Advertisement

Premium refreshment with added heritage

It was back in 1904 when William Thatcher first started crafting cider from the apples in his Somerset orchards. Now, with four generations of cider making expertise, Thatchers is Britain’s leading independent family cider maker.

From the carefully chosen varieties of apples it uses, to its passion for crafting premium ciders bursting with flavour, Thatchers takes great care to stay true to its roots, committed to creating cider sustainably for generations to come. Only the best will do, so you know that with each glass of Thatchers the quality is the same, every time.

Whether seeking out new flavours, such as sweet and vibrant Thatchers Rosé; Britain’s #1 cloudy cider, Thatchers Haze, attracting a younger lifestyle drinker; or the much-loved Thatchers Gold with the highest rate of sale of any apple cider; Thatchers innovative, great tasting cider selection, loved by its drinkers, will bring premium refreshment to your bar and help drive sales this summer.

Source: CGA 52 w/e 20.02.21

With new flavours being plucked from obscurity left, right and centre, and even sweet shop stalwarts being bottled by UK cider’s big hitters, where does the category go next? Surely all the fruit and flavours worth mixing have been done by now?

According to Godelieve Crawford, senior cider brand manager at C&C Group – which manufactures, markets and distributes Bulmers and Magners Irish cider brands – despite its ripe and shiny exterior, cider is still a “relatively underdeveloped category”.

“Space on the bar and on shelf is continuing to be squeezed with new brands entering the market, however, it’s still quite two dimensional, with both mainstream and premium brands concentrating on apple and fruit variants,” she tells The Morning Advertiser (MA).

“Premiumisation hasn’t evolved within cider as is has other categories, and there is still an opportunity for cider to tap into this,” she adds.

Alistair Morrell, CEO of trade alliance Cider Is Wine, goes as far as to ask if there ever was, in fact, a cider “peak” given the category’s less than stellar sales statistics. "A decade in decline – what will revive cider?’ would be a fairer reflection of the situation,” he poses.

“Let’s be clear, the cider industry is in dire straits and requires value-adding initiatives not more proposals which perpetuate the reality that cider is a cheap drink,” he continues. “Fruit ciders are no answer to value creation, merely perpetuate volume with little value.

“Indeed, the National Association of Cider Makers recently published figures which demonstrate this – sales 28% down in a decade, market share down 30% in the same time,” Morrell adds. “Drinks are fashion, and the hospitality industry needs propositions that hit the trends as a method of creating value.”

Value lies in trade

Though these figures suggest the present outlook for cider isn’t currently as rosy as the bountiful crop of new variants would have you believe, category commentators are keen to point out abundant green shoots.

“During 2020, almost half of all UK households bought cider in retail – and the year before that, cider was worth a staggering £2bn to the on-trade,” Darryl Hinksman, head of business development at Westons Cider explains.

“What’s more, when the on-trade reopened last summer, cider stole share from beer – increasing its share of on-trade serves from 10.5% to 12%.

“These figures demonstrate both a sustained appetite for cider – which certainly didn’t dip while pubs, bars and restaurants were closed – and an opportunity for the category to attract new drinkers with innovation,” he adds.

On top of this, the founder of Klynk ventures – a firm which works closely with new and disruptor brands to connect them to retailers and shoppers – Hamish Clarke, goes as far as to predict that cider pip other categories as the “next big growth market” following the resumption of pub trading.

“Cider value lies in trade, whereas retail tends to push more volume,” he tells The MA. “That said we can derive that there is willing market looking for and, critically, open to exploring and spending more on ciders alone or with foods.

“We think while the most recent growth of fruit flavoured ciders does meet a specific consumer need cider seems to have lost its way a little and needs to return to its core – pun intended.

“What is unique about cider is that it offers the consumer a wide range of taste profiles and appeals to both food and non-food occasions,” he continues. “This versatility, which is derived from the variety of apples, their sweetness, and acidity levels coupled with the various production techniques to make ciders, means that there can be a wide variety of taste, sweetness, and alcohol levels.”

Advertisement

Why tropical?

