Quick links

The data has once again been compiled by insights expert CGA by NIQ and covers sales in terms of volume and value in the past 12 months up to 7 October 2023.

Last year’s Drinks List 2023 showed a huge bounce back after the previous year or two had been destroyed by the pandemic.

The way the Drinks List: Top Brands to Stock in 2024 works is individual variants in each drink category are ranked from best-performing to 10th best-performing when it comes to volume and value sales throughout the year from October 2022 to 7 October 2023.

The data for RTDs was not finalised at the time of publication and will be covered in the new year.

Many brands remain the same but not necessarily in the same positions and surprisingly, only one brand in a single division has given up its crown as leader from last year.

To match last year’s positive uplifts in volume and value sales in every single position in every category, bar one, would be pretty much impossible so while some have seen rises, an equal number have seen falls.

• All data provided by CGA for the 12 months to 7 October 2023

Liqueurs & specialities

Jagermeister has again retained the number one brand for the liqueurs and specialities category.

Volume sales for the brand were down 41.3% while value also dropped by 39%.

Baileys also kept its number two spot and saw a rise in sales of 8.2% in volume and up 13% in value.

However, last year’s fourth place – Aperol – came in at third for 2024 with sales up for both volume and value. There was an 18.5% uplift in volume and 27.7% in value for the brand.

A new entry at number 10 was Tequila Rose. This brand saw the biggest sales rise in the top 10 with volume up by three quarters (75.3%) and value a similar percentage (81.1%).

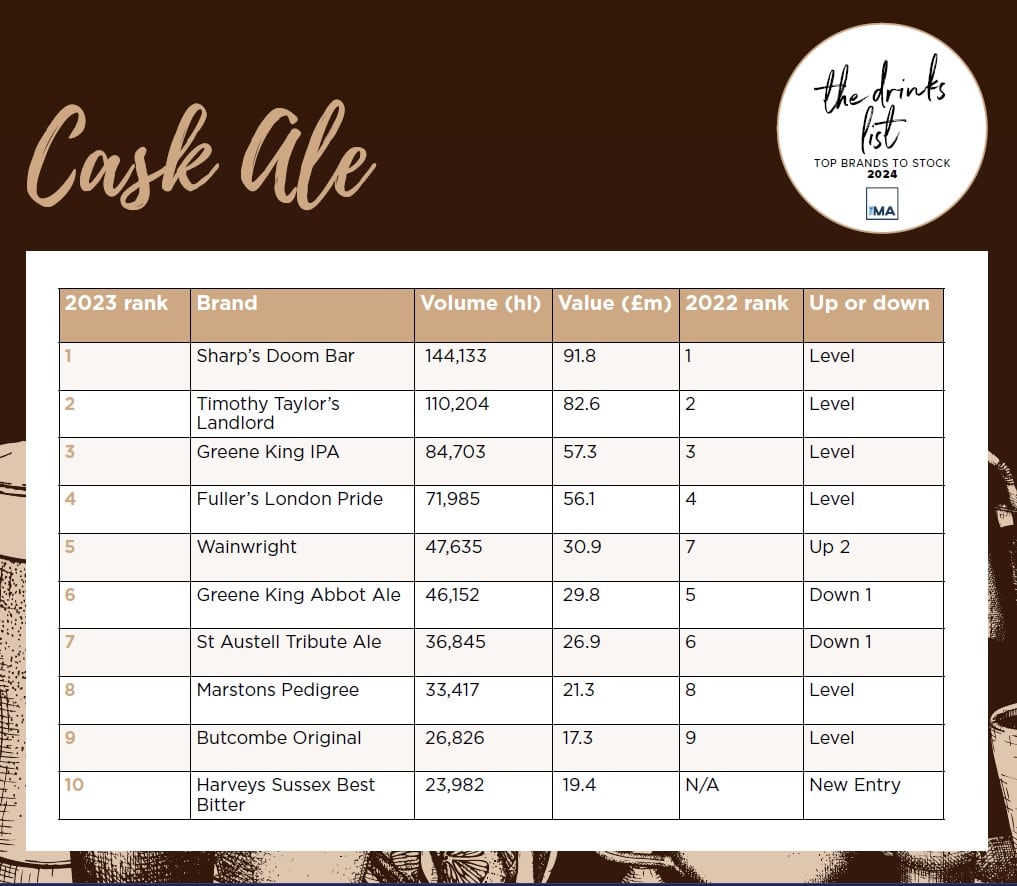

Cask ale

PROMOTIONAL CONTENT

Butcombe Brewing Co.

