In a recent open letter calling on Chancellor Rishi Sunak to “step up” and divert Britain away from a “cliff edge of mass redundancies”, Beds and Bars’ managing director Murray Roberts highlighted the operator of bars and hostels across 13 cities and 9 countries had received more robust job retention support from governments on the continent than it had at home.

“The schemes across continental Europe are sustainable and give comfort to the hundreds of thousands of employees who work in Covid-19 stricken industries,” he wrote.

“The schemes, bar none, are workable and far more beneficial to employees and companies alike, to allow them to see light at the end of this very dark tunnel.”

Roberts contrasted the support issued to staff by the French Government with that offered by Sunak as an example, stating after authorities in France announced a 15-day bar closure on 5 October, teams were sent home on 89% of their usual salary with a 39.7% contribution from the authorities.

Conversely, he explained if the same was to occur in the UK there would be “no alternative” but to made wholesale job cuts as adopting the latest Job Support Scheme would see the Government cover just 14.4% of the operator’s wage bill, with Beds and Bars forced to stump up 68.6% on “zero trade and income”.

Based on 50% hours worked, Roberts also calculated that the Government’s wage contribution was outstripped by schemes in Germany, Spain and the Netherlands (see findings below) where respective Government contributions of 28.9%, 47% and 41.7% keep employer costs below 50% of each employee’s normal salary.

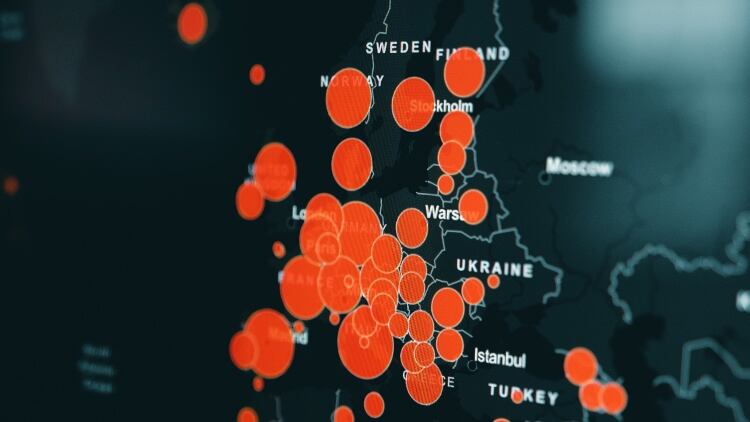

With this in mind, The Morning Advertiser (MA) ran the rule over some of the job retention schemes and broader support packages available to hospitality businesses across Europe to see how they compare to the Government's Jobs Support Scheme and wider relief.

- With pandemic restrictions being imposed on hospitality businesses both across the UK and further afield, The MA has also taken a closer look at how night spots in some of Europe's major cities are being affected by Covid-19's second spike. Who did it best? How other countries are treating pubs during Covid-19 second spike - read more here

France

France’s job retention scheme, Chômage partiel, allows businesses to register employees as “partially unemployed” with the government paying a rate of 70% of the basic gross salary of hours not worked.

According to Roberts, the measure – a constant in France – encourages companies to give hours to staff in the knowledge that they only pay what is worked. What’s more, he adds that after declaring hours monthly, reimbursement is paid within a fortnight.

On top of this, French President Emmanuel Macron met with unions and business owners in June to further adapt state schemes to help businesses through the pandemic, which has brought France to the brink of a recession forecast to be its worst since World War II.

Consequently, the Government extended its "solidarity fund" until the end of 2020 to help small businesses and the self-employed survive the pandemic by providing grants.

Initially, only businesses of 10 employees or fewer and with an annual revenue of at most €1m (approximately £897,500) could qualify for €1,500 (approximately £1,339) grants. However, this has been increased to 20 employees and maximum annual revenue of €2m (approximately £1,795,740) per year.

What’s more, the threshold to qualify for the grant has also been increased from a 50% drop in income to 80%.

Additionally, eligible businesses in sectors that have been particularly damaged by the pandemic such as hospitality can apply for help packages of between €2,000 (approximately £1,787) and €10,000 (approximately £8,959) if they have at least one employee, are unable to pay debt for 30 days, and have been declined a bank loan.

Germany

Germany’s Kurzarbeit furlough scheme, under which workers are sent home and receive an initial 60% of their pay from the Government – 67% for parents – has recently been extended until the end of 2021.

Payments increase to 70% of worker pay after four months and 80% after seven months.

What’s more, Germany’s “Corona-Schutzschild”, or Corona-shield, is the largest aid package in the country’s history.

Angela Merkel’s Government initially created a €600bn (approximately £534.5bn) fund for large companies, a state-backed quick loans programme of up to €500,000 (approx. £449,115) for small and medium-sized enterprises, alongside a €50bn (£44.54bn) grants fund for small businesses, the self-employed and freelancers – none of which need to be repaid.

Companies with up to five employees could get up to €9,000 (approximately £8,066) for three months, while small businesses fewer than 10 employees can claim up to €15,000 (approximately £13,444) over the same period.

