JDW U-turns on price rise

The pub group previously confirmed it was increasing prices on food and drink across its estate by about 20p a meal and about 10p an alcoholic drink.

This reduction announcement followed Chancellor of the Exchequer Rishi Sunak cutting VAT on food and soft drinks from 20% to 5% in his ‘mini Budget’.

JDW is set to fully pass on the tax benefit to its customers starting this week (Wednesday 15 July). The price of a number of products including real ale, coffee, soft drinks, breakfasts, burgers and pizzas will all see a drop in prices with all reductions fully implemented by Monday 20 July.

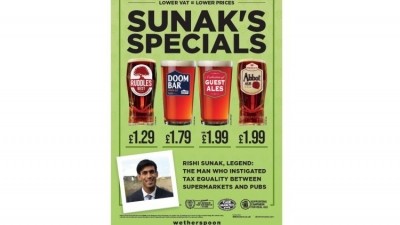

As a result of the tax cut, JDW will offer a pint of Ruddles Bitter for £1.29 (down about 50p on average), a pint of Doom Bar at £1.79 (down 31p on average), Abbot Ale (down 40p on average) and guest beers at £1.99 (down 26p on average) across 764 of its pubs.

Tax differences

The pub group's Lavazza tea and coffee prices will fall to £1.29 (down 16p on average), pizzas including a soft drink will start from £5.49 (a drop of 66p on average) and the burgers and a soft drink deal will start from £4.99 (a decrease of 66p on average).

All JDW pubs including those in town and city centres, airports and stations will see prices reduced for these products.

Founder and chairman Tim Martin said: “JDW will invest all the proceeds of the VAT reduction in lower prices, spread across both bar and food products, with the biggest reductions on real ale.

“JDW has campaigned for tax equality between pubs, restaurants and supermarkets for many years. Supermarkets pay no VAT on food sales and pubs pay 20%.

“Supermarkets pay about 2p per pint of business rates and pubs pay about 20p. These tax differences have helped supermarkets to subsidise their selling prices of beer, wine and spirits, enabling them to capture about half of pubs’ beer sales, for example, in the past forty years."

Trend reversal

Martin added: “A VAT reduction will help pubs and restaurants reverse this trend – creating more jobs, helping high streets and eventually generating more tax income for the Government.

“Not every UK hospitality business will be able to reduce prices immediately. Some will need to retain the benefit of lower VAT just to stay in business. Others may need to invest in upgrading their premises.

“However, lower VAT and tax equality will eventually lead to lower prices, more employment, busier high streets and more taxes for the Government.

“Congratulations to Chancellor Rishi Sunak for a sensible economic initiative, which is long overdue.”