Bristol born and made to stand out, Butcombe Brewing Co. began life in 1978 at a time of cultural, social and political change, crafting beer before ‘craft beer’ was even a thing.

Our flagship cask beer ‘Original’ that started the brewery, continues to go from strength to strength. It is now a top 10 national cask beer and second-fastest selling in the south-west, rapidly closing in on the top spot.

Brewed to a secret recipe using the finest ingredients for over 45 years, our Amber Ale Original has a distinctive bitter, clean and refreshing flavour with moreish appeal.

With an impressive ROS that is growing ahead of the market and its competitors, Original has an attractive price point, loyal fan base, is easy to cellar and serve and is steeped in quality and consistency.

Available in cask as well as keg and packaged formats it’s a ‘must-stock’ on any discerning bar.

Email orders@butcome.com or call 01934 863963 to stock.

Cask ale always seems to be in a position of having to defend itself as people believe sales have fallen hugely.

However, half of the top 10 in this category have seen volume sales rise while value sales have risen for six in this list.

Doom Bar once again topped the in both volume and value sales while Timothy Taylor’s Landlord remained second with Green King IPA sticking in third spot from last year.

However, Doom Bar saw a fall in volume and value sales, recording an 11.7% and 9.2% fall respectively.

Greene King IPA also dropped 7.8% and 4.6% respectively.

Timothy Taylor’s Landlord closed the gap on Doom bar as volume sales rose 6.4% from last year and value climbed an impressive 11.1%.

The changes from last year included Wainwright rising to fifth from 10th to knock Abbot Ale down one spot while St Austell Tribute Ale also fell a place.

Butcombe Original and Harveys Best Bitter were new entries in at nine and 10 to depose St Austell Proper Job and Wadworth 6X from the top 10.

Read more here.