In addition to these support programmes, Germany's federal states also have the power to grant bespoke aid packages to businesses.

What’s more, with the food sector identified as being particularly hard hit by Covid-19, it was decided on 23 April that the usual VAT rate of 19%, which applies to meals consumed in restaurants, cafés or bars, would be reduced to 7% from 1 July 2020 until 30 June 2021.

Spain

The EU country hardest stung by the pandemic in both health and economic terms, Spain has plumped for a jobs scheme that has been described as a mid-point between the UK and German equivalents.

Spain’s emergency leave scheme, known as ERTE, was recently extended from the end of September until 31 January.

Under the system, companies suffering losses from the pandemic and resultant lockdown measures can temporarily send home workers or reduce their hours. Spain's government then covers 70% of an employee’s salary for hours not worked while employers pay 15% of social security charges.

The scheme currently covers in the region of 700,000 people compared with 3.5m at its peak.

What’s more, the Spanish Government hopes that its economy will be transformed in the long-term by €140bn (approximately £124.67bn) worth of grants and loans from the EU’s coronavirus recovery fund.

Norway

Norway’s Government introduced a support programme for businesses whose revenue dropped significantly amid Covid-19’s economic downturn.

Businesses whose turnover has fallen by at least 30% per month year-on-year are eligible for financial support, while up to 90% of unavoidable costs incurred by companies closed down by government order are also covered. For businesses whose turnover has merely declined due to infection control measures, this is reduced to 80%.

Support grants are capped at NOK 80m (approximately £6,695,944) a month per business.

While the deadline for applying for compensation covering June, July and August is on 31 October, businesses can still make amendments to already filed applications for March, April and May.

Denmark

When coronavirus hit, Danish hospitality businesses were offered a three-month VAT payment suspension, initial temporary salary compensation for affected employees and the return of excise duties unsold beer.

More recently, Denmark’s Government has agreed to compensate businesses suffering under new measures imposed on hospitality businesses such as a 10pm curfew and mandatory face coverings when not seated.

This includes fixed cost compensation for hospitality businesses which have experienced a loss of revenue of at least 30% or 35% due to the 10pm curfew introduced on 18 September, compensation for small businesses who chose to shut down temporally due to the new measures, compensation for suppliers and DKK 100m (approximately £12,166,600) in economic support for the industry.

The scheme will be in place from 29 August until 31 October with further extension a distinct possibility.

Netherlands

According to the Dutch Government, hospitality businesses have been among the hardest hit by Covid-19 and consequently are being offered monthly compensation in the region of €4,000 (approximately £3,580)

Businesses are eligible if they have suffered a decrease in turnover of more than 30%, were established before 15 March 2020 and registered with Trade Register of the Dutch Chamber of Commerce, have no more than 250 employees and operate within the hospitality, travel, event organisation, food or non-food retail sectors.

The scheme aims to lighten the burden from ongoing expenses such as rent, lease, maintenance and insurance.

What’s more, the Netherlands’ existing small and medium-sized business credit guarantee scheme has been enhanced so it can be used by businesses with less than 250 employees which are struggling to obtain financing.

Under the scheme, the Dutch government provides 75% of required credit with a 90% government guarantee (67.5% of the loan) up to a maximum of €1.5m (approximately £1,347,555)

What’s more, between March and September the Dutch Government agreed to pay a percentage of an employer’s wage bill equal to 90% multiplied by loss of turnover if turnover dropped by 20% or more. For example, if 100% of turnover was lost, the Government footed 90% of the wage bill, or if 50% of turnover was lost it stumped up 45% of wages.

However, following changes made on 1 October, the minimum loss of turnover to be able to claim under this scheme will increase from 20% to 30% from 1 January until 1 July when it expires.

Support over this nine-month period will see reimbursement percentages taper off every three months – from 80% to 70% then finally to 60%.

New Zealand

Not in Europe, we know, but as New Zealand was voted as having the world’s best pandemic response and is the country giving business leaders the most confidence for future investment according to a Bloomberg Media survey, it seemed worth a closer look.

Bloomberg's index scored New Zealand at 238, above second-placed Japan (204) and Taiwan in third (198). Interestingly, the UK and US – despite their high case numbers and fatalities from Covid-19 – were ranked ninth and 10th respectively.

The island nation, which has returned to alert level one – meaning that all businesses can operate, provided they comply with Covid-secure rules – introduced a number of measures to support businesses through the pandemic.

It’s Leave Support Scheme has provided businesses with funds to pay their workers, or sole traders, who needed to take leave due to Covid-19 public health guidance.

What’s more, applications for one-off loans of up to NZD 100,000 (approximately £50,787) for businesses of up to 50 full time employees, including sole traders and the self-employed, impacted by Covid-19 are open until 31 December.

Alongside income relief payments for anyone who lost their job between 1 March and 30 October due to Covid-19, Jacinda Arden’s Government also introduced a business debt hibernation scheme and business finance guarantee programme allowing participating lenders to provide new loans, increased limits to existing loans or revolving credit facilities to eligible businesses with the authorities taking on default risk of up to 80% of the loan.