The survey, which has been conducted by the British Beer & Pub Association (BBPA, the British Institute of Innkeeping (BII), UKHospitality (UKH) and Hospitality Ulster, found Government action business rates was a top priority for 60% of respondents – up 16% from August.

Moreover, the research also highlighted an 18% increase in firms noticing consumers buying drinks when out with more than seven in 10 (72%) reporting the number of drinks purchased having fallen slightly (55%) or significantly (17%).

A joint spokesperson for the trade bodies said the figures laid bare the enormous impact the sector would face if there was no action announced at the Autumn Statement.

Tied hands

They added: “Pubs, restaurants, hotels, coffee shops to name a few will fall victim to a significant business rates bill, if relief expires and rates are hiked with inflation.

“Reducing investment and cutting staffing levels are the last thing venues want to do. In fact, they want to do the opposite but their hands will be tied if rates increase to such an extent in April.

“Businesses are only able to absorb endless cost rises for so long and yet more pressure in the form of business rates will only force them to consider whether this is passed onto consumers.”

The trade bodies urged the Government to listen to the concerns of hospitality firms and help the sector, which is the nation’s third largest employer.

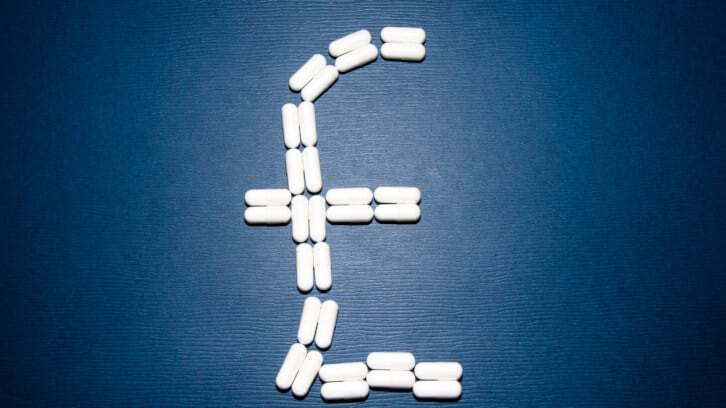

They called for the hospitality sector relief on business rates to be extended as well as a freeze on the multiplier at the Autumn Statement alongside taking steps to reduce the overall tax burden on the sector in relation to rates, VAT and excise duty.

Community hubs

“The businesses are at the heart of communities and high streets across the country, employing millions, generating economic growth and driving investment across our cities, towns and villages,” the spokesperson said.

“Our economy cannot grow if hospitality cannot grow. The Government must act immediately to underpin this growth and ensure our pubs and hospitality venues survive.”

The survey also showed business optimism had nosedived by 10 percentage points since the summer to 29%.

More than half of respondents (55%) said the had not raised menu prices by as much as their own cost increases despite energy bills being 60% higher year on year and record food and drink inflation.

A snap poll by The Morning Advertiser last month (October) revealed 60% of the 95 respondents wanted a VAT cut announced at the Chancellor’s statement while a fifth (21%) felt an extension to business rates relief would be most beneficial.

Further research last month showed just one in two hospitality businesses were making a profit.

Insights from BII members showed two in three respondents reported trading back to normal levels or saw a rise in sales over the past year.