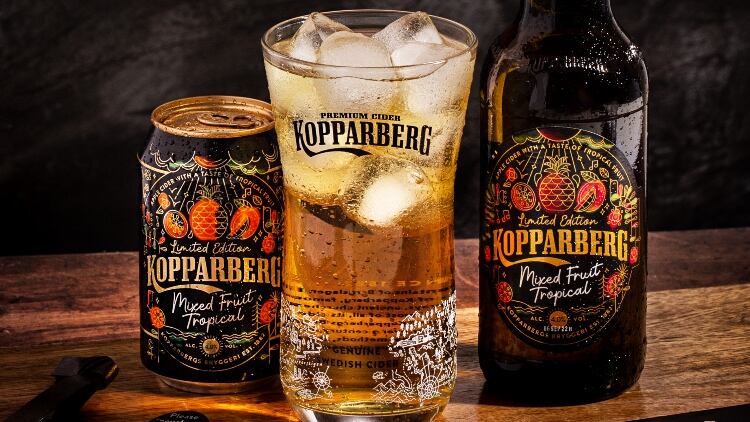

“Keeping the offering exciting with seasonal trends and draught options will prove integral,” according to Anne Claypole category controller at Kopparberg. “As tropical flavours dominate the fastest growing current drinks trends, no brand is better positioned for success by bringing out a new tropical variant as Kopparberg.

“Kopparberg Mixed Fruit Tropical is available now, with a limited-edition bottle and can already on the market. The new limited-edition has been developed to create cut-through and appeal with younger customers and is sure to standout in beer gardens and create intrigue and excitement.

“Popularity of the new variant is already soaring, with high demand for the limited-edition packaging.

“Why Tropical? Tropical is the third biggest fruit cider flavour and the fastest growing profile across other drinks categories (IRI, Carbonated Drinks, MAT To 26/07/20) and with Kopparberg being the brand of choice in the on-trade with 45% of drinkers saying they would choose Kopparberg vs. its competitors (CGA BrandTrack Feb 2020 - Aug 2020) no brand is better positioned for success by bringing out a new variant at such a critical time,” Claypole continues.

“Let’s also not forget that Kopparberg has the fastest growing sales of any cider brand when temperatures rise like we’re seeing at the moment and whilst we can’t quite go on holiday abroad, but when we’re sitting in that beer-garden with the sun shining, drinking an ice-cold Kopparberg Mixed Fruit Tropical with the bold flavours of pineapple, mango and passionfruit, it’ll feel like we could be anywhere in the world.”

‘Less but better’

According to David Sheppy, managing director at craft cider maker Sheppy’s, consumer demand for quality is a popular trend that’s having a positive impact on the cider category.

“With 46% of shoppers inclined to trade up to premium food and drink options when dining at home, it’s no surprise that premium beer and cider played a key role during the pandemic,” he says.

On top of this, figures from Cider Is Wine forecast that within the £3.5bn UK cider market there’s an untapped opportunity worth some £150m for cider and perry made from 100% juice without any concentrates – a figure based on 5% of current UK cider sales.

“Less but better is a clear trend in alcohol consumption and has been for a decade or more,” the body’s CEO Alistair Morrell explains.

As such Cider Is Wine accredited pours must adhere to standards mirroring EU – and globally accepted – winemaking rules defining wine as “product obtained exclusively from the total or partial alcoholic fermentation of fresh grapes, whether or not crushed, or of grape must”.

“How come the need for this differentiation? Quite simply because there are no global standards, and the UK allows a drink to be called ‘cider’ (or ‘perry’) when it contains just 35% apple (or pear) juice and all of that can be from concentrate,” Morrell adds.

“Fancy a wine made from 35% grape juice, all of which can be from concentrate (and, pretty well, from anywhere)? If this is a shocking statement for wine, why isn’t it for cider?”

John Gemmell, Heineken’s on-trade category and commercial strategy director, argues that operators can packaged cider to encourage trade up to such premium pours.

“Particularly for reopening, consider your packaged offering to cater for this demand for premium or different brands,” he says. “Exotic choices are driving growth within premium flavoured cider, led by a younger generation who are looking for sessionable fruit ciders in unique flavours.”

‘Story of home-grown glory’

New cider occasions?

Klynk Ventures’ founder Hamish Clarke talks through what he believes are four key opportunities and occasions for pub operators within the cider category.

Food: Cider is the perfect accompaniment to food. We have seen how they are making their way onto menus as the preferred tipple to partner with dishes and even winning accolades from the likes of wine critic Jancis Robinson. Cider is being recognised as a strong challenge to the traditional wines. Consumers are really searching for these enhanced meal and drink pairings but often do not know where to start. Because there are so many expressions of cider, particularly with some of the up-and-coming cider makers, it does offer an opportunity to entice consumers to spend a bit more on their meals by simply recommending a cider with a dish.