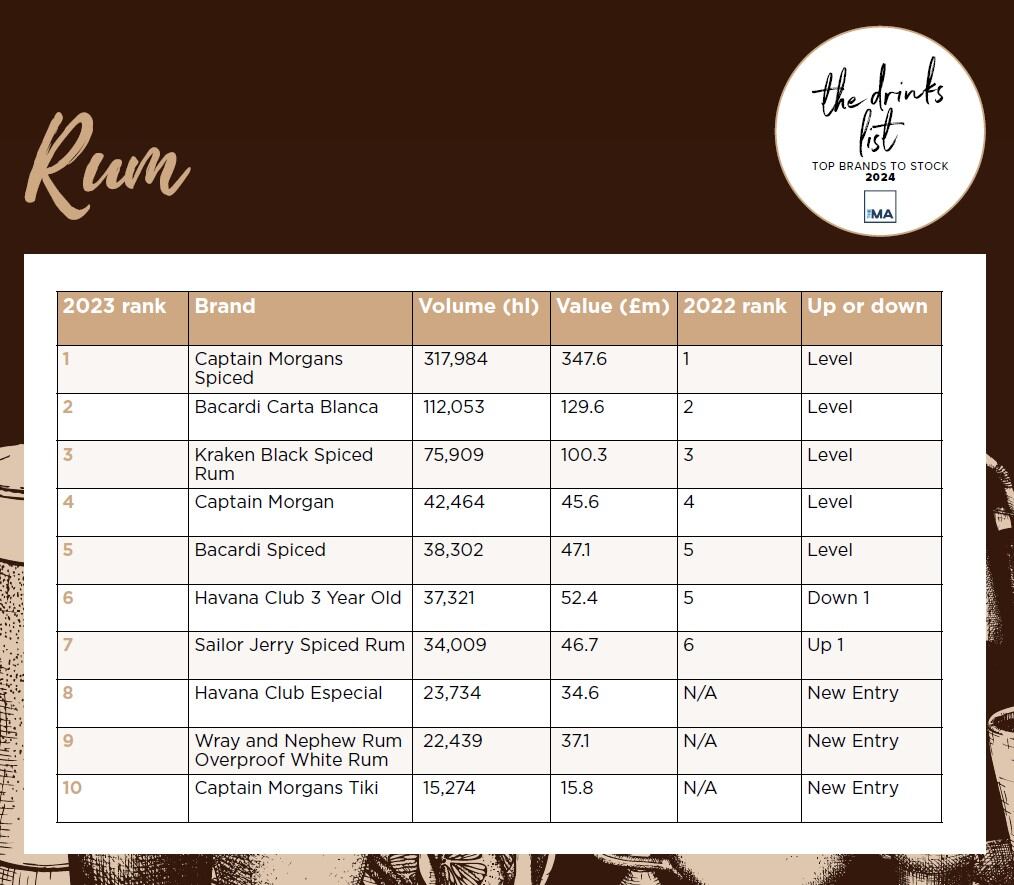

Rum

It’s been a mixed bag for the rum category this year, with one half of products in the top ten seeing volume sales rise, with the other half seeing them fall.

The top four rums have retained their positions from last year’s Drinks List. Captain Morgans Spiced holds onto the no.1 spot, despite seeing volumes sales fall by 13.4% from 367,369 9lcs last year to 317,984 9lcs this year, and value drop by 10.7% to £347.6m.

It’s been a strong year for Bacardi Spiced, which displaces Havana Club 3 Year Old from fifth place, with a staggering 64.3% hike in volume sales from 23,311 9lcs to 38,302 9lcs this year. Its value has also soared by 81.7% from £25.9m to £47.1m.

Captain Morgans Tiki also has a lot to celebrate this year. A newcomer in last year’s list, it has stayed steady in the 10th spot, but volume sales have climbed by 31.6% and value has risen by 36.4%.

A newcomer has also been welcomed into the rum list. Wray and Nephew Rum Overproof White Rum joins in ninth place, despite seeing a drop in volume sales of 5.8%. Value, for the spirit, rose by 2.1% from £36.4m last year to £37.1m.

Craft beer

PROMOTIONAL CONTENT

Greene King

Crafted by our brewing apprentices in 2019, Ice Breaker has continued to gain share and popularity with craft drinkers over the past few years.

The unfiltered 4.5% ABV pale ale is refreshing, easy drinking, and bursting with juiciness and fruity hop characters.

This year we’ve also secured several awards for Ice Breaker with the highest star rating, 3 stars, at the Great Taste Awards and Country Winner for Pale Beer at the World Beer Awards.

In summer 2022, we launched a new portfolio of craft beers, Level Head, a session IPA, and Flint Eye, a dry-hopped lager. These beers embody Britain’s eccentric past but are designed for the modern-day drinker.

The premium craft beers offer a delicate balance of flavours and play homage to our brewing heritage, bringing to life historical myths and legends of Bury St Edmunds in a delicious pint.

Visit www.greeneking.co.uk to find out more about our beers.

Craft beer is the only category to see a new leader of the division in this year Drinks List.

Beavertown Neck Oil has swapped silver for gold with long-term title holder Camden Town Hells lager slipping to second spot.

Notably, these two beers along with Marston’s Shipyard American Pale Ale are the only variants to enjoy volume and value sales lifts in the top 10.

Camden Town also secured third spot once again with its Pale Ale with BrewDog Punk IPA, Blue Moon, Marston’s Shipyard and Gamma Ray maintaining their positions from last year.

Brooklyn Lager usurped Greene King Ice Breaker as they switched places in eighth and ninth while Goose Island Midway IPA entered the list at 10th in place of Innis & Gunn Lager.

Spirits

The spirits category has seen a mass-decline in sales over the past year with six out of the 10 brand measured below last year’s levels.

Smirnoff Red retained its title as the best-selling spirit in 2023 despite a 20% decrease in sales of 9 litre-cases and 16.5% drop in value.

The Diageo-owned vodka saw 1,055,294 9 litre-cases sold in the year to October with a value of £1.87m, down from 1,320,014 and £1,421.5m in 2022.

Captain Morgans Spiced also held second spot this year while Gordon’s Pink Gin replaced Jagermeister as the third best-selling spirits brand of the year, while the latter moved down to seventh place with the biggest drop in volume and value on the list.

