The South of England and Channel Islands pub operator and brewer completed the combination with Cirrus Inns on 16 December 2022.

In its 12 week trading update, it revealed in the 37 weeks from 15 May 2022 to 28 January 2023, the managed pubs UK lfl estate was up 4.5% at 36 pubs. Drink sales were up 12.2% but food sales were down 2% (not adjusted for VAT).

What’s more, accommodation sales increased by 4.8%, and the Channel Islands lfl estate of 16 pubs rose by 4.5%.

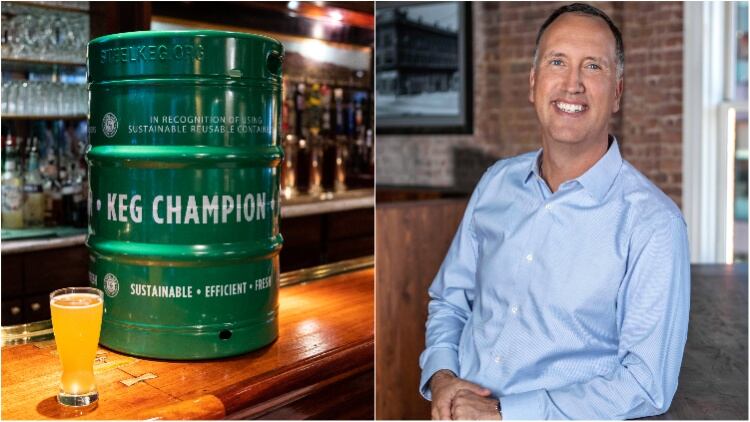

Liberation Group chief executive officer Jonathan Lawson was “delighted” and “impressed” the company had made since Christmas, with the teams working “quickly and effectively”.

For the 52 weeks ending 28 January 2023, the average EBITDA per pub in the tenanted estate was £94.6k versus £90.2k in the year ending January 2020.

UK OBV volumes rose by 21.5% vs FY22, and Butcombe Original is now classed as a top 10 UK cask ale.

Award-winning brands

Lawson continued: “We are now in the position where all 22 of the new Pubs and Inns are fully integrated into our systems, processes and infrastructure and trading under the Butcombe brand.

“We have launched our award-winning food and drinks offerings, which have been really well received by our teams and customers, brand new websites are now in place and customers are now able to take advantage of our fantastic loyalty club.”

In addition, for the first 12 weeks of the new financial year to 22 April compared to FY23, the managed pubs UK lfl estate was up by 4.7%. Drinks sales rose by 4.4%, food by 2.8% (not adjusted for VAT) and accommodation by 13.9%.

The Channel Islands lfl estate dropped by 4.6% during this period due to local trading issues in selected sites. Furthermore, the tenanted EBITDA per pub was flat and UK OBV volumes were up by 8% versus FY23.

Lawson said part of the logic behind the deal was to leverage the benefits of scale the larger group would bring, and the team had already been able to do this across food and drink to the benefit of the entire group in both the UK and Channel Islands.

This included the pubco’s accommodation offering, as it now had more than 400 rooms, versus under 100 in 2020.

Lawson continued: “We are now able to operate at a different level in terms of marketing appeal and our higher room sales has additional and positive impact on our food and drink sales and margin mix."

Cautious optimism

He added: “We have only had to add a small incremental overhead to our business to integrate the new pubs into the larger group, which has enabled us to achieve the targeted overhead savings from the combined business.

“Most importantly, the integration has seen us welcome some fantastic new team members to our team and we have been incredibly encouraged by the quality and calibre of the new chefs, managers and team members applying to join us and play a part in our exciting next stage of growth.”

The chief executive said the outlook for the rest of the year was uncertain due to high inflation rates, rising interest rates and the resulting impact on consumers’ disposable income. But, the company had been “cautiously encouraged” by the start of the year and was confident in the quality of the business, offer and teams.

He added: “All markets and channels offer us the opportunity to grow market share and our work over the last few years places us in a strong position to seize these opportunities.

“Targeted investments have already commenced, and we have a clear pipeline of internal investment opportunities available to us, including additional rooms.”