The ‘aperitif occasion’: In France, wine is losing its hold with younger consumers mainly because it is losing its relevance for the aperitif occasion – which is currently growing in the UK. Gin has had a role in this but then so has orange spritzers we see on tables. Lighter and lower alcohol ciders could easily play their part in this on-trend occasion as their natural credentials are what many consumers are looking for. Offering bottled ciders which compliment taste cues could see them considered as on option alongside G&Ts, spritzes and the like. Ciders which have some bitterness in the background will balance out sweetness.

Wine buffs: The romance of wine translates into cider. As many wine buffs are now learning, cider is made in the same way as wine – who knew! Local apples, fermentation and terroir are no longer just the buzz words for anyone wearing red corduroy. There is a portion of drinkers who are continuously searching for new things to discuss and explore through our food and drinks choices. They actively seek out new taste and flavour profiles. They want to know the back story of the producers, the types of apples, the harvest and finally to enjoy this culmination in a glass, sharing generously with their friends or even some acquaintances.

‘The Sesh’: Because cider can be made with a variety of apples which have lower sugar levels, harvested at various times, and benefit from arrested fermentation techniques, it means that ciders can offer a range if naturally lower alcohol options. Galipette, a French made cider, is playing in this area. As we see lower alcohol drinks becoming more and more in demand, cider is perfectly positioned as a natural solution. One of the barriers for wine has always been the sessionability of it, so cider, with its wine-like production process and naturally lower ABV, means it’s perfectly positioned.

Barny Butterfield, chief cider maker at Sandford Orchards, suggests that while there aren't many drinks categories in which the UK can “put its hands on its hips and be the boss”, despite aforementioned stuttering sales and lack of global standards, when it comes to cider “we're the king-pin”.

“Nearly half the cider on the planet is made and consumed on this sceptred isle,” he tells The MA.

“In a more Britain focused climate, expect cider to tell a big story of home-grown glory and world leading products and producers.”

Nicola Randall, senior marketing manager at Brothers Drinks adds that this heritage and authenticity is increasingly important to consumers.

“A significant 75% of cider drinkers agree that supporting British cider brands is important and 47% of cider drinkers agree it is important to know about a cider brand’s heritage,” she says.

Rise of independent, craft cider brands

On top of this, craft and independent cider growth continues to outpace the overall category – up 48.7% versus 21.2% – as consumers seek out high-quality, crafted ciders with heritage and provenance.

“In fact, premium and crafted brands now account for a 46% share of draught apple cider – and these offerings have helped add value to the category, driving up the overall price per litre of cider to £3.90 in the on-trade channel,” Westons Cider’s Darryl Hinksman says. “This continued growth represents a huge sales opportunity for on-trade retailers.”

Additionally, David Sheppy of Sheppy’s Cider predicts that craft pours will only become more prominent throughout 2021 as the category shakes off its Covid symptoms and consumers embrace smaller, independent brands.

“Craft breweries were among the hardest hit by Covid-19 lockdowns in 2020, however in line with the popularity of craft beer, craft cider is now what is piquing consumer interest,” he says.

“Having identified the brands that offer inherently craft cider, shoppers will seek these out as restrictions lift. To take advantage of this trend, brands need to have authenticity and provenance to go alongside a craft cider offering.”

‘Green’ apples

In keeping with this, Katie Walker, brand Manager at Aston Manor Cider, flags that transparency and education are key, with consumers seeking out substance from cider, including green credentials – of which Barny Butterfield of Sandford Orchards adds there are plenty.

“Apple orchards suck in atmospheric carbon, ploughed soils produce 20% of atmospheric carbon, beer and spirits depend on the plough – while orchards lock up carbon, year after year,” he says.

“As a domestic, non-brewed, non-distilled product cider's energy consumption in production is significantly lower than beer or spirits and it's water usage is a fraction of either,” Butterfield continues.

“Beer brands know this reckoning is coming and a few have signalled attempts to address their generations of carbon and water usage – but no amount of carbon credits will put more humus into depleted soils, or provide the amazing wildlife habitat that orchards provide.

“Consumers want to connect on levels with products now, that go beyond flimsy brand promises, cider is ready to tell its story,” he adds.

‘An apple a day’

While flavour new product development spanning confectionary, lemon and seasonal fruits have been the common innovation “go tos” recently, according to C&C Group’s Godelieve Crawford there may be opportunity for new to market innovations to go beyond flavour.

“In the wake of the pandemic physical and mental health has become more of a priority to consumers, building on a growing trend of betterment,” she says.

“Subsequently we have seen a rise in brand extensions into low and no alcohol products to cater for this market, with no and low alcohol cider growing by 30.7% in the last 12 months, from £11.5m to £15.1m.

