A ‘contract with the people’ (Brexit Party)

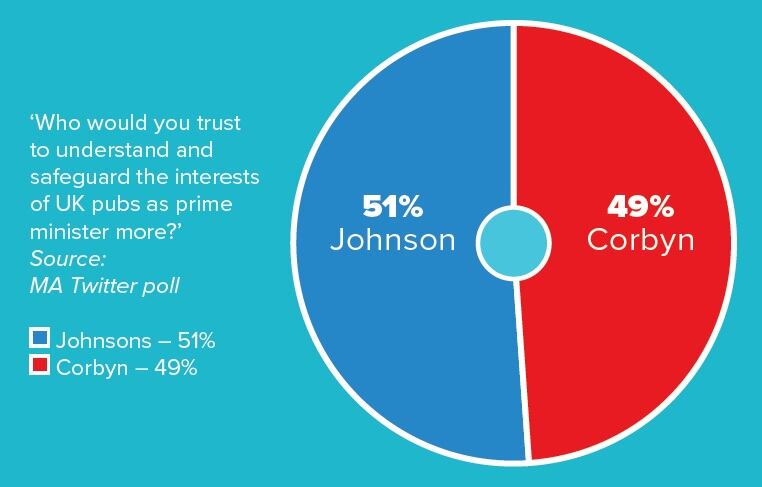

Brexit Party leader Nigel Farage has a long-standing affinity with Britain’s pubs. A survey conducted by YouGov on behalf of the Campaign for Real Ale (CAMRA) in November 2016 found that 17% of publicans would trust Farage to run their pub – second only to Prime Minister Boris Johnson, who polled 22% of the vote.

What’s more, in a survey of The Morning Advertiser’s (MA) readers in the build-up to the 2015 general election, Farage was named as the party leader most would like a drink with as almost half of respondents said they would opt for a pint with the then UKIP frontman ahead of David Cameron (29%) and Ed Miliband (8%).

According to Farage, the Brexit Party’s 22-page policy document for the 2019 general election is not a manifesto but a “contact with the people”.

It promises to raise £200bn – through measures such as scrapping HS2, keeping the annual £13bn EU contribution and redirecting 50% of the foreign aid budget – which it then hopes to invest back into the young, families and the high street.

As part of its investment in the high street, the party has pledged that, alongside reforms to corporation tax, it will replace business rates with a simplified system to assist smaller retailers and leisure operators – including pubs – outside the M25, with reductions funded by an online sales tax.

VAT, business rates and MUP (Green Party)

Former Green Party leader – and vice chair of the All-Party Parliamentary Pub Group – Caroline Lucas has previously thrown her weight behind the pub sector, joining more than 50 MPs pledging their support to the pub sector in September 2017 and backing a campaign for residents of the Hanover area of Brighton to buy and run the Greys as a community pub in spring 2018.

Like the party’s only ever MP Lucas, current co-leader Siân Berry has been on the campaign trail with embattled publicans, working with the Dartmouth Arms in Highgate, north London, to make it an asset of community value in 2015 before joining protests at the HQ of owners Faucet Inn.

According to its 2019 election manifesto If not now, when? – revealed by co-leaders Berry and Jonathan Bartley – the Greens plan to reduce VAT on food and drink served in pubs, bars and restaurants as part of a policy to boost the leisure and cultural sectors and help 125,000 businesses at the heart of their local communities.

What’s more, the party has pledged to abolish council tax and business rates – replacing them with a land value tax that will also absorb national non-domestic rates, stamp duty on land, annual tax on enveloped dwellings, capital gains tax on land sales, inheritance tax on land and income tax on land for owner-occupiers.

However, its manifesto also outlines plans to raise £3bn from increased alcohol duties, prohibit commercial advertising of alcohol – and all other drugs – and introduce minimum unit pricing (MUP) which the party claims has been shown to reduce harmful drinking in Scotland.

