Baileys Chocolat Luxe

Diageo

This September, the drinks giant invested £5.5m in a TV advertising and sampling campaign to support the launch of Baileys Chocolat Luxe, the new premium sub-brand for its cream liqueur Baileys. The luxury liqueur uses real Belgian chocolate blended with Irish whiskey. It has been invented to encourage consumers to trade up from Baileys Original, as well as attract more women to the brand.

Buddy’s Bourbon Flavored Beer

Global Brands

Hooch and VK maker Global Brands increased its presence in the burgeoning spirit-beer sector with the launch of Buddy’s Bourbon Flavored Beer in March. The 5.1% ABV spirit-beer mixed with honey, sugar and Bourbon flavours is brewed under licence from Buddy’s Brewhouse in the USA and is designed to appeal to 18 to 24-year-old men. The launch was supported by Prohibition-style PoS.

Carling British Cider

Molson Coors

This new Carling product was launched in the off-trade in March this year and its on-trade unveiling this autumn has been supported by a £4.5m marketing campaign, which includes a range of TV, outdoor and digital advertising activity. The cider was made available on draught in Punch Taverns pubs and bars, with plans to roll out the brand to the rest of the trade in the new year.

Carlsberg Citrus

Carlsberg Group

Launched in February, this new low-alcohol flavoured lager marked the first new beer under the Carlsberg brand for a number of years. The blend of lager and Persian and Key limes was developed by the brewer in response to consumer trends and in direct competition to brands such as Carling Zest and Foster’s Radler. The launch was supported by a new marketing campaign, including TV and print advertising and extensive sampling.

Cuvana and Dead Crow

SHS Drinks

At the start of 2013, WKD owner SHS Drinks launched two spirit-flavoured beers aimed at 18 to 25-year-olds. Cuvana, a light beer with rum and a hint of lime, takes its cues from Latin American and Cuban culture, while Bourbon-flavoured premium beer Dead Crow is inspired by Kentucky and the unusual town names of the Wild West. Both are 5.5% ABV, packaged in 330ml bottles, and retail at c.£3.50.

Foster’s Radler

Heineken

Radler-style beers — a blend of beer and lemon — are said to have been invented in the 1920s by German cyclists seeking a refreshing beer to enjoy after a bike ride. This provenance, and the recent successes enjoyed by the lower-alcohol lager category in Europe, led to the development of Foster’s Radler — a 2% ABV mix of Foster’s and cloudy lemon juice. The new beer launched in March with a £4m poster, print and sampling campaign.

Frontier Craft Lager

Fuller’s

This summer, Fuller’s launched its first lager, which also became the brewer’s first beer in keg for the UK market. The 4.5% ABV beer aims to bring new drinkers to the brand as well as tap into the growth of craft beer around the world by describing itself as a new-wave craft lager. Frontier is sold at a premium to other lagers and ales, as it is quite costly to make.

Gordon’s Crisp Cucumber Gin

Diageo

This blend of Gordon’s Original London Dry Gin with natural cucumber flavouring, designed to be mixed with tonic water, was launched by Diageo in March supported by a £1m marketing campaign. The launch was a way for the brand not only to capitalise on the growing consumer trend for gin and flavoured spirits but also attract new younger gin drinkers by showing how versatile gin can be.

Hornsby’s Cider

C&C Group

This new US-style cider was launched into the on-trade in August in two flavours: Crisp Apple (4.5% ABV); and Crisp Pear with Strawberry & Lime (4% ABV). Hornsby’s has a soft carbonation and was made available across hundreds of bars throughout the UK. Introduced into the trade by Tennent Caledonian (owned by C&C Group), it was supported by in-bar activity and sampling, PoS materials and staff incentives.

Manchester Pale Ale

JW Lees

Manchester Pale Ale was launched in April to do for JW Lees what London Pride has done for Fuller’s. The beer, made using Liberty and Mount Hood hops, is available in both bottle (4.1% ABV) and cask (3.7% ABV). To promote the launch, the brewer organised for Parka-clad ballet dancers to emerge from crowds in central London and entertain spectators with a Britpop-style dance.

Manzana Loca

Hi-Spirits

This Tequila-cider mix was the first of the two spirit ciders listed here to hit the market, a mere week before Brothers launched its Perro Loco brand. It is hoped that the innovation will help shift cider drinking later into the evening and was the “logical next step” given the success of the spirit beer, or ‘speer’, category, which is now worth more than £81m, according to figures from Hi-Spirits. The brand is the first foray into cider for the company, which says the drink is “less sweet than most flavoured ciders and more refreshing than spirit beers”.

