RedCat to snap up 40 Stonegate pubs

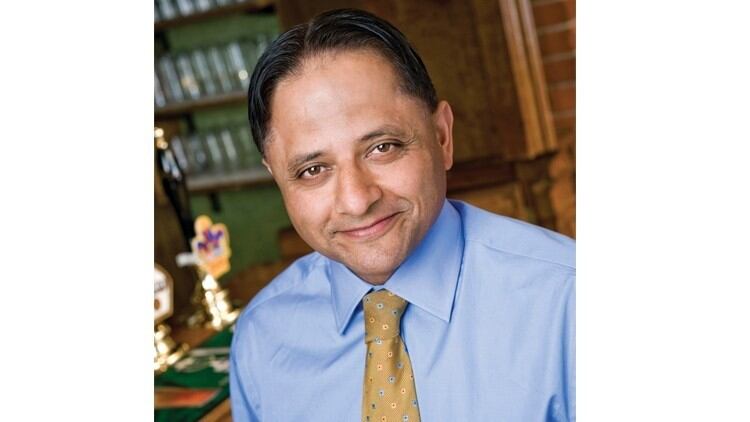

According to reports by Sky News, former Greene King CEO Rooney Anand is poised to buy 40 pubs from Stonegate as part of a first acquisition for his new investment vehicle, RedCat Pub Company.

It’s been reported that the acquisition could complete this week and is awaiting the approval of the Competition and Markets Authority (CMA).

As a solution to previous competition concerns, Stonegate agreed with the regulator that it would offload 42 sites as a condition of its takeover of Ei Group last year.

Former New World Trading Company CEO Chris Hill is heading up RedCat Pub Company while Sharon Badelek, formerly of Novus Leisure, has joined as chief financial officer.

The company is backed by £200m investment from US investment fund Oaktree Capital and is looking to acquire retail and tenanted pubs predominately focused on the east, south east and south of England.

The Inn Collection Group portfolio hits 20 sites

Northern pub operator the Inn Collection Group has grown its portfolio to 20 sites with the acquisition of waterfront Lake District venue the Wateredge Inn at Ambleside, Cumbria.

The undisclosed deal for the 38-bedroom venue was finalised on 24 March, with the Wateredge Inn becoming the Group’s third venue in Ambleside and seventh Lake District site.

The landmark venue, which has frontage on to Lake Windermere – the largest natural lake in England – is set in over an acre of private grounds and has direct lake access, a private jetty and large outdoor seating area.

“The Wateredge Inn is a magnificent addition to our portfolio,” managing director Sean Donkin said. “We are excited to have brought this extraordinary venue into our collection as our group continues to earn its stripes for its outstanding pubs with rooms in the very best locations across the north of England.

“In the most challenging of times for the hospitality sector, it’s a real boost to have good news like this to share as the trade looks ahead to reopening in line with lockdown restrictions easing and we prepare for a predicted staycation boom fuelled by Covid uncertainties about overseas travel and Brexit.

“Our priority is identifying and sourcing remarkable venues with their own USPs,” he continued. “With its lakeside setting and close proximity to Ambleside, the Wateredge Inn is matchless and will be a stunning new addition to our eat, drink, sleep and explore collection.”

The Wateredge Inn will reopen in line with the planned lifting of lockdown restrictions for indoor hospitality venues on 17 May.

Brighton Pier Group scales back bar operation

As reported by The Morning Advertiser’s (MA) sister title MCA Insight, Brighton Pier Group has permanently shuttered three venues.

Smash in Wimbledon and PoNaNa in Bath were both disposed of while a lease for Fez in Cambridge was not renewed in December.

The Luke Johnson-chaired group now has nine bars, having at one stage operated 25.

In half year results to December 2020, Brighton Pier Group reported bars division revenue hit £700,000, just 11% of the prior period (2019: £6.6m).

However, the operator also reported a profit after highlighted items and before tax up 44% at £2.7m, benefiting from the income from business interruption insurance, summer trading, and Government support measures.

“We look forward to the reopening of all of our businesses, following what has been a traumatic time for the whole industry,” Anne Ackord, chief executive, said.

“We are encouraged by our performance during the relatively short times when we have been permitted to operate and have full confidence that the group is well placed to take advantage of the opportunities that the anticipated staycation boom will present, along with the expected pent-up retail spend.

“We are pleased to note that the combination of the strong summer trading in the Pier and Golf coupled with the receipt of interim business interruption payments have resulted in earnings before tax 44% ahead of the same period last year.”

Total group revenue for the same six-month period was down 53% at £8.2m having hit £17.3m in 2019.

Oakman expands to 34 sites with Woburn Hotel lease

The Oakman Group has acquired the Woburn Hotel in Bedfordshire after signing a 25-year lease with the Bedford Estates.

The 18th-century property boasts 48 luxury bedrooms and seven individual cottages within its grounds, as well as three conference and events spaces, a restaurant and a large bar.

The venue becomes the 34th and largest property in the Oakman Group portfolio, giving them a total of 225 bedrooms across the 13 venues featuring accommodation.

The hotel closed last year due to the impact of Government restrictions with Oakman now hoping to reopen the site on 17 May when indoor dining is permitted under the Government’s proposed hospitality roadmap.

“Following our acquisition of the Seafood Pub Company, this represents another major step in delivering our vision for the business,” Dermot King, chief executive officer of the Oakman Group, said.

“The Woburn Hotel represents a significant addition to our existing portfolio which contains many historical coaching inns and remarkable buildings. The Woburn Hotel’s history and strategic position in Bedfordshire make it a superb venue for both the leisure and business traveller.

“We now have 225 bedrooms across the Oakman Group and we will be looking to further grow our capacity,” King continued. “We are developing our ability to provide compelling ‘stay-cation’ packages as well as ensuring we meet the needs of business travellers.”

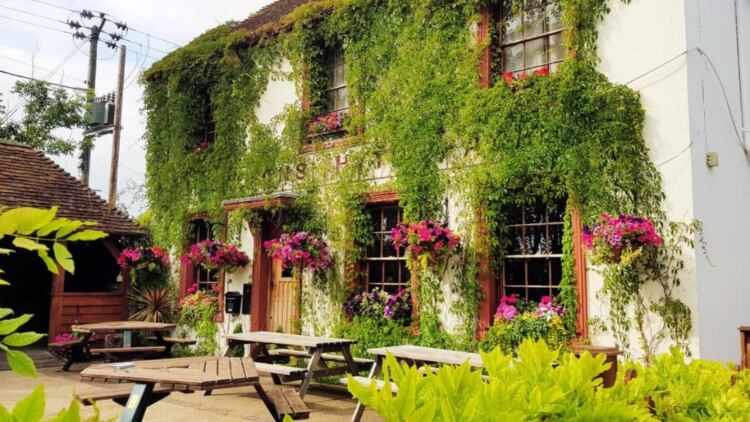

Historic west London pub to reopen under independent ownership

According to reports by The MA’s sister title BigHospitality, former Youngs pub the Surprise in Chelsea will be independently run by hotelier and restauranteur Jack Greenall.

Built in the 1800s and named after a Napoleonic warship captured and redeployed by the British, the London pub will reopen on 17 May following a complete refurbishment, pending the lifting of lockdown restrictions on indoor hospitality.

Pedro Costa, formerly head chef of Rabbit in Chelsea, will oversee the kitchen at The Surprise; while Andres Cabrera, previously of The Harwood Arms, will serve as general manager.

Greenall, who also owns the Pheasant Inn in Berkshire – placed 38th on the most recent Top50 Gastropubs list – hopes the pub will build a reputation for 'exceptional seasonal dishes, world class wines and spirits', according to BigHospitality.

"I hope The Surprise will play its tiny part in revitalising London hospitality post-Covid," he said.

"It’s vital that we get our vibrant pubs, restaurant, bars and hotels open and back at the centre of our lives. They play such an important role in society- from simply unwinding, first dates, celebrations, proposals and more.”

Marquis Hotel Group expands pub portfolio

Commercial finance specialist, Christie Finance has supported the Marquis Hotel Group purchase the shares of Innfair Limited, a company that owns the Tiger Inn in Stowting, Kent.

Owned by Darrell Healey, the Marquis Hotel Group was formed to create hospitality brand, Contemporary Pubs Limited, to be owned and run by his daughter Nadine and her husband Will Sheldon.

In June 2018, the pair purchased and refurbished the Marquis of Granby, and are now looking to do the same at the Tiger Inn.

Contemporary Pubs aim to reopen for business during Summer 2021 following a full refurbishment.

Chef Adam Handling to launch Windsor eco pub

As reported by BigHospitality, the chef behind the Frog in Covent Garden, Adam Handling, is to open a sustainability-focused pub restaurant with rooms in Old Windsor, Berkshire, on 17 May.

The Loch & the Tyne will be led by former Adam Handling Restaurants group executive chef Steven Kerr and former Adam Handling Chelsea head chef Jonny McNeil.

The new site will be Handling’s first venture outside the capital but not his first eco focused venue, as the Ugly Butterfly in Chelsea, which closed last year due to the pandemic, boasted a menu based on 'waste products' from his high end portfolio.

"Steven and Jonny have both worked for me for over 10 years and it’s great to be able to give them their opportunity to really shine," Handling explained.

"I first met Steven in Newcastle in 2008 and Jonny in St. Andrews in 2010. There we have it, the Loch & the Tyne is born.”

The vision for the Loch & the Tyne is “ultra British luxury” coupled with being “one of the most sustainable pubs in the UK” with features including an eco-beer garden, vegetable garden, an orchard and an area for composting biodegradable waste.

“The water used in all of our sinks will be recycled as toilet water, minimising water waste and solar panels, installed on the roof, will reduce our electricity consumption,” Handling adds.

“I’ve always dreamed of having a pub as part of the group and so have Steven and Jonny. They aren’t just my team, they’re my best friends and have helped me to build my restaurant group."

"I’ll be visiting them every Sunday for a roast and a pint.”

JDW to invest £895m into new pubs and upgrades over the next decade

JD Wetherspoon has earmarked an initial £145m for 18 new pubs and 57 extensions and upgrades to its existing 871 houses as well as a more long-term £750m investment project.

Once the planned 75 projects are completed, the operator plans to open 15 new pubs and expand 50 existing ones each year for 10 years.

“Our immediate investment will provide work for architects, contractors and builders as well as result in 2,000 new jobs for staff in our pubs,” JDW founder and chairman Tim Martin said.

“We are geared up to start on the first projects within a few months.

“We are also committed to our long-term investment and job creation programme over the next decade.

“However, the investment is conditional on the UK opening back up again on a long-term basis, with no further lockdowns or the constant changing of rules.”

- To find out more about pubs for sale, lease and tenancy visit our property site