Jack Daniels and Absolut Blue both moved up two spots this year, from sixth place in 2022 to fourth and from eighth to sixth place respectively.

Baileys slipped one place this year to take the eighth spot on the list, with sales growth of 13% in 2023 compared to 147.9% in 2022.

A new entry for this year, Aperol was the ninth best-selling spirit of 2023 with an 18.5% increase in sales of 9 litre-cases and a 27.7% jump in value, while Bacardi Carta Balanca was the tenth most sold spirit of the year.

Wine

PROMOTIONAL CONTENT

Lanchester Wines

Now, more than ever, consumers want to know the background of the product they’re purchasing, particularly its sustainability credentials.

Serious consideration should be given to the benefits of bulk wine – wine that is shipped in Flexitanks, essentially a 24,000-litre bag in box.

The cost savings for pubs, both monetary and sustainably, are undeniable – a Flexitank containing 24,000 litres will fit in one 20ft container, while the same volume in bottle would require two 40ft containers.

- 1x 20ft container with 13,200 75cl bottles = 9,900 litres of wine

- 1x 20ft container with 1 Flexitank = 24,000 litres of wine

With this comes a significant win on the environmental front – CO2 savings of up to 40%, or around 2kg of CO2 per km travelled.

Lanchester Wines has created a Sustainable Wine Partner Portfolio that shows the commitment from each of our winery partners so our customers can be assured the wine in their glass truly is sustainable.

Visit https://www.lanchesterwines.co.uk/what-we-do/sustainable-wine-business/ for more information.

Jack Rabbit Pinot Grigio has retained top spot as the most sold wine over the past 12 months with a 13.5% rise in value and 7.9% hike in volume in sales on 9-litre cases (9lcs) from 158,649 last year to 117,878 this year.

Fetzer Coldwater Creek Pinot Grigio has also secured its spot in second place for the second year running, and volume and value sales have inched slightly upwards by 0.5% and 3.7% respectively.

Then there’s Vinuva Prosecco in third place, with a 0.8% change in volume sales and 8.6% uplift in value from £20.4m last year to £22.1m this year.

In fact, it booted out Moet & Chandon Brut Imperial, last year’s third placeholder, for the spot. This drink actually saw the biggest plummet in volume sales (down 28.4%) and value sales (down 24.4%). 79,987 9lc were sold this year, a far cry from last year’s 111,643 9lc.

On a more positive note, Jack Rabbit White Zinfandel saw the highest uptick in value and volume sales at 24% and 20.1% respectively, hopping into the chart at ninth place. This means Jack Rabbit products make up half the top ten. We bet they’re leaping for joy.

Cider

PROMOTIONAL CONTENT

Strongbow

STRONGBOW'S BOLD REBRAND CEMENTS CIDER'S PUB PROMINENCE

Earlier this year, Strongbow unveiled a vibrant, modern rebrand - its biggest in a generation. Since the April launch, over 7,000 venues have adopted the new look, helping drive Strongbow's +2% market share growth[1]. As cider becomes the second most popular pub drink[2], Strongbow is primed to lead the charge and boost sales for operators.

Strongbow’s uplifting ‘Take a Bow’ campaign has been instrumental in the brand’s success, making it a popular fixture on the bar with operators. Recently, it toasted unsung hospitality heroes, recognising staff who have gone above-and-beyond for customers, daily.

Between a game-changing rebrand and re-energising the category, Strongbow continues innovating and investing to hold its top spot as the on-trade’s number one cider[3]. Selling over nine million pints monthly[4], Strongbow has certainly earned cheers all around as it caps off 2023 on a high note. To become an on-trade stockist, visit: https://uk.strongbow.com/takeabow

[1] CGA OPMS MAT TY (09.09.23)

[2] CGA Brandtrack August 22, CGA Strategy Value Share MAT TY Dec 22/ Alcovision

[3] CGA OPMS MAT TY (09.09.23)

[4] CGA OPMS MAT TY (09.09.23)

Strongbow has kept its place at the top of best-selling cider chart for yet another year despite a drop in volume and value sales of 6.9% and 3.9% respectively.

Thatchers Gold held second spot and Strongbow Dark Fruit also stayed in third spot.