McEwan’s Red

Wells & Young’s

Launched in May, this beer was created to rejuvenate the McEwan’s brand by drawing in new drinkers, as well as keeping existing fans interested with a new brew. The 3.6% ABV chestnut beer is aimed at 30 to 50-year-old drinkers who want a “sessionable” ale and was backed by a marketing campaign focusing on “football final” weekend at the end of May. Wells & Young’s acquired McEwan’s and fellow Scottish brand Younger’s from Heineken back in 2011 and the brewer has signalled its continued support for both by recently employing a brand new Edinburgh-based team.

Oddka

Pernod Ricard

With flavours including Fresh Cut Grass and Electricity, the low-alcohol (all 20% ABV, except Electricity at 30% ABV) vodka range was launched in August, following a successful rollout in the US last year. Five flavours of the nine available have been launched in the UK market — Salty Caramel Popcorn, Twisted Melon and Peach Bellini, alongside the aforementioned two — all aimed at the prized 18 to 24-year-old market and the shot category. In the on-trade, the company is leading with a serve called the Lightning Bolt, a shot of the Electricity flavour, swiftly followed by a mouthful of popping candy.

Pardál

Budweiser Budvar

At 3.8% ABV the Czech brewery said this new beer met “the emerging requirement of a lot of drinkers for a quaffable session beer with the added plus of coming from the celebrated Budvar stable”. It was launched in the Czech Republic four years ago and accounts for 18% of the brewery’s domestic sales. In the UK it is hoped the brew will draw new drinkers into the brand, and offer existing fans another top-quality lager.

Perro Loco

Brothers Cider

In a bid to offer drinkers “more than just another flavoured cider” Brothers launched its Tequila-cider offering in October, days after Hi-Spirits launched its spirit cider, Manzana Loca (see far left). It is aimed at 18 to 35-year-olds and is made with cider, Tequila, lemon and agave nectar.

The launch of spirit-infused ciders will help boost the booming cider sector, by tapping into the rival ‘speers’ (spirit beers) category. Some predict this could be a £400m segment by 2016.

Revisionist Craft Lager

Marston’s

This new beer was designed to tap into the growth in craft beer and to put a British twist on the New World styles found in the craft-beer sector — a sector that can command an average 33p per pint more than premium lager. It is the brewer’s first keg lager in more than 30 years, a permanent addition to the Marston’s range and the first under the new Revisionist brand. The brewer says the move, which came in June, builds on what it is already doing with cask. It is not the only cask brewer to notice the opportunity — rival Fuller’s launched its first lager, Frontier, the same month. Early indications show this has been a shrewd move by Marston’s.

Smirnoff Gold

Diageo

Backed by a £4.5m marketing budget this cinnamon-infused liqueur was launched in August to “further boost” the flavoured-vodka category, which is growing 2% year-on-year in the on-trade, says CGA Strategy. It also takes Smirnoff into the shot market, an area where the brand has not played before, and capitalises on the boom in liqueurs made with cinnamon and gold flakes, which are up 17%, representing the biggest growth in the liqueurs category, itself up 19% (both CGA).

Somersby

Carlsberg Group

The Danish brewer first unveiled its Somersby brand in July 2012, but it wasn’t until March of this year that the cider made its debut in pubs and bars. Since then the brand has generated impressive growth figures and is now available in more than 8,500 on-trade outlets. No doubt this performance was helped by a £10m spend this year, including an online ad that generated 1.5 million viewings.

It was also voted Brand Launch of 2013 at the Publican’s Choice Awards in September.

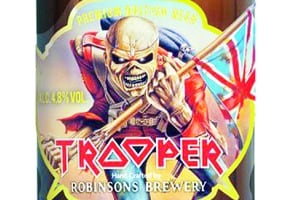

Trooper Ale

Frederic Robinson

The 4.8% ABV cask ale (4.7% ABV in bottles) is a collaboration between Stockport-based brewer Robinsons and Iron Maiden singer Bruce Dickinson (pictured right), and the celebrity connection has certainly proved a winner. Named after one of the band’s most famous songs, and with packaging featuring its mascot Eddie, the ale is undoubtedly Robinsons’ most successful beer to date. It sold more than a million pints in less than eight weeks following its launch in May, and has now reached the 2.5 million pints mark in just six months. The brew has been a significant export success for the brewery, which sends it as far as Canada and Brazil.

Zeo

Freedrinks

Originally conceived as a non-alcoholic vodka and reborn as a low-calorie, less-sweet soft drink, Freedrinks — the firm behind Zeo — aims to reinvent softs. Launched in April, the brand is backed by an £8m campaign and Freedrinks says it is well ahead of its target to reach 3,500 on-trade outlets by the end of the year.

Additional content by Robyn Black