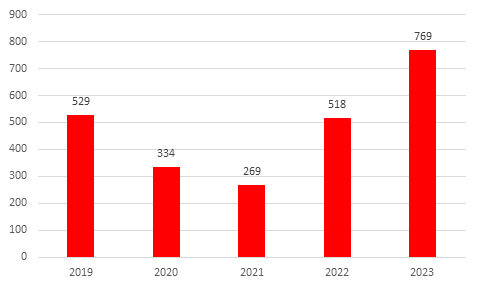

The figures showed liquidations across the sector rocketed by 48% during the 12-month period, with 769 pubs having entered insolvency last year, up from 518 in 2022.

According to the data, obtained by the chartered accountants under the Freedom of Information Act, 2.1 pub businesses went bust per day in 2023 on average, up from 1.4 per day in 2022.

The numbers also showed there were 38,175 pubs in the UK at the end of 2023, down from 41,015 a decade earlier.

In addition, many of the businesses that closed last year consisted of multiple pubs.

Price Bailey further explained “many more pubs” could have been closed by groups which own multiple pubs but did not enter insolvency.

Extra strong pressure

The uptick in closures was attributed to a “convergence of adverse factors” having squeezed the hospitality sector, including high energy, labour and food costs as well as diminished disposal income of pub-goers amid the cost-of-living crisis.

Price Bailey head of insolvency and recovery Matt Howard said: “2023 saw the highest level of pub failures in more than a decade.

“While there are some glimmers of hope, underlying trading conditions remain challenging and rising labour costs continue to exert strong pressure on margins.

“The inflation rate for pubs crept up again in January and hopes of an early rate cut appear to be receding.

“The first quarter is a much slower trading period for pubs, and while sales growth was impressive in December many pubs are struggling to turn a profit.”

In particular, the charted accountancy firm noted the Bank of England interest rate stood at 3.5% at the start of 2023, but was “hike aggressively” throughout the year, finishing at 5.25% in December.

The Government’s £18bn energy support package for businesses also began to taper away at the end of Q1 2023, meaning energy costs for publicans rose sharply from Q2 onwards.

Into the red

Other factors cited by Price Bailey included Covid support loan repayments and strike action on the railways having left many pubs in city centre locations losing out on vital trade at key points in the year.

Additionally, it said many pubs are continuing to operate at reduced capacity or hours due to high energy costs and shortages of staff, reducing their ability to capitalise on improved demand.

Howard added: “Many pub businesses piled up barely manageable levels of debt during the pandemic lockdowns and rate hikes are tipping an increasing number into the red.

“The longer rates stay at current levels, the more pubs are likely to close their doors for good.

“Even though many of the large pub chains and independent pubs are struggling, innovative new market entrants, such as pubs owned by craft breweries, and theme pubs are successfully shaking up the industry.”