Unleashing hospitality’s potential? (Scottish National Party – SNP)

Highlighting that Scotland’s tourism industry contributes around £7bn to GDP and employs more than 200,000 people, the SNP’s manifesto promises to pressure the UK Government to examine a reduction in VAT for the hospitality sector in order to level the playing field with other EU nations and create new jobs.

What’s more, with EU nationals comprising 11% of Scotland’s hospitality workforce, the SNP outlined a commitment to preserving freedom of movement and standing firm against Brexit.

“There are some very positive proposals that would help to unleash hospitality’s potential if implemented,” UKHospitality’s chief executive Kate Nicholls said of the SNP’s Stronger for Scotland manifesto.

“The many references to hospitality in the manifesto pay due respect to the economic and social might of our sector.

“We particularly welcome measures to reduce employers’ national insurance contributions, a policy for which we have long campaigned, which would help to free up investment to create more employment.

“It is also heartening to gain political recognition that a lower VAT rate for hospitality would make economic sense, generating more commercial activity and tax receipts via tourism and hospitality trade. This is another issue on which we have pushed hard.

“The party’s statements about migration policies that focus on best serving the economy and society are also welcome and are a message that we would urge be heeded by whoever forms the next Government.

“Hospitality operators in Scotland will hope that the positive tone and references to our sector are re-elected in SNP policy more widely. A good starting point would be to resist calls for a tourist tax that would kill a golden-egg laying goose that serves Scotland so well.”

Business rates replaced (Liberal Democrat Party)

Liberal Democrat leader Jo Swinson, who became MP for East Dumbartonshire in 2005, was heavily involved in the introduction of pubs code legislation.

A piece by former MA editor Rob Willock in April 2013 stated: “The coalition Government’s plans to regulate the pubco/tenant relationship via statute have had a distinctly Lib Dem flavour to them — driven hard by the yellow-hued axis of Cable, Jo Swinson and Greg Mulholland.”

In 2014, Swinson sparked fury among pubcos while Business, Innovation & Skills minister by penning an open letter, outlining powers of a pubs code adjudicator. Pub-owning businesses responded by expressing fears that measures detailed could give rise to legal challenges and abolish the tie by the back door.

Both Swinson and Cable were praised in April 2015 by then parliamentary Save the Pub Group chair Greg Mulholland for standing up to George Osborne and David Cameron, and insisting on a consultation on the introduction of a statutory code of practice and an adjudicator for the pub sector.

What’s more, Swinson was involved in debating the pubs code bill in parliament and took aim at minimum wage offenders, telling MA “There’s no excuse for companies that don’t pay staff the wages they are entitled to, whether by wilfully breaking the law or making irresponsible mistakes,” while business minister in 2015.

Ahead of the first December election since 1923, Swinson – who became leader of the Liberal Democrats in July 2019 – has pledged that she will review the UK excise duty structure to better support whisky exports, replace business rates in England with a commercial landowner levy based solely on the land value of commercial sites, and introduce MUP for alcohol – like the Green Party, taking note of the impact of the policy in Scotland in its manifesto.

“Any review of UK alcohol taxation must include beer – a lower-strength, British-made product,” Emma McClarkin, chief executive of the British Beer & Pub Association, said in response to the Lib Dems’ manifesto. “Beer tax is a particular burden for pubs because seven out of 10 alcoholic drinks sold in them are beer and we pay 11 times more beer duty than Spain or Germany.

“With three pubs a day closing their doors for good, cutting or freezing beer duty as part of a review of UK alcohol taxation is essential. This would answer the call of the 220,000 people who have signed the Long Live the Local petition calling on the next Chancellor to cut beer duty, supporting local pubs and the communities they serve.

“A complete overhaul of the existing system is required, but at this stage it is not clear if the Liberal Democrats’ commercial landowner levy will directly help pubs.”

ACV and bank holiday pledges (Labour Party)

According to a piece written by MA in September 2015, teetotaller Jeremy Corbyn has, broadly speaking, put his name to parliamentary business that is against large pub companies, and has been a signatory for motions supporting licensees, music in pubs and community pubs in general.