“This is the fastest growing segment, performing ahead of total cider at 24.8% and been fuelled by increased shopper penetration of 28% with new drinkers buying into the segment.”

Aston Manor’s Katie Walker adds that as consumers are looking to make healthier and smarter choices, the sector is starting to see more products highlighting their added benefits – especially low alcohol content – given the number of people who are choosing to moderate.

“The increase in popularity of low and no alcohol options among ‘teepartial’ and teetotal drinkers is a trend that is set to continue as more people choose to moderate their alcohol intake or upgrade from their regular soft drink,” she explains.

“According to recent research, 27% of 18 to 35-year-olds say they are actively cutting down on alcohol consumption. More than half (56%) of the same age range are now consuming more low or no alcohol products, demonstrating the increased sales opportunity in this category.”

Continued experimentation and influence from other categories

Nicola Randall of Brothers Drinks adds that fruit cider and the innovation seen in the segment are still highly relevant not just in retaining the interest of existing cider drinkers but also in attracting and piquing the interest of new consumers.

“Some 42% of cider drinkers express an interest in more unique flavours and this rises to 49% amongst women and 48% amongst 25 to 54s,” she says. “With this in mind, and as the on-trade opens up again, there is a huge opportunity for brands to drive interest and value in the cider category through innovation whilst tapping into the trend towards premiumisation.”

While these unique flavours are often plucked from fruit stands or sweet shop shelves, they’re also increasingly being influenced by other drinks categories.

Godelieve Crawford of C&C Group, for example, explains that she has seen a growth in subcategories like rosé and cloudy ciders with increased demand for “pink drinks” like pink gin and rosé wine.

“Cocktail flavours also continue to prove popular,” Katie Walker of Aston Manor adds. “We launched an exciting twist on usual ciders – cocktail inspired flavoured cider by Friels. Friels Pina Colada Cider and Friels Passionfruit Punch Cider are available in ready-to-drink 250ml cans.”

Getting your range right

“Although apple cider represents the lion’s share of draught cider serves (70%), the fast-growing fruit cider category remains an important consideration when deciding what to stock,” Darryl Hinksman, head of business development at Westons Cider says. “In fact, fruit cider now accounts for a third of all draught cider sales in the on-trade (29.9%) .

“What’s great about fruit cider is that it attracts non-traditional cider drinkers – like women and younger adults – to the category, as well as having helped spread the geographic footprint of cider by attracting more northern drinkers.

“It’s also far more reactive to the seasons – especially those lighter, summer evenings, which leave consumers seeking a sweet, light and refreshing serve. This means it’s essential to get your fruit cider selection right as the weather warms up.

“Looking at draught apple specifically, it’s clear that this subsector presents an exciting opportunity for outlets to drive growth.

“To maximise profitability, on-trade retailers should consider regularly reviewing their taps and rotating formats, keeping draught apple as their mainstay year-round, prioritising a draught fruit cider during the summer months, and then switching this out in favour of a crafted proposition – perhaps within the fast-growing cloudy subsector – in late August.

“With the promise of live sporting events, warm evenings and plenty of drinking occasions, cider offers a clear opportunity for on-trade outlets to drive sales this summer, and venues can boost revenue by making premium mainstream trade-up options, available on draught to drive value sales.”

Style of serve

According to Westons Cider’s Darryl Hinksman, consumers are increasingly looking towards draught fruit ciders for elevated drinks choices which are “tricky” to replicate at home.

“As such, we’ve seen a 9p in the average price per print – up from £3.56 to £3.65 – offering retailers a significant opportunity to add value sales by maintaining availability of draught fruit offerings,” he says.

Anne Claypole, category controller at Kopparberg, adds: “We are seeing huge demand for draught in our pubs, bars and beer gardens already this summer. To capitalise on this, operators must ensure they have the best offers for their customers and relevant point of sale and branded glassware for standout and differentiation.”

However, in addition to tapping into fruit cider on draft, operators are beginning to experiment with new serves within cider to further emphasise the unqiue experiences on tap in the on-trade including what Sandford Orchards’ Barny Butterfield refers to as “the sharing serve”.

Rob Sandall, on-trade sales director for Thatchers Cider, adds that cider cocktails are another great way of creating a premium experience unavailable in the home.

“We’ve been working with mixologists to create a series of cider cocktails especially for pubs and bars,” he says. “Thatchers Hazey Crush, Big Apple Sour, to name but a few, and all available on our website.”