Midlands consumes the most (17%), followed by London (15%), south-west England (13%), Lancashire (11%), Yorkshire and the south region (which each consume 10%), Scotland (7%), the north-east and East Anglia (each consuming 6%) and Wales (5%).

Source: Westons Cider Report Winter Update

But cloudy isn’t the only trend operators need to look out for as the impact of the craft beer movement has also benefited cider.

Shedden says: “The interest in craft has also been a positive driving force for cider – although imagery becomes important.

“Research has suggested that consumers already see craft in cider and are aware there aren’t orchards under the railway arches of east London.

“Cider can complement a craft beer range; including smaller brands with attractive imagery. This appeals to specific consumption occasions and offers huge growth opportunity.”

In fact, operators outside the pub trade are also seeing this, as general manager of Bristol Cider Shop, Sebastian Langkamer highlights.

He says: “At the moment, more and more people are moving away from the commercial side of things.

“People are starting to go back to the beginning of cider again. Back to the proper, flat, still, traditional method cider, which seemed to have been forgotten about for the past 20 to 30 years.”

“The craft beer movement is helping drinkers get more interested in the process of how things are made and they are caring about what goes into their alcohol.

“You can walk into a craft beer pub and hear young people talking about hops. That is brilliant. People are talking about the method, process and ingredients that goes into their alcohol as a subject, not just something to get tipsy on.

“If people could start explaining ciders in the same way and getting people excited about how they are made and the different types of apples that are going into them, the different fermentation methods, then more people will get interested in cider as a subject.

“If it is happening with beer, there’s no reason why it can’t happen with cider too.”

While apples keep doctors away, licensees need to pull in the punters by focusing on the three Cs – craft, cloudy and cider.