The new entrant in at fourth place, Inch’s, had an amazing year with a stunning 141.5% volume sales boost and 161.2% lift in value sales.

There was quite a lot of movement in the top 10 with Kopparberg Strawberry & Lime being a new entrant to the list while Magners Original and Carling Black Fruit Cider fell out of the top 10.

Stowford Press, Thatchers Haze, Rekorderlig Strawberry & Lime and Old Mout Berries & Cherries all dropped places.

Aspall Cyder rose from ninth to fourth.

Gin

The gin category has seen two new entrants this year though the top spot on the list has remained the same.

Gordons claimed first and second place, with its Pink Gin variant crowned the best-selling gin of 2023 despite a fall in both volume and value, while its original serve was runner up on this year’s list.

Tanqueray stayed in third place while Beefeater, the only gin brand on the list to see growth this year, moved up one space to be named the fourth best-selling gin of 2023.

Bombay Sapphire slipped on space over the last 12-months down to fifth place following an 11.1% downturn in sales while Hendricks was once again the sixth most sold gin of the year, with 45,531 9 litre-cases sold with a value of £68.7m.

Pernod-owned Beefeater Pink London Dry Gin and Blood Orange Gin serves were the only brands featured in the gin category to see growth on this year’s list, in seventh and eighth place respectively, with the former having seen a 35% rise in value from £28.6m to £38.7m.

Whitley Neill’s Rhubarb and Ginger and Raspberry offerings were the ninth and tenth best-selling gins of the year, both of which were new entrants for 2023.

Lager

PROMOTIONAL CONTENT

Cruzcampo®

PUT CRUZCAMPO® AT THE TOP OF YOUR LIST – IT’S TIME TO SERVE A TASTE OF SEVILLA

Demand for Spanish lagers is soaring with a staggering 73% growth rate. So, it’s little surprise that they contribute one in every five pints sold in the UK on-trade[1]. After numerous requests on social media for Spain’s number one lager[5] to be launched in the UK, Cruzcampo® has taken the on-trade by storm, meeting this increased demand, while offering a great quality, authentic experience at an accessible price point.

More than ever, we’re seeing a greater emphasis on ‘smart spending’ to maximise the return from disposable income, with nearly a third of drinkers reducing alcohol spend[3]. But they are still seeking high-quality brands and experiences[4]. With 119 years of brewing heritage, Cruzcampo® helps operators create these experiences, and is already delivering the most money in the till versus its competitive set, at £577 per week[7]. Find out more about Cruzcampo® here – we’ll see you on the drinks list next year!

[1] CGA OPMS MAT TY (09.09.23)

[2] CGA Brandtrack August 22, CGA Strategy Value Share MAT TY Dec 22/ Alcovision

[3] CGA OPMS MAT TY (09.09.23)

[4] CGA OPMS MAT TY (09.09.23)

[5] Nielsen Spain FY data 2022

Carling remains top of lager list but volume and value sales took respective losses of 9.6% and 7.5%.

Birra Moretti climbed above Foster’s to round out the top three.

Peroni Nastro Azzuri held fourth place and Coors kept fifth while Madri Exceptional was a new entry at six, taking the category by storm with lifts of 1255 and 138.1% in volume and value sales.

San Miguel rose to seventh from eighth while Stella Artois dropped to eighth from sixth.

Carlsberg Pilsner also fell two places to ninth and Tennents Lager held 10th place while being one of only four lagers to see sales lift.

Mixers

The mixer category has seen value and volume sales plummet across the board, but there are a few silver linings. The first is Fever Tree Tonic Water, which retains its crown in top spot, with a 1.7% increase in volume sales from 105,991 HL last year to 107,915 HL this year, and a 4.1% value change from £115.8m to £120.6m.

In fact, nine of the mixers have stubbornly kept their spots from last year’s list. Then it’s mixed up a bit, with Fever Tree Ginger Ale, a newcomer with the highest rise in volume sales and value at 15.9% and 18.2% respectively, coming into ninth place.

But other mixers have seen downturns in sales. Notably, Britvic Tonic Water has been hardest hit, with a 20.1% drop in volume sales from 22,032 HL to 17,603 HL and 17.3% fall in value from £19.7m to £16.3m.

Fever Tree, Schweppes and Britvic dominate the mixers category, with Canada Dry being the only outlier in the top 10 that doesn’t hail from these companies.

No and low-alcohol beer

Once again, this year’s top selling low and no-alcohol beer is Heineken 0.0. The brand reported rises in both volume and value sales of 19.6% and 24.4% respectively.

But Peroni Nastro Azzurro 0.0 has knocked Becks LA Alcohol Free (Blue) into third place. The brand has rocketed from seventh to second spot, with a 396.7% uptick in volume sales and 426.3% hike in value from £2.7m last year to £14.4m this year.

Lucky Saint has risen from eighth place to fourth this year, and San Miguel 0%, rounds off the top half of the list in fifth place (down one from last year).

But the highest increases are from Guinness Draught 0.0, another new face in the list at eighth place. The brand has seen eyewatering hikes of 8526.9% in volume sales from 34 HL to 2,950 HL, in addition to an 8399.4% rise in value from £0 to £2.5m, with the product only launching for the on-trade at the end of 2022.

Soft drinks

Of this year’s top 10 soft drinks brands, seven have remained in the same place including the top four.

Coca-Cola kept the number one slot with a rise in volume sales (7.8%) and value (12.2%) against the previous period.

Sales for second place Diet Coke revealed a marginal slip in terms of volume (0.4%) and a rise in value (4.3%).

Pepsi Max was in third with a 5.9% increase for volume while value sales were up by 10.9% for the brand.

Schweppes Lemonade (four), Coke Zero (seven), Diet Pepsi (eight) and Schweppes Lime Cordial (nine) all remained in the same spots as before while R Whites fell one and Pepsi rose one.

However, number 10 was a new entry for this year. J20 Orange & Passionfruit saw a slight decline in volume sales of 3.1% while volume was up a little (0.5%).

Tequila

The top four have remained unchanged since last year with Jose Cuervo Especial Gold and Silver at numbers one and two.

When looking at the sales figures, Gold saw a drop of more than a quarter (27.4%) and a similar proportion in value (26.1.%).

However, Silver saw sales up by 17% in volume and an 18.5% rise in value.

Third place remained with Olmeca Blanco, which the figures showed a slip in volume sales of 24.2% and 22% in value.

Its sister brand Olmeca Resposado came in at number four and saw a drop in sales – down 17.1% in volume and 13.9% in value.

A new entry to the top 10 was Sierra Tequila Silver, coming in at number 10, however sales were down 8.2% in terms of volume sales and value saw a drop of 6.8% against the previous period.

Vodka

The top three best-selling vodkas in the on-trade remained unchanged throughout 2023.

Smirnoff Red, Absolut Blue and Ketel One took the first, second and third spots on the list respectively, though Absolute Blue was the only brand of the three to see an increase in volume and value while Smirnoff Red saw the biggest decline on the list.

Grey Goose moved up one spot to be crowned the fourth best-selling vodka of the year with a 15.9% rise in sales of 9 litre-cases and a 19% upswing in value, while Absolute Vanilla slipped one place to fifth this year.

Smirnoff also took sixth spot on the list with its Raspberry Crush variant, which saw a 107.5% increase in sales of 9 litre-cases, 15,337 in 2022 to 31,817, and a 118.7% hike in value, from £18m last year to £39.4m.

The biggest uptick in volume and value in seventh place was Halewood-owned JJ Whitley Artisanal Vodka, up 238.4% and 295.4% respectively.

Chekov Imperial and Glens vodka took eight and ninth place respectively while Ciroc was named the tenth best-selling vodka of 2023.

Whiskies

Jack Daniels retained the top spot in the whiskies category for 2024, despite a drop in sales.

Volume sales were down by 5.7% compared to the previous year and value saw a decline of 1.8%.

Last year’s fourth place Jameson has climbed the ranks to second in the latest data and was one of four brands to see a rise in volume sales (up 5.1%). Value sales also saw a rise of 9.4%.

Famous Grouse slipped one place to third this time with a drop of almost a quarter (24.6%) in volume sales and a similar percentage decrease (21.9%) in value.

Outside of the top three, Whyte & Mackay was in sixth place (up from seventh) but also saw the largest increase in both volume and value sales – up 45.4% and 62.9% respectively.