According to TheyWorkForYou.com – Corbyn has always voted in favour of requiring pub companies to offer operators rent only leases – registering three votes in favour between 2013 and 2016.

What’s more, the Labour leader voted consistently in favour of smoking bans between 1999 and 2015 – registering nine votes for, one vote against and two absences – and has, on the 22 occasions on which he’s been required to vote on raising alcoholic drink taxes cast five votes in favour, 13 votes against with four absences.

As revealed on 21 November, Labour’s 105-page manifesto outlined plans to list pubs as assets of community value so community groups could buy local pubs under threat of closing, replace business rates with a land value tax, introduce four new bank holidays celebrating the four patron saints’ days, review the evidence on the effect of minimum unit pricing of alcohol and label alcoholic drinks with “clear health warnings”.

“The Labour party has rightly noted in its manifesto that too many pubs are closing,” McClarkin said of Labour’s manifesto.

“When it comes to community pubs, what is needed is investment and support. It is important that measures to bolster the rights of individual communities to purchase pubs do not act as a disincentive to invest in or operate a pub business.

“A further 109,000 people have also written to their MP calling on them to support pubs by cutting beer tax, showing the strength of feeling on the matter, which the next Government must recognise.

“The current business rates system is hugely unfair on pubs – they pay 2.8% of the business rates bill, despite accounting for just 0.5% of turnover. At this stage it is not clear if Labour’s land value tax will directly help pubs.

“Additional bank holidays will hopefully be a boost for the pub trade and could be done in tandem with extended hours to give further uplift. MUP should be carefully evaluated before a proposal is considered in England. Particularly as it has only been in place in Scotland for just over a year.

“As an industry, we already clearly label our products with health information including alcohol units and ABV, as well as signposting to Drinkaware where the full guidance on low risk drinking can be found.”

‘Steps in the right direction’ (Conservative Party)

Shortly after being appointed Foreign Secretary in 2016, Prime Minister Boris Johnson was voted the politician most trusted to run a pub, with almost a fifth (22%) of those surveyed claiming they would trust him with their business.

Most of the Prime Minister’s recent engagement with the on-trade occurred while he was Mayor of London between May 2008 and May 2016.

He has never been required to vote on demanding pub companies offer rent-only leases in parliament, for example, and has generally voted for higher taxes on alcoholic drinks and pledged to review ‘sin taxes’ such as sugar in his campaign to become leader of the Conservative party.

In a strategic plan, published in March 2015, Johnson pledged to help London’s 33 local authorities to protect valued pubs – representing the first time the role of the capital’s pubs was recognised in the London Plan.

He also backed the ‘agent-of-change’ principle in an attempt to protect London’s live music venues.

Before the release of its manifesto on 24 November, the Conservative party vowed to protect Britain’s ailing towns and communities with a swathe of measures, including slashing business rates for pubs.

Additionally, the Prime Minister said his party would commit to re-assessing alcohol duty in a bid to encourage UK drinks producers’ sales and exports.

According to its manifesto, the Conservatives will cut business rates for small retail businesses including pubs, establish a £150m community ownership fund to help purchase community assets, including pubs and review alcohol duty to ensure the tax system is supporting British drink producers.

“Employment costs, property taxes and skills are key challenges for hospitality if it is to add yet more economic value and employment to the UK,” Nicholls said in response to the Tories’ raft of pledges.

“A fundamental review of business rates is long overdue. A commitment to cut the rates bills is certainly welcome and it is heartening to see pubs and music venues referenced in the context of reliefs – we wait with interest to hear further detail.

“Alongside previously announced National Infrastructure Commission changes to improve take home pay, this manifesto also commits to improving the apprenticeship levy system and wider initiatives and funds for upskilling. It seems that our messages have been heard.

“We also welcome the manifesto’s inclusion of community ownership proposals, including for pubs, but the focus must primarily be to create an operating environment that bypasses the need for bail outs for hospitality venues.

“These are all steps in the right direction but there is much more still to be done to empower hospitality yet further as an economic driver of prosperity, jobs and growth.”