Total revenue for the business is up 19% when including the business’s German side, which includes rises of 23% and 12% in accommodation and food & beverage divisions respectively, in the 13 weeks to 1 June 2023.

Meanwhile like-for-like growth versus Q1 FY23 has gone up by 14% for its UK business and 15% in total.

UK food & beverage sales reached £193.7m – 10% ahead v FY23 – having benefited from several commercial initiatives put in place during the second half of FY23.

Remain confident

On the future outlook, the company, which operates Premier Inn, said: “With strong trading momentum across the group, we remain confident in the full year outlook.

“Forward booked revenue in the UK is well ahead of last year and in Germany we remain on course and expect to reach break-even on a run-rate basis during calendar year 2024.”

The group has extended its existing £775m revolving credit facility, which remains undrawn, for a further 12 months to May 2028.

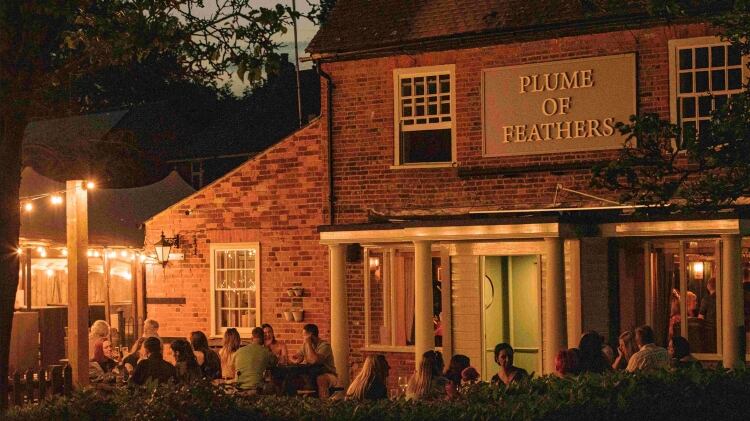

The company stated: “In food and beverage, the encouraging start to the quarter has continued and total sales were up 10% versus last year.

“While trading at the value end of the pub-restaurant market remains challenging, we have been pleased with the positive impact of a number of commercial initiatives introduced in FY23.

“We are continuing to explore a variety of options to optimise our food and beverage offer while maintaining a quality experience for our Premier Inn guests.”

Impressive revenue growth

Whitbread chief executive Dominic Paul said: “In the UK, our market-leading brand and value-led customer proposition is continuing to deliver impressive revenue growth and a healthy RevPAR (revenue generated per room regardless of if rooms are occupied or not) premium versus the wider meetings & events market.

“The structural reduction in hotel supply, coupled with strong consumer demand, is highlighting the strengths of our differentiated business model, as evidenced by our continued strong performance. Our forward booked position into Q2 underpins our confidence in being able to deliver a strong first half result.

“Our business is in great shape and trading well. Given the lack of branded supply growth and permanent decline in the independent sector, I am confident that our business model will continue to deliver as we strengthen Premier Inn’s position in the UK, unlock our potential in Germany and maximise long-term returns for